The Nation’s Fiscal Health: Federal Action Critical to Pivot toward Fiscal Sustainability

Fast Facts

The federal government faces an unsustainable fiscal future. If policies don't change, debt will continue to grow faster than the economy. This year's review of the nation's fiscal health found:

- Large annual budget deficits drive debt growth, as the government borrows money to finance spending that exceeds revenue

- Medicare and Social Security costs drive spending increases, especially as the population continues to get older

- Interest costs are projected to grow and could increase even faster if interest rates rise more than expected

Difficult policy decisions are needed to address the growing debt and change the government's fiscal path.

Highlights

What GAO Found

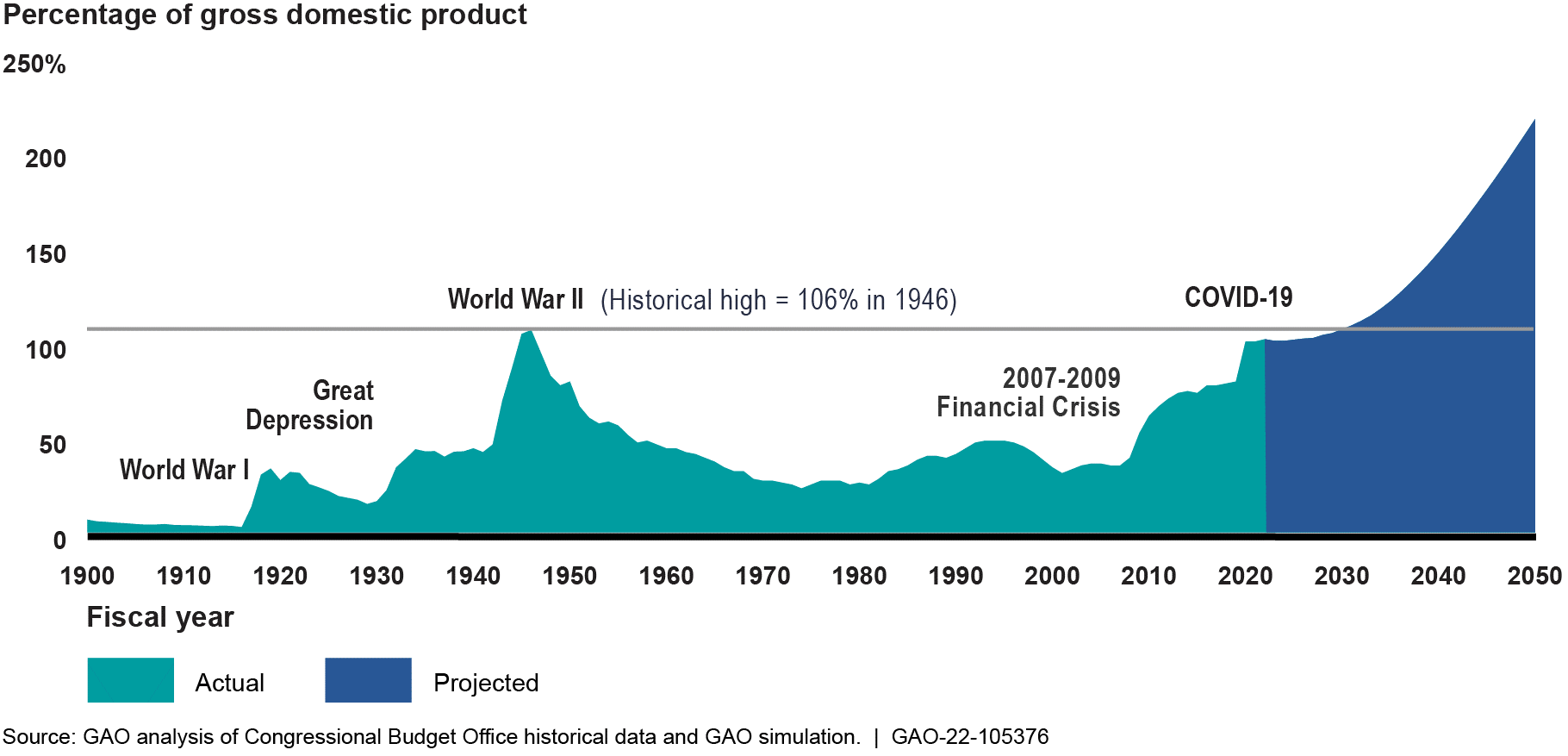

The federal government faces an unsustainable fiscal future. At the end of fiscal year 2021, debt held by the public was about 100 percent of gross domestic product (GDP), a 33 percent increase from fiscal year 2019. Projections from the Office of Management and Budget and the Department of the Treasury, the Congressional Budget Office, and GAO all show that current fiscal policy is unsustainable over the long term. Debt held by the public is projected to reach its historical high of 106 percent of GDP within 10 years and continue to grow at an increasing pace. This ratio could reach 217 percent of GDP by 2050, absent any change in fiscal policy.

Debt Held by the Public Projected to Grow Faster Than GDP

The underlying conditions driving this unsustainable fiscal outlook existed well before the COVID-19 pandemic and continue to pose serious challenges if not addressed.

Federal Budget Deficit in Fiscal Year 2021 was Second Largest in History

The fiscal year 2021 federal budget deficit of $2.8 trillion was the second largest in history, after the fiscal year 2020 deficit of $3.1 trillion. These historically large deficits were due primarily to economic disruptions caused by the COVID-19 pandemic—which decreased revenues in fiscal year 2020—and the additional spending by the federal government in response to the pandemic. Federal debt held by the public grew by about $5.5 trillion during fiscal years 2020 and 2021, reaching $22.3 trillion at the end of fiscal year 2021.

