As A New Tax Filing Season Kicks Off, We Look at the IRS Efforts to Improve Customer Service and the Audits of Two Very Different Kinds of Taxpayers

Taxes are due April 15 this year. You might be ready to file your taxes, but is IRS ready to process them?

IRS is expected to process more than 160 million individual and business tax returns this filing season. Some good news: in general, IRS has reduced the average number of days it takes to process returns. But, as in past years, IRS still faces a backlog of correspondence, including amended returns.

Today’s WatchBlog post looks at our new report on the 2023 tax filing season, as well as our other recent reports about two populations of taxpayers with unique filing features—those with very high incomes and sole proprietors, such as gig workers.

Image

IRS service improved, but there’s still more work to do

In recent years, customer service has been an issue for IRS. Taxpayers have faced long phone wait times, unanswered calls, and delays in the processing of their tax returns. But as our new 2023 filing season report shows, IRS's service is improving. For example:

- Wait times were down. The average time to answer a call shortened from 28 to 3 minutes.

- IRS is doing a better job answering taxpayer phone calls. During the 2023 filing season, it answered 7.7 million calls—a 65% increase compared to 2022.

- Additionally, IRS has reduced its backlog of tax returns. By the end of the last filing season, IRS had processed nearly all 2022 returns and had a smaller backlog of 6.1 million returns—10.3 million fewer than at the same point the year before.

But despite these improvements, IRS still must do more to meet taxpayer needs and the challenges of the tax season. In our new report, we found that IRS still fell short of some of its goals for processing tax returns on time. On top of that, IRS responses to mail requests from taxpayers continued to be delayed, with 61% of inquiries considered late as of the end of the 2023 filing season. To address this and other issues, we recommended that IRS evaluate and address areas where its processing efforts missed timeliness goals, among other actions.

We may see more improvements this filing season, which just kicked off. IRS says taxpayers can now respond to correspondence and notices digitally. As a result, the agency estimates that more than 94% of individual taxpayers will no longer need to send physical letters. IRS is also piloting a “Direct File” service to allow some taxpayers to file their taxes directly through the IRS for free.

Improving how IRS audits the highest-income tax filers

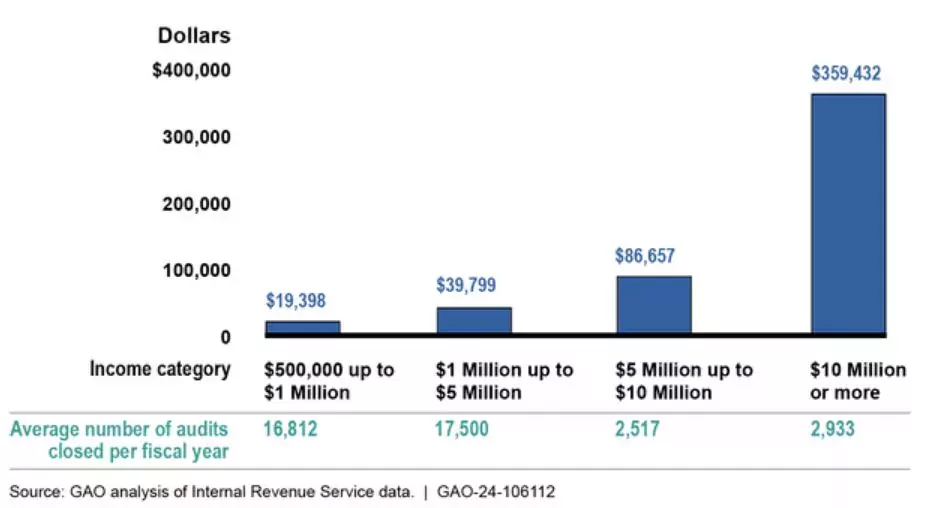

IRS audits tax returns to ensure that taxpayers are properly reporting their income. But during the past decade, IRS’s audit rate for individual returns has declined, particularly at higher-incomes. In a new report, we looked at the results of IRS’s high-income individual audits and how they could be improved.

We found that, as income increased, IRS recommended more taxes per audit, on average. However, IRS generally closed fewer of these audits per year.

Average Additional Tax Recommended per Audit, Fiscal Years 2012-2022

Image

IRS has taken steps to improve its audits of high-income returns, such as improving its research data for certain segments of this taxpayer population. However, IRS auditors and managers told us that heavy workloads, limited time, and the complexity of high-income returns sometimes led to closing audits without fully examining all potential noncompliance.

To address this and other challenges, we recommended that IRS assess its research efforts, audit selection models, and auditor hiring and training, among other actions. By focusing on these areas, IRS can better understand the types and prevalence of noncompliance on high-income returns, identify the highest risk returns for audit and reduce burden on compliant taxpayers, and further its mission of fairly enforcing the tax law.

