Defined Contribution Plans: 403(b) Investment Options, Fees, and Other Characteristics Varied

Fast Facts

Millions of employees of tax-exempt organizations rely on savings in 403(b) plans for retirement. Like 401(k) plans, 403(b) plans are employer-sponsored, and participants make investment decisions and bear the risk.

Our surveys found plan fees varied widely:

- Record keeping and administrative fees ranged from 0.0008% to 2.01% of assets

- Fees for investment options ranged from 0.01% to 2.37%

Larger plan sponsors—universities, states, and sponsors with $1 billion or more in assets—reported taking steps to reduce fees. Plan sponsors with less than $1 billion in assets more often reported not having information needed to monitor fees.

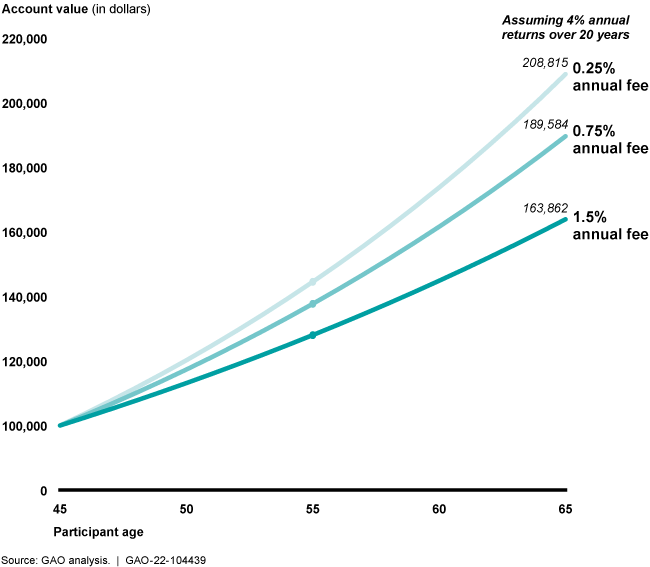

Illustrative Examples of How Fees Impact a Participant's Retirement Savings Over 20 Years

Highlights

What GAO Found

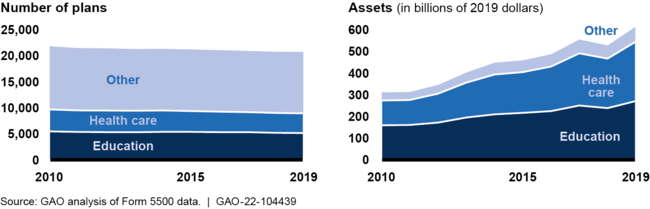

Total assets held by 403(b) plans—retirement savings plans for certain public sector and tax-exempt sector employees—amounted to more than $1.1 trillion in 2020, according to industry data, and other characteristics varied. Industry data show that about half of these assets were held in plans covered by the Employee Retirement Income Security Act of 1974, as amended, (ERISA), which are generally required to submit an annual filing known as the Form 5500. ERISA 403(b) assets grew from 2010 to 2019, the most recent year for which 5500 data are available, while the number of plans declined, as shown in the figure.

Number of 403(b) ERISA Plans and Value of Plans' Assets, by Sector, 2010-2019

According to industry experts and 5500 data, these trends likely resulted from consolidation of firms in the health care sector, which represents a large portion of plan assets. The vast majority—93 percent—of ERISA 403(b) plans were the employer's sole or primary retirement plan. While less information is available for 403(b) plans not covered by ERISA (non-ERISA plans), which do not file a Form 5500, of the 21 plan sponsor respondents to GAO's survey, most stated their plans were supplemental to another retirement savings plan offered by the employer. Available data also show that the number of investment options, which may be annuities or mutual funds, offered by 403(b) plans varied but were generally higher than the number offered by 401(k) plans in the private sector.

Fees for 403(b) plans varied widely according to GAO's survey of ERISA and non-ERISA plan sponsors and service providers, as well as Form 5500 data. For example, plans that GAO surveyed reported record keeping and administrative service fees ranging from 0.0008 percent of plan assets to 2.01 percent of plan assets. In addition, fees for investment options offered by the plan ranged from 0.01 percent to 2.37 percent among plans GAO surveyed. Prior GAO work has shown that even seemingly small fees can significantly reduce participants' retirement savings over time. Available data also show that large 403(b) plans had lower administrative fees than smaller ones. In GAO's survey, university, state-sponsored, and plan sponsors with $1 billion or more in assets reported taking multiple steps to reduce fees, while other sponsors more often reported not having information that would help them monitor fees. For example, five public school district plan sponsors reported that they did not know expense ratios, which are measures of how much of a fund's assets are used for administrative and other operating expenses, for investment options offered by their plan that would also allow them to monitor fees.

Why GAO Did This Study

Millions of teachers and other employees of public schools, universities, and tax-exempt organizations rely on savings they accumulate in 403(b) plans to provide income security in retirement. Like 401(k) plans, 403(b) plans are account-based defined contribution plans sponsored by employers, and individuals who participate in the plans make investment decisions and bear the investment risk. Private sector employer-sponsored retirement plans are generally subject to ERISA requirements intended to protect the interests of plan participants. However, some 403(b) plans are not covered by ERISA. This report addresses (1) the number and characteristics of 403(b) plans; and (2) fees charged to 403(b) plan participants.

For this report, GAO analyzed plan-level characteristics—including the number of participants, the amount of plan assets, and available information on plan investment offerings from 2010 through 2019—the most recent year for which data are available—from the Department of Labor's (DOL) Form 5500 database as well as available industry data. GAO analyzed individual-level data from the Health and Retirement Study (HRS) of respondents over age 50 who reported participating in 403(b) plans. GAO also analyzed information on plan characteristics and fees from non-generalizable surveys GAO conducted of 403(b) plan sponsors and 403(b) service providers (a total of 45 survey responses), and interviewed DOL and other U.S. agency officials, industry stakeholders, and experts identified as being knowledgeable about 403(b) plans.

For more information, contact Tranchau (Kris) T. Nguyen at (202) 512-7215 or nguyentt@gao.gov.