Sole Proprietor Compliance: Treasury and IRS Have Opportunities to Reduce the Tax Gap

Fast Facts

Each year, sole proprietors—like gig workers, social media influencers, and trade workers in business for themselves—underreport income that leads to about $80 billion in unpaid taxes.

These taxpayers may have difficulty paying their taxes accurately, in part, because they have no tax withholding. Experts we surveyed also said that sole proprietors may find current tax guidance too technical and could be confused about income from online platforms.

To help sole proprietors pay their taxes, we recommended that Congress consider requiring the Treasury and IRS to act on 2 of our prior recommendations—and made 3 new recommendations to IRS.

Highlights

What GAO Found

The Department of the Treasury and the Internal Revenue Service (IRS) have not developed an overall tax gap strategy that includes specific approaches to address sole proprietor noncompliance, as GAO recommended in July 2007. Sole proprietor underreporting is one of the largest segments of the tax gap (the difference between federal income taxes owed and the amount paid). Sole proprietors are individuals who own an unincorporated business by themselves.

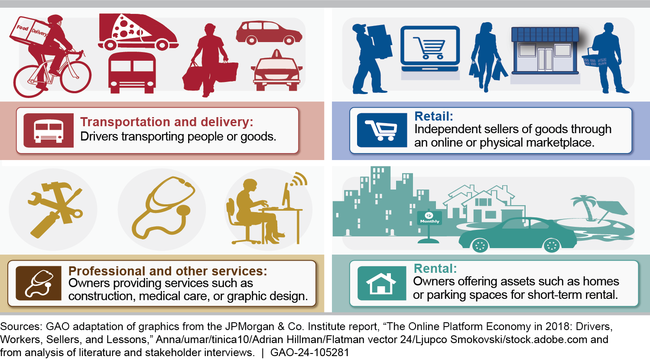

Examples of Sole Proprietor Industries

GAO identifies 17 options to improve sole proprietor tax compliance. The options involve tradeoffs and would best be considered as part of an overall tax gap strategy. However, Treasury officials said they have no plans to develop a strategy. Also, IRS has not taken steps to allow for voluntary withholding on payments to independent contractors, including sole proprietors, as GAO recommended in May 2020. Without voluntary withholding, these workers may find making quarterly tax payments burdensome, which may reduce compliance.

IRS's strategic operating plan outlines its priorities for the coming years, but neither this plan nor other IRS documents provide an approach specifically to improve sole proprietor compliance. While IRS has some methods to assess noncompliance risk, they are not complete or specific to sole proprietors. A risk assessment would allow IRS to make strategic decisions related to enforcement and outreach priorities to help it reduce sole proprietors' share of the tax gap.

IRS has a communications plan for platform workers, who are one type of sole proprietor. However, it does not have a coordinated communications plan focused on informing the wide variety of sole proprietors about their tax and reporting responsibilities. Such a plan would help sole proprietors meet their tax obligations and navigate tax law changes. According to stakeholders GAO spoke with, some sole proprietors are unaware of their tax obligations on income earned through online platforms. Additionally, stakeholders told GAO that they found the existing guidance overly technical and difficult to understand.

Why GAO Did This Study

IRS attributes approximately $80 billion in unpaid taxes to sole proprietors underreporting income each year. This comprises 16 percent of the estimated annual $496 billion tax gap. In tax year 2019, roughly 27.8 million sole proprietors filed tax returns, which accounted for about 18 percent of all individual taxpayers.

GAO was asked to review the tax compliance of sole proprietors. This report (1) reviews options for IRS to close the tax gap by increasing sole proprietor compliance, (2) evaluates IRS efforts to assess the risk of sole proprietor noncompliance, and (3) assesses IRS efforts to conduct outreach to improve voluntary compliance among sole proprietors.

GAO reviewed literature and conducted a nongeneralizable survey of 25 experts and stakeholders on options to improve sole proprietor compliance. GAO also analyzed IRS tax gap and statistical data, reviewed agency documentation, and interviewed agency officials.

