Retirement Security: The U.S. Virgin Islands' Pension Plan Faces Risks Paying Government Employee Benefits

Fast Facts

The U.S. Virgin Islands' Government Employees' Retirement System remains one of the lowest funded public pension plans in the U.S. While most public plans in our review had enough funding to cover 60 to 111% of plan liabilities as of 2021, USVI's plan had enough to cover about 10%.

The USVI government secured additional funding for the plan through an excise tax on rum in April 2022. But assets are expected to decline over the next decade, and many factors could add to the plan's insolvency risk—such as a lower federal excise tax rate. We identified several options to help ensure that USVI workers and retirees get their promised benefits.

Highlights

What GAO Found

The U.S. Virgin Islands' (USVI) Government Employees' Retirement System (GERS) remains one of the lowest funded public pension plans in the United States, according to GAO's analysis of national data. These plans offer a lifetime benefit for government workers. While most public plans in GAO's review had sufficient expected assets to cover between 60 and 111 percent of plan liabilities as of 2021, GERS had enough to cover about 10 percent. To improve plan solvency, GERS has made changes to its plan since 2005—similar to eight other selected public plans, including in the four U.S. territories. These changes applied to all new hires and included decreasing benefits, increasing the retirement age, and increasing employee contributions.

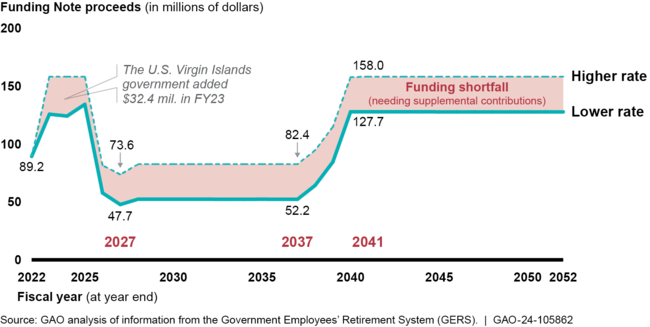

The USVI government secured additional funding for the plan through an excise tax on rum in April 2022. However, GERS continues to face the risk of insolvency. According to GAO's analysis, GERS may face insolvency within the next 10 years if the excise tax rate is lower than expected or if rum sales decline, among other risks. For example, the GERS' revenue projections for the excise tax used a $13.25 per proof gallon tax rate that expired in 2021 and reverted to a lower statutorily defined rate in 2022 ($10.50). While the USVI government has paid the resulting shortfall in 2023, it is not required and may not be sustainable. This could result in a long-term funding shortfall (see figure).

GERS Funding Projections Using Different Excise Tax Rates on Rum

According to interviews with stakeholders and plan officials, and literature GAO reviewed, a shared commitment between the government and the plan to ensure funding is adequate, resilient, achievable, and enforceable can help ensure a plan's promised benefits. The USVI government could consider several options to better ensure such benefits. For example, some governments have dedicated additional specific revenue streams, such as a portion of sales taxes, to their plans. In the past, GERS also received government funding for administrative expenses. The Department of the Interior can provide limited technical assistance upon request, such as for examining strategies to address risks.

Why GAO Did This Study

GERS is a defined benefit pension plan that covers all USVI government employees and retirees. It includes nearly 19,000 participants. The plan has historically been underfunded by the USVI government. In 2021, GERS actuaries projected that the plan would be insolvent by March 2025. The USVI government has made changes to the plan over the years to maintain its solvency, including providing GERS with additional funding in 2022. However, the plan continues to face uncertainties. GAO was asked to review the financial position of GERS.

This report describes (1) how GERS compares with other public defined benefit pensions regarding funding and benefits, (2) risks GERS faces in being able to pay promised pension benefits, and (3) options for the USVI government and GERS to better ensure GERS provides promised pension benefits.

GAO analyzed 2021 data on the characteristics of selected public pension plans from the Center for Retirement Research at Boston College, as well as 2021 and 2022 GERS data from the USVI government. In both cases, these were the most recently available data at the time of GAO's analysis. GAO reviewed publicly available information from eight public pension plans, selected to represent a mix of plan size and funding status. GAO also reviewed information from GERS actuaries and investment consultants and from relevant literature. GAO interviewed USVI and GERS officials; stakeholder groups such as actuary, state retirement administrator and other associations; and Department of the Interior officials.

For more information, contact Tranchau (Kris) T. Nguyen at (202) 512-7215 or nguyentt@gao.gov, or Frank Todisco at (202) 512-2700 or todiscof@gao.gov.