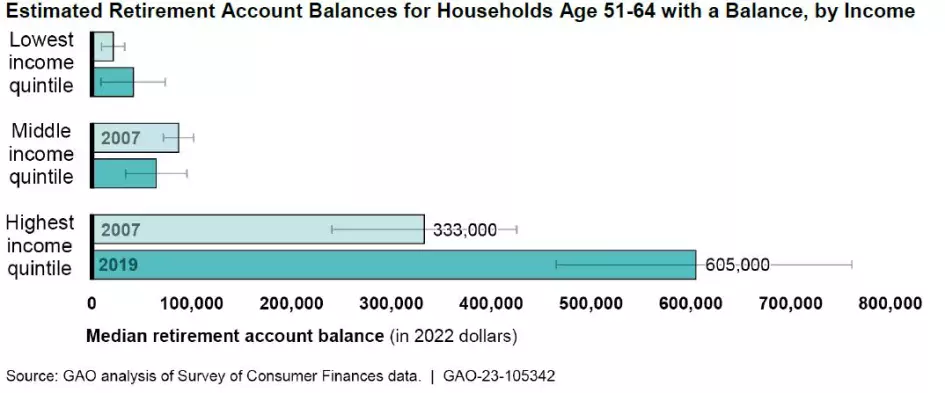

Growing Disparities in Retirement Account Savings

In recent decades, workers have taken on increasing responsibility for securing their retirement savings through retirement accounts, such as 401(k)s. Factors like whether an employer contributes to these accounts or not can effect retirement savings. But so can a number of other factors. And disparities between low- and high-income workers may be widening. For example, the number of low-income households approaching retirement (ages 51-64) that had a retirement account balance dropped from 1 in 5 in 2007 to just 1 in 10 in 2019. These disparities existed even prior to the economic strains of the COVID-19 pandemic.

Today’s WatchBlog post looks at our new report on the factors that may be contributing to this growing divide.

Image

Savings, children, and education may explain retirement account disparities

Factors like income, employer contributions, the number of children in a household, and educational achievement could affect the size of retirement account balances.

Income. It’s probably no surprise that high-income households typically save more for retirement. We found high-income households saved 8% of their pay, while low-income households saved 5%. But high-income households also typically received more in employer contributions than low-income households. High-income households got about $5,000 in contributions, while low-income households got $1,300.

Children. Households with children tended to have less retirement savings. Specifically, households with 2 children had about 40% smaller retirement account balances than childless households. The expenses of raising children may affect some families’ ability to save for retirement.

Education. Households with lower educational achievement generally had less retirement savings. We found that when heads of households did not attend college the household had balances that were 63% smaller than those that did. Workers in college-educated households may stay in the workforce longer, such as if fewer work in physically-demanding jobs, or they may complete more financial education and achieve higher rates of return on savings.

Workers from low-income households may have less support from employers and more disruption in employment, reducing savings

Workers from low-income households may be more likely to experience disruptions in employment or unemployment, which can impact their retirement savings. But even when employed, we found that only about 23% of low-income households had access to a retirement account offered by their employer in 2019. By comparison, 75% of high-income households did.

Households without access to an employer-sponsored retirement account may face the greatest challenges saving for retirement, as we found in our 2017 report. For instance, these households generally have to take more action on their own to open a retirement account and regularly contribute to it. Additionally, non-employer accounts, such as individual retirement accounts (IRAs), often charge higher fees than employer-sponsored accounts.

We found that workers from low-income households also change employers more frequently than high-income households. When switching jobs, all workers are at risk of losing track of employer-sponsored retirement accounts and workers from low-income households are more likely to “cash out.” When workers cash out—or withdraw all the money in their account—before age 59 ½, their money is generally subject to extra taxes, which reduces the balance. They also give up long-term investment growth.

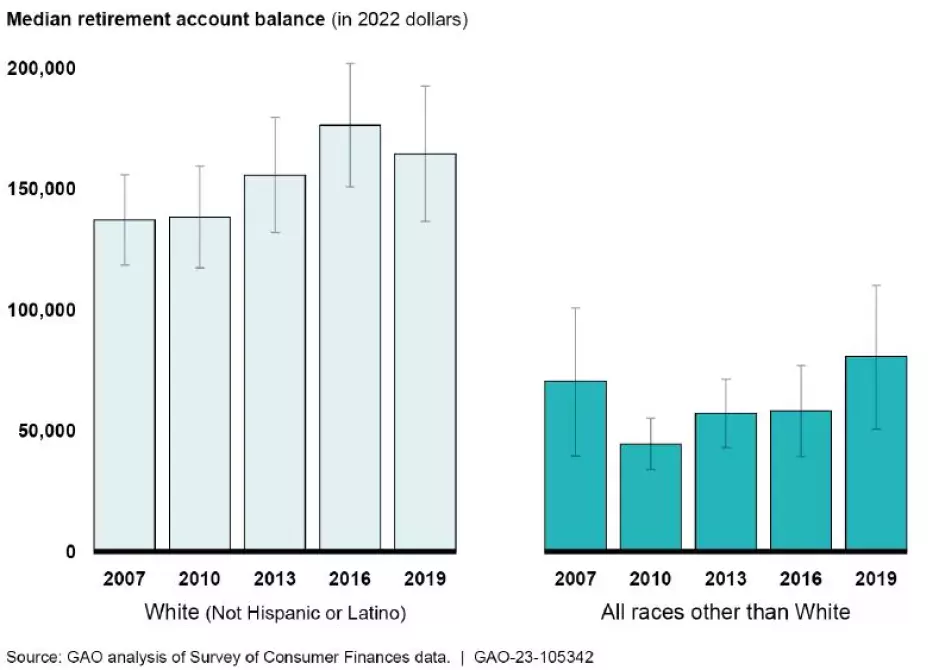

Racial disparities in retirement accounts reflect disparities in income

In addition to income-related disparities and other factors, we found racial disparities in retirement accounts that mirror the racial gap in income level. For example, we found that White households had higher incomes and, as discussed above, higher income workers were more likely to save and have stable employment.

Likewise, about 63% of White households had a balance in 2019 compared to about 41% of households of all other races. Also, White households had about double the median balance than households of all other races.

Estimated Median Retirement Account Balances by Race and Ethnicity for Older Households with a Balance, in 2022 dollars, 2007 to 2019

Image

These are just some of the findings from our report. To learn more about growing disparities in retirement savings, check out our new report.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.