Financial Literacy: Better Outcome Reporting Could Facilitate Oversight of Programs for Older Adults and People with Disabilities

Fast Facts

Older adults and people with disabilities can generally be vulnerable to financial distress, so it's important to help them understand and manage their finances.

We found 24 examples of federal financial literacy programs for these groups, such as a curriculum for teaching older adults about scams and financial information for people with disabilities.

A federal commission coordinates federal financial literacy efforts—but its reports aren't clear about how well these programs are working. We recommended that the commission improve its reports to help Congress and agencies ensure that these programs are increasing financial literacy.

Highlights

What GAO Found

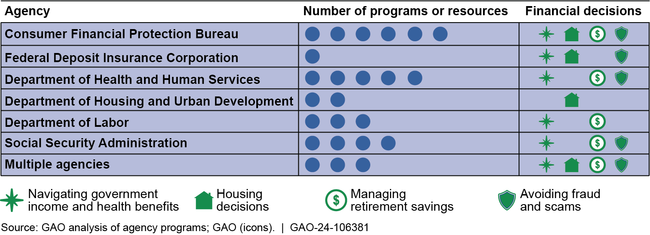

Older adults and people with disabilities face financial decisions that can have lasting consequences for their financial well-being. They often must navigate government benefits, such as Social Security and Medicare; make housing decisions; manage retirement savings; and avoid fraudulent schemes. GAO found 24 examples of federal financial literacy programs and resources designed to help older adults and people with disabilities with financial decision-making. Examples include a curriculum for preventing elder financial exploitation, a website with information on employment for people with disabilities, and a hotline that provides information on retirement, disability, and other benefits.

Federal Financial Literacy Programs for Older Adults and People with Disabilities

The Financial Literacy and Education Improvement Act established the Financial Literacy and Education Commission—which comprises the heads of 24 federal agencies and entities—to improve financial literacy and education through coordinated federal efforts. It does so through working groups, public meetings, and coordination on financial literacy programs and resources. The Department of the Treasury and Consumer Financial Protection Bureau serve as the chair and vice chair, respectively, of the Commission, which primarily communicates information on its efforts through its annual reports to Congress.

Of the 24 financial literacy programs GAO identified that serve older adults and people with disabilities, the Commission's five annual reports from fiscal years 2015 to 2022 included program outcome data for one. The reports contain similarly limited outcome information for other financial literacy programs. The Commission's national strategy highlights the importance of collecting data on the outcomes of financial education activities to assess their impacts and inform data-driven improvements. Further, GAO's prior work has shown that evidence-based policymaking is important for effective program management. Enhanced focus on outcome reporting for federal financial literacy efforts could provide the Commission and Congress with more robust information to facilitate oversight of federal financial literacy efforts. More information could also help member agencies assess program effectiveness and help Congress determine how agencies' efforts are meeting the needs of specific groups, such as older adults and people with disabilities.

Why GAO Did This Study

Financial literacy—the ability to make informed decisions and take effective actions regarding money—is essential to helping ensure the financial health and stability of individuals and families. Financial literacy is particularly important for older adults and people with disabilities. Many federal agencies promote financial literacy through programs and resources such as print and online materials.

GAO was asked to report on federal financial literacy programs for older adults and people with disabilities. This report addresses (1) financial decisions older adults and people with disabilities face and federal resources available to help improve their financial literacy, and (2) how the Financial Literacy and Education Commission coordinates financial literacy efforts and reports program outcomes to Congress and the public. GAO reviewed agency strategic plans, annual reports, websites, and other materials, and interviewed representatives of federal agencies and relevant organizations, such as the AARP and National Disability Institute.

Recommendations

GAO is making two recommendations —specifically, that Treasury and the Consumer Financial Protection Bureau coordinate with each other and with Commission agencies to encourage the ongoing collection of data on financial literacy program outcomes and include these data in the Commission's annual report to Congress. Treasury and the Consumer Financial Protection Bureau agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury, as chair of the Financial Literacy and Education Commission, should coordinate with the vice chair and agencies represented on the Commission to encourage the ongoing collection of data on financial literacy program outcomes and include these data in the Commission's annual report to Congress. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Consumer Financial Protection Bureau | The Director of CFPB, as vice chair of the Financial Literacy and Education Commission, should coordinate with the chair and agencies represented on the Commission to encourage the ongoing collection of data on financial literacy program outcomes and include these data in the Commission's annual report to Congress. (Recommendation 2) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|