Financial Decision Making Can Get Harder with Age—We found 24 Federal Programs that Help Seniors and Those with Disabilities

Older adults and people with disabilities must often make tough decisions that can have lasting consequences on their financial well-being. They may also need assistance in making these choices. At the same time, they could be vulnerable to financial scams and more in need of assistance to navigate government benefit systems—such as Social Security and Medicare.

Today’s WatchBlog post looks at our new report about the many federal programs and resources designed to help these Americans make the best decisions for them.

Image

What programs and resources are available?

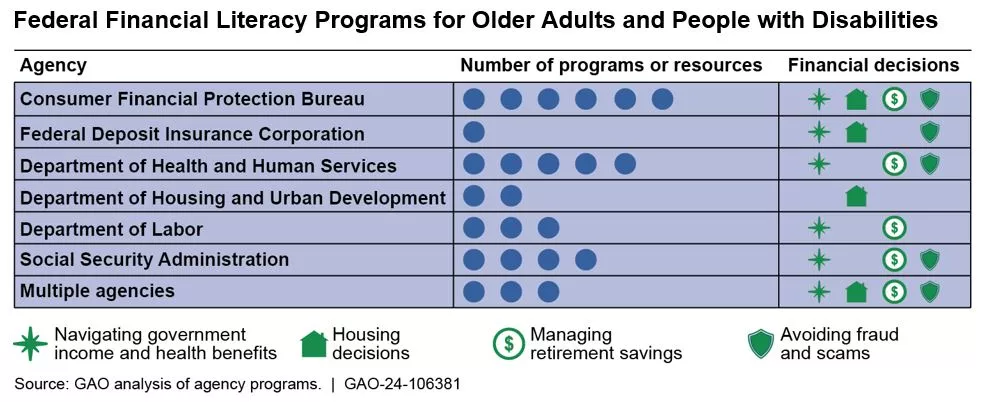

We identified 24 federal government financial literacy programs and resources that have information for older adults or people with disabilities. These included educational materials for classes on preventing financial exploitation, a website to help those with disabilities find jobs, and a hotline for answering questions about retirement, disability, and other benefits.

Image

Programs and resources:

- Medicare. The Department of Health and Human Service’s Get Started with Medicare website provides information to both older Americans and those with disabilities about how to sign up for Medicare, as well as information on the cost of Medicare and how to compare the costs of different plans.

- Social Security. The Social Security Administration provides information through websites and paper statements to help older adults and people with disabilities understand and estimate their benefits.

- Fraud and scam prevention. The Consumer Financial Protection Bureau and the Federal Deposit Insurance Corporation’s (FDIC) Money Smart for Older Adults provides information to older adults and their caregivers on how to prevent fraud, scams, and other elder financial exploitation. The program provides online resources for instructor-led financial literacy education. A similar program also includes Disability-Related information on financial topics relevant to people with disabilities.

- Fraud and scam prevention. The Consumer Financial Protection Bureau’s Elder Fraud Prevention and Response Networks also provides guidance and assistance to individuals or groups interested in creating a network to prevent elder fraud.

- Housing decisions. The Department of Housing and Urban Development (HUD) requires counseling for those considering a reverse mortgage. Reverse mortgages are meant to allow older Americans to stay in their homes longer by drawing income from their homes’ equity. This counseling service helps people understand whether a reverse mortgage is right for them.

- Housing decisions. HUD also provides information, advice, and tools for those both renting and owning a home. While this counseling is available to the general public, housing counselors can help older adults navigate decisions that have financial consequences, such as whether to remain in their home as they age.

- Employment for people with disabilities. The Department of Labor’s Financial Toolkit for People with Disabilities webpage has information on employment resources for people with disabilities, such as frequently asked questions, worksheets, videos, and links to other relevant webpages.

Our new report includes a full list and brief description of the 24 federal financial literacy programs we identified.

How is the government ensuring programs do what they are supposed to?

The goal of these 24 federal programs and resources is to improve Americans’ financial literacy. But providing resources is just one step. It’s also important to understand the outcomes of federal efforts. Congress created the Financial Literacy and Education Commission in 2003 to improve financial literacy and education efforts.

Many federal programs measure outcomes to ensure they are meeting the needs of those they serve. But when we looked at these 24 financial literacy programs and resources, we found that only one reported outcome information to the Commission that could be used to measure effectiveness. Without this information, it’s difficult to know whether programs are helping people as intended.

We recommended the Commission encourage the ongoing collection of data on financial literacy program outcomes, and then include that information in its annual reports to Congress.

Learn more about our review of these 24 financial literacy programs and resources by checking out our full report.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.