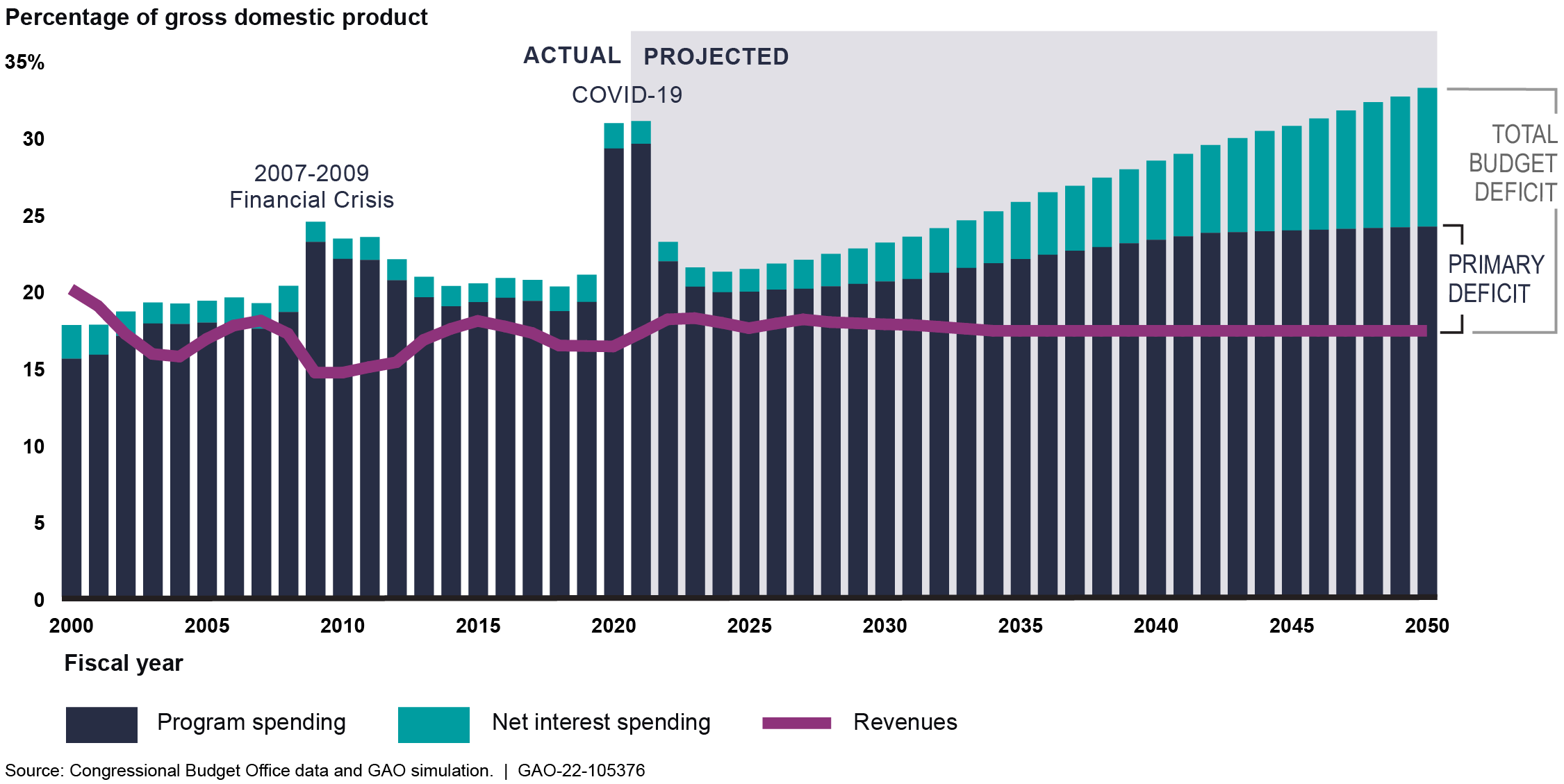

Increasingly Large Deficits Drive Unsustainable Debt Levels

In GAO’s simulation, starting in 2024, debt held by the public grows faster than GDP in every year. In most years, debt held by the public grows more than twice as fast as the economy, in real terms. The growing debt is a consequence of borrowing to finance increasingly large annual budget deficits. The total budget deficit is composed of two parts:

- The primary deficit: the gap between non-interest (program) spending and revenue and

- Spending on net interest: primarily the cost to service the debt.

Primary Deficit and Total Budget Deficit, Actual and Projected

In GAO’s simulation, increasing primary deficits are driving spending and revenue trends.

- Spending: Medicare, other federal health care programs, and Social Security are requiring an increasingly large share of federal resources. Under GAO’s simulation, spending for both major federal health care programs and Social Security would account for 85 percent of projected revenue in 2050, up from 63 percent in 2019.

- Revenue: Average annual revenue as a share of GDP was lower over the last 20 years than in prior decades. From 2000 to 2021, revenue averaged 16.8 percent of GDP annually, compared to annual average of 17.9 percent of GDP between 1980 and 2000.

Further, certain fiscal risks are not fully accounted for in the simulations. Consistent with CBO projections, GAO’s simulations assume that interest rates will increase over the next 30 years to 4.6 percent in 2051, from the historically low levels over the last 20 years. Interest rates higher than projected would further increase interest costs and debt. Other fiscal risks include potential delays in raising the debt limit and additional potential spending from certain fiscal exposures, such as such as potential global or regional military conflicts, public health crises, and natural disasters and climate change.

