403(b) Retirement Plans Are Widely Used by Teachers—Here’s What You Need to Know About Risks and Oversight

Millions of teachers and non-profit workers save for retirement using 403(b) retirement accounts. But these accounts can sometimes be subject to excessive fees and limited oversight that could impact the amount retirees ultimately receive.

Today’s WatchBlog post looks at our new report about 403(b) oversight and outcomes.

Image

Why do ERISA protections matter?

Teachers, non-profit employees, and other workers in educational or religious settings may all have 403(b) retirement accounts. Like 401(k) retirement plans, these are defined contribution plans. Individual participants choose from a range of investment options, and the return on the investment is based on the rise and fall of the market, fees paid, and other considerations.

403(b) participants may pay high fees. For example, in a 2022 report, we found that certain administrative fees could be more than 2% each year, on top of individual investment option fees that could also be higher than 2% each year in some cases. Our work has shown that even seemingly small fees, such as a 1% annual charge, can significantly erode the amount of savings people have to fund their retirement.

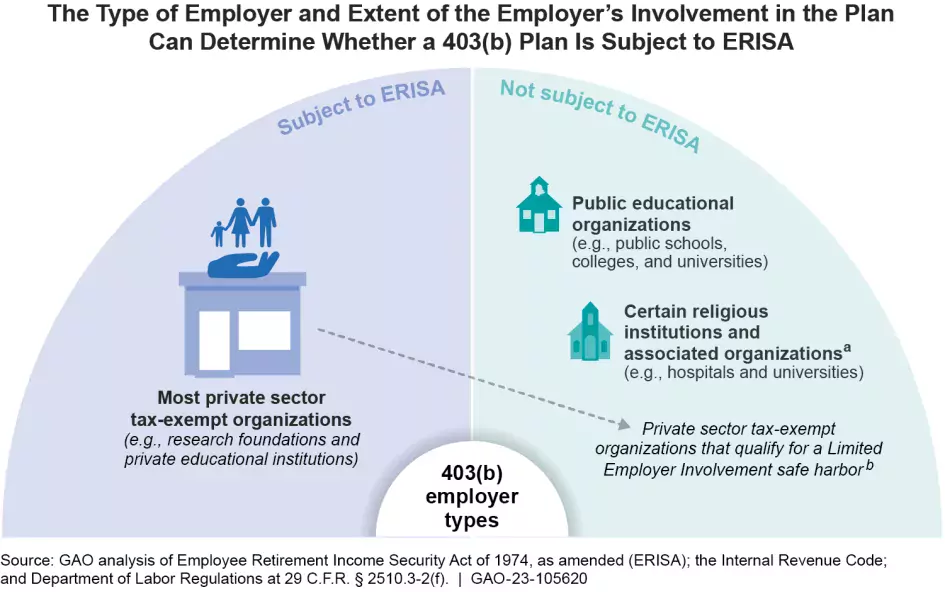

Some participants may also be in plans with less oversight, which could result in plans being managed in a way that does not minimize participant fees. Unlike 401(k) plans, only about half of the estimated $1 trillion of assets in 403(b) retirement plans are subject to the Employee Retirement Income Security Act (ERISA), the main federal law protecting holders of these types of retirement accounts. Those plans that are not covered by ERISA are subject to state laws and regulations, which can have varying levels of consumer protections.

ERISA requires that those operating a retirement plan, including plan sponsors—such as a university or nonprofit organization--and service providers, maintain a “fiduciary duty” to account holders—meaning, they must act solely in the interest of participants and beneficiaries, and for the exclusive purpose of providing benefits and paying plan expenses. But 403(b) plans for K-12 teachers and other public educators are generally not covered by ERISA, and therefore participants in non-covered plans do not receive this or other ERISA protections. Some states’ laws and regulations for 403(b) retirement plans do include fiduciary responsibilities. But others do not.

Image

Some states have taken actions to curb higher fees

Some states have taken action to combat high fees. And our report found that when states took action to provide more oversight of the 403(b) plans they reduced the fees that participants pay. For example, officials in one state reported that they reduced fees for 403(b) account holders by 1.2% each year by taking action to consolidate their plans and vet the options offered for investment.

How can you learn more about your 403(b) plan?

What can teachers and non-profit workers who have these accounts do? As our report notes, the Securities and Exchange Commission website provides consumer protection information for 403(b) participants, including information specifically aimed at teachers. We think more information is needed, however, from the Department of Labor. In our report we recommended that Labor update its educational materials to make content more relevant to 403(b) plans, and include information that could help 403(b) participants understand their account fees.

Learn more about our work on 403(b) plans by checking out our new report.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.