Tax Compliance: Opportunities Exist to Improve IRS High-Income/High-Wealth Audits

Fast Facts

In 2020, to address a decline in audit rates for the highest-income taxpayers, the Department of the Treasury directed IRS to audit at least 8% of tax returns filed by individuals with income of $10 million or more. While IRS has increased the number of these audits, IRS still needs to assess its:

Research efforts to understand the complexity of high-income returns

Audit selection models to ensure IRS is not burdening compliant taxpayers

Auditor hiring and training needs to address any staffing and skill gaps

IRS should also centralize its management of high-income/high-wealth audit programs.

Our 8 recommendations address these issues.

Highlights

What GAO Found

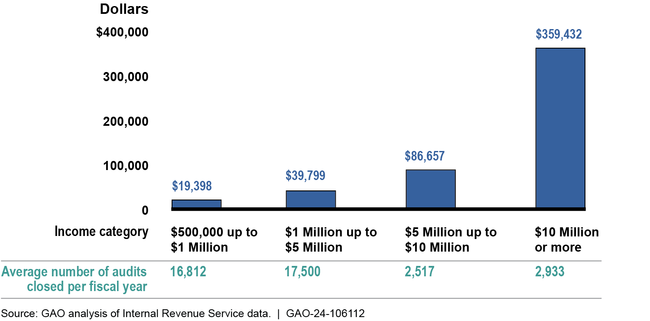

GAO analyzed the results of Internal Revenue Service (IRS) audits of individual returns with $500,000 or more in total positive income (TPI)—all positive income amounts on the tax return—closed in fiscal years 2012 to 2022. GAO found that, as income increased, IRS recommended more taxes per audit, on average, but generally closed fewer audits.

Average Additional Tax Recommended per Audit, Fiscal Years 2012 to 2022

In 2020, the Department of the Treasury directed IRS to audit at least 8 percent of returns filed each year by individuals with $10 million or more in income. In response, IRS established two initiatives to increase the audit rate of returns with $10 million or more TPI. GAO found that IRS is on track to meet the 8 percent audit rate goal for tax years 2018 to 2020. However, GAO's analysis of preliminary results (2 fiscal years) found that the subset of audits under these initiatives recommended less additional tax per audit, in contrast to other audits of taxpayers of similar income. IRS officials attributed the initiatives' preliminary results to auditors gaining experience with these audits, as well as closing simpler audits earlier and said that results may change over time.

IRS has taken steps to improve high-income/high-wealth auditing. However, GAO identified additional areas for improvement. For example:

Assessing data sufficiency. IRS has taken steps to improve its research of high income/high wealth taxpayers and their returns but could not demonstrate that its research is sufficient to understand the complexity and compliance of such returns. For example, IRS now measures compliance for three new high-income/high-wealth categories—$1 million to $5 million, $5 million to $10 million, and $10 million and above—rather than one combined income level of $1 million or more. However, according to IRS and other researchers, the audits that generate these data do not effectively identify all types of high-income/high-wealth tax evasion. IRS has not yet determined how to address these limitations.

Evaluating selection models. IRS relies on several computer models to select high-income/high-wealth returns to audit. IRS officials said they are in varying stages of developing, updating, and evaluating these models. However, IRS could not provide documented plans for evaluating these models. Until these evaluations are completed, IRS may be unnecessarily burdening compliant taxpayers and missing opportunities to address noncompliance.

