Commercial Aviation Manufacturing: Supply Chain Challenges and Actions to Address Them

Fast Facts

Air travel has rebounded since 2020, increasing airlines' demand for new aircraft and parts for current fleets. Boeing and Airbus—and companies that supply them with parts and materials—have faced challenges increasing production to meet demand.

Aviation manufacturers reported shortages of workforce and materials. Some said they were

offering financial incentives

working with local schools to build interest in aviation careers

increasing oversight of suppliers

adding new suppliers

To adapt to difficulty getting new aircraft and parts, airlines reported reducing the number of flights and working to safely extend the life of some parts.

Highlights

What GAO Found

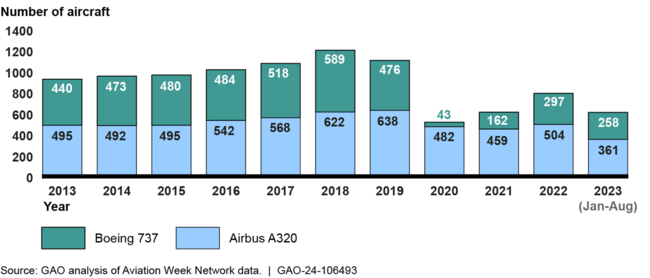

Orders for new commercial aircraft have rebounded since they declined in 2020. However, the two main manufacturers of commercial aircraft—Boeing and Airbus—have faced challenges in increasing production of their most popular models—the Boeing 737 and Airbus A320—to meet demand. Steps Boeing and FAA are taking to ensure safety after a January 2024 in-flight failure of a section of the fuselage have also affected Boeing's production levels early in 2024. Additionally, of the 15 companies GAO interviewed that supply components to Boeing and Airbus, nine said that they have likewise had difficulty filling orders with the rebound in demand following the COVID-19 pandemic.

Estimated Number of Boeing 737 and Airbus A320 Aircraft Produced, 2013–2023

Manufacturers attributed these production challenges to workforce and material shortages and are working to mitigate them. Fifteen of the 17 manufacturers GAO spoke to said they or their suppliers have had difficulty hiring enough skilled workers to enable them to satisfy the demand for their products. Six manufacturers said that difficulty hiring sufficient workers may be related to difficult or hazardous working conditions that some of these jobs entail, such as the use of toxic chemicals. Some manufacturers reported offering financial incentives and working with local schools to build interest in aviation careers to address their workforce needs. Further, fifteen manufacturers said that they or their suppliers have had difficulty procuring materials needed to complete their orders. Material shortages included a broad range of items, such as engines and semiconductors as well as raw materials like aluminum. To address these material shortages, manufacturers said they have increased monitoring of suppliers and established additional sources for some supplies.

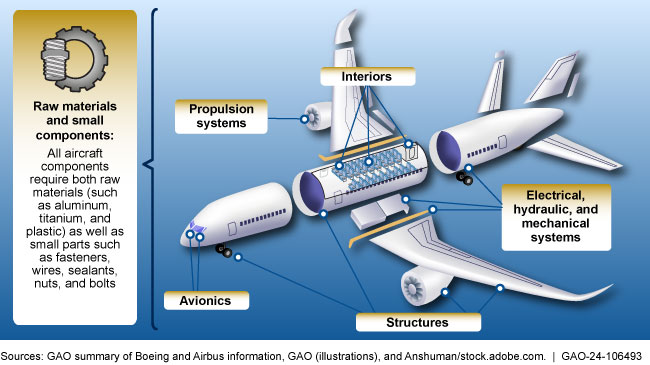

Airlines reported making changes to scheduled flights and developing ways to safely extend the life of some parts, among other actions, due to the difficulty obtaining new aircraft or the parts needed to maintain their current fleet. Seven of the eight airlines GAO spoke with reported delays of new aircraft they had expected to receive in 2023, and all eight airlines said they have had trouble obtaining a broad range of parts needed to maintain their fleets. Parts in short supply included small hardware like nuts and bolts as well as specialized items like cockpit windows and engine components.

Why GAO Did This Study

Aviation manufacturing is a major economic driver in the United States, with the largest trade balance (exports minus imports) among all U.S. manufacturing sectors. A global network of manufacturers and suppliers provides the aircraft and components that airlines in the United States rely on to support their operations. Aircraft manufacturers and their suppliers have faced headwinds in recent years, including steep declines in orders for new aircraft and supply chain disruptions brought on by the COVID-19 pandemic in 2020. As airlines respond to the rebound in demand for air travel that began in 2021, aviation manufacturers' ability to provide new aircraft and parts is key to airlines' efforts to maintain and grow their operations.

GAO was asked to examine challenges facing the aviation manufacturing supply chain. This report describes (1) what is known about demand for and production of new aircraft and parts since 2020, (2) factors affecting manufacturers' production of new aircraft and parts and actions to mitigate these factors, and (3) how airlines have been affected by the availability of new aircraft and parts to support their operations.

GAO analyzed data on new aircraft orders and deliveries from Boeing and Airbus along with data on aircraft production from Aviation Week Network for 2013 through 2023. GAO interviewed a non-generalizable sample of 38 stakeholders—including manufacturers and airlines—who were selected to achieve a range of perspectives.

For more information, contact Heather Krause at (202) 512-2834 or krauseh@gao.gov.