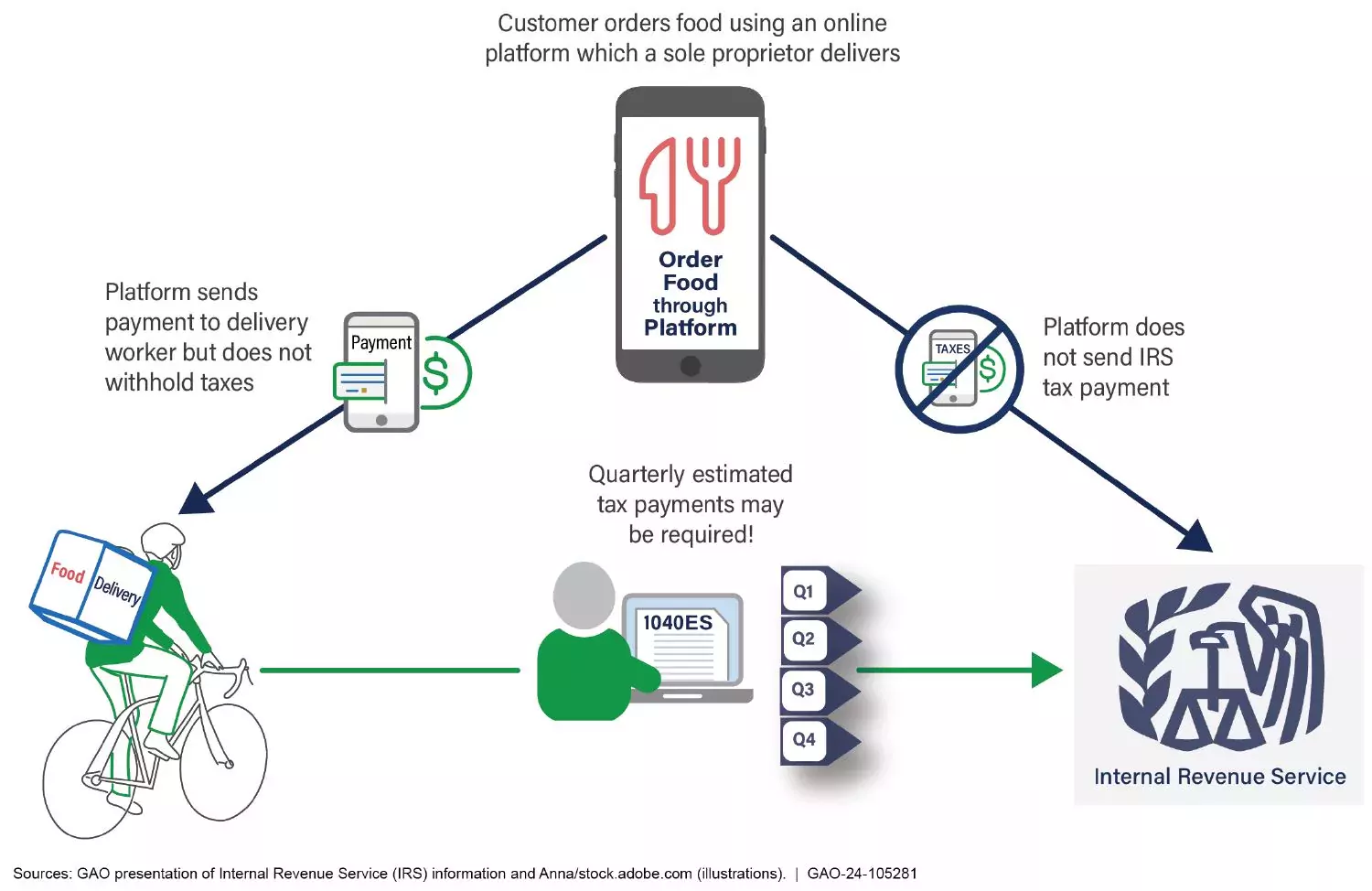

What can IRS do to help sole proprietors file their tax returns accurately?

Sole proprietors—like gig workers, social media influencers, and trade workers in business for themselves—tend to underreport their incomes. This has led to about $80 billion in unpaid taxes each year.

Even when trying to report income accurately, these workers may have difficulty, in part, because IRS does not allow taxes to be withheld from their paycheck. Instead, they may need to pay their taxes quarterly. This can be confusing and time-consuming.

Without Tax Withholding, Some Sole Proprietors Are Required to Pay Quarterly Estimated Taxes

Image

In an October report, we surveyed experts who told us that sole proprietors may find current tax guidance too technical. They could also be confused about what income from online platforms is taxable. These experts weighed in on 17 options to improve sole proprietor compliance that IRS and Congress could consider implementing.

As a result, we recommended that Congress consider requiring Treasury and IRS to act on two of our prior recommendations related to (1) developing a strategy to reduce unpaid taxes and sole proprietors’ share of them and (2) allowing voluntary withholding. We also made three new recommendations to IRS.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.