Older Workers: Retirement Account Disparities Have Increased by Income and Persisted by Race Over Time

Fast Facts

Congress is concerned that federal tax incentives for workers to save in tax-preferred retirement accounts are going mostly to higher income workers—and are doing little to help low-income workers save for retirement.

We found that:

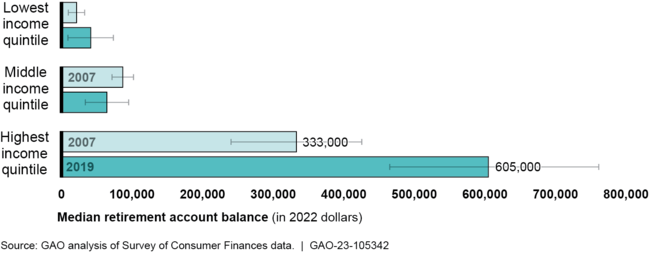

Disparities between low-income and high-income older workers households' (ages 51-64) retirement accounts were greater in 2019 than in 2007.

1 in 10 low-income households had a retirement account balance in 2019, compared to 1 in 5 in 2007.

9 in 10 high-income households had a retirement account balance between 2007-2019.

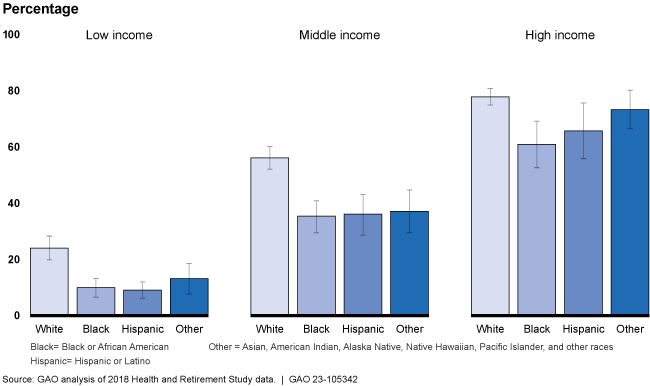

More White households had a retirement account balance than those of all other races.

Estimated Percentage of Older Households with a Retirement Account Balance in 2018

Highlights

What GAO Found

Disparities between low-income and high-income older workers' retirement accounts were greater in 2019 than in 2007, according to GAO's analysis of Survey of Consumer Finances (SCF) data on households 51 to 64. For example, about one in 10 low-income households had a retirement account balance in 2019 compared to about one in five in 2007, while about nine in 10 high-income households had a balance through the period. For those with a balance, the median balance was higher for high-income households over the period, while any change for the other income groups was not statistically significant. Racial disparities also persisted over the period. A higher share of White households had a balance than those of all other races. Also, White households had about double the median balance as households of all other races.

Estimated Retirement Account Balances for Households Age 51-64 with a Balance, by Income

Note: Brackets represent 95 percent confidence intervals. Overlapping brackets for the lowest and middle income quintiles indicate no statistically significant difference between 2007 and 2019.

Income, job-related factors, and race were strongly related to disparities in older worker households' retirement account balances, according to GAO's analysis of 2018 Health and Retirement Study (HRS) data. High-income households contributed a larger percentage of their pay than low-income households (about 8 and 5 percent) and received larger employer contributions. Households with higher income, longer job tenure, and a college education tended to have larger balances. Households of all other races than White and households with children had about 28 and 20 percent smaller balances, respectively.

The effects of selected strategies meant to increase workplace retirement savings vary across workers of different income groups, according to illustrative scenarios using GAO's analysis of SCF and HRS data. For example, automatic enrollment can increase participation of low-income older workers with access up to about one-third. However, only about 23 percent of low-income workers have access to a workplace retirement account. Further, they may choose not to participate, for example, if they have limited disposable income or expect Social Security to provide most of their retirement income. In contrast, increasing contribution limits for workplace retirement accounts almost entirely benefits high-income workers, as about 23 percent of high-income compared with about 3 percent of middle-income older workers contribute the individual limit.

Why GAO Did This Study

In 2022, the tax incentives for workers to save in tax-preferred retirement accounts cost the federal government nearly $200 billion in forgone revenue, according to the Department of the Treasury. Members of Congress and others are concerned these incentives accrue primarily to high-income workers and not low-income workers. Knowing the distribution of retirement account balances can help illuminate the retirement security of households of different incomes.

GAO was asked to examine disparities in the distribution of retirement account balances. This report describes, among other issues, (1) how the distribution of retirement account balances among older households by income changed over time; (2) factors associated with the distribution of retirement account balances among older households by income; and (3) how selected strategies meant to increase retirement savings affect high-, middle-, and low-income workers.

GAO examined retirement account balances for older workers' households (age 51 to 64) over time using 2007-2019 SCF data. GAO analyzed 2018 HRS data to identify factors associated with the balance distribution. Both datasets were the most recent data available at the time of GAO's review. GAO crafted illustrative scenarios to show the effects of four strategies meant to increase retirement savings using SCF, HRS, and 2018 Internal Revenue Service Statistics of Income data. GAO selected these strategies with input from agency officials, federal reports, and experts. GAO also reviewed relevant literature and interviewed retirement security experts.

For more information, contact Tranchau (Kris) T. Nguyen at (202) 512-7215 or NguyenTT@gao.gov.