Recommendations

GAO is recommending that Congress consider requiring (1) Treasury to develop a tax gap strategy that includes efforts to improve sole proprietor compliance, and (2) IRS to implement voluntary withholding when both companies and sole proprietors would like to participate. GAO is also making three recommendations to IRS related to policies and practices that could improve sole proprietor compliance. IRS agreed with one recommendation and disagreed with two. GAO maintains that all the recommendations are valid, as discussed in the report.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider legislation requiring the Secretary of the Treasury to ensure the tax gap strategy includes (1) a segment on improving sole proprietor compliance that is coordinated with broader tax gap reduction efforts, and (2) a specific, integrated plan that could include options we identified, as we recommended in July 2007. (Matter for Consideration 1) | When we confirm what actions Congress has taken in response to this recommendation, we will provide updated information. | |

| Congress should consider requiring the Commissioner of Internal Revenue to work with the Secretary of the Treasury to implement tax withholding that is voluntary for companies facilitating payments for services provided by sole proprietors for those taxpayers who choose to participate, as we recommended in May 2020. (Matter for Consideration 2) | When we confirm what actions Congress has taken in response to this recommendation, we will provide updated information. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should ensure that the Small Business/Self-Employed (SB/SE) Division assesses the risks of sole proprietor noncompliance, including defining objectives and the risk tolerance SB/SE is willing to accept, as part of its broader efforts to enforce compliance among small businesses. (Recommendation 1) |

IRS disagreed with this recommendation. As of May 2024, IRS stated that it assesses noncompliance risk at every step when identifying the returns likeliest to result in non-compliance. IRS also stated that its efforts in identifying noncompliance, combined with its education and outreach to encourage voluntary compliance, demonstrate its holistic approach to addressing noncompliance by all small businesses, including sole proprietors. IRS said that there is no consistent set of attributes that apply to all sole proprietors which would make it useful to address these taxpayers separately from other small business taxpayers. We maintain that sole proprietors are different from other business types and warrant separate risk assessments and outreach. To fully implement this recommendation, IRS needs to conduct a risk assessment for sole proprietors, distinct from other businesses. Without a comprehensive risk assessment, SB/SE is limited in its ability to make strategic decisions related to enforcement and outreach priorities.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should analyze existing data and forthcoming Form 1099-K data to better understand and gain insights into sole proprietor noncompliance and taxpayer burden that may be unique to sole proprietors, and use that information to make decisions on enforcement and outreach priorities for sole proprietors. (Recommendation 2) |

IRS agreed with this recommendation. As of May 2024, IRS stated that it would analyze Form 1099-K data using both past and future analyses of Form 1099-K data to identify compliance opportunities. If IRS's planned analyses assess noncompliance and taxpayer burden among sole proprietors and IRS uses its findings to inform enforcement and outreach priorities, it would satisfy this recommendation. Without such an assessment, IRS and policy makers will not have potentially key insights into the effect of the change on taxpayer burden and tax compliance.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should develop and implement a communications plan focused on outreach and education to improve sole proprietor compliance, particularly when tax laws or IRS guidance change. This should include mechanisms to ensure IRS communicates relevant information to sole proprietors in a timely manner and engages stakeholders, as appropriate. (Recommendation 3) |

IRS disagreed with this recommendation. As of May 2024, IRS stated that it incorporates sole proprietor audiences as a part of its broader compliance communications and outreach plans and conducts programs and events of interest to sole proprietors across the country. IRS also stated that it will continue to identify additional opportunities to expand and deepen communication with and outreach to this taxpayer segment to help them understand their tax obligations. However, IRS continues to incorporate these communications as part of a broader audience of businesses. To fully implement this recommendation, IRS should tailor communications to sole proprietors since some -- including those who do not realize that they are sole proprietors -- may not know to seek out information for small businesses on the IRS website to understand their tax filing obligations.

|