Action Is Needed to Change the Unsustainable Fiscal Path

An effective fiscal plan would support the difficult policy decisions needed to achieve a more sustainable fiscal policy, one where publicly-held debt is stable or declining relative to the size of the economy. GAO’s work has identified several components of an effective fiscal plan:

- Incorporate well-designed fiscal rules and targets to help manage debt by controlling factors such as spending and revenue;

- Assess the drivers of the primary deficit, such as mandatory and discretionary spending and tax policy—including tax expenditures;

- Consider alternative approaches to the debt limit; and

- Address financing gaps for Medicare and Social Security trust funds.

Why GAO Did This Study

- GAO produces this annual fiscal health report to examine the current fiscal condition of the federal government and its future fiscal path, absent policy changes in revenue and program spending.

- This report describes: (1) federal government’s fiscal condition and changes from fiscal years 2019 to 2021; (2) outcomes from our 75-year simulation of the federal government’s fiscal outlook; (3) additional risks to the federal government’s fiscal outlook; (4) components of a plan for a sustainable long-term fiscal path; and (5) actions that Congress and federal agencies could take to yield financial benefits.

For more information, contact Jeff Arkin, (202) 512-6806 or arkinj@gao.gov, Robert F. Dacey at (202) 512-3406 or daceyr@gao.gov, or Dawn B. Simpson, (202) 512-3406 or simpsond@gao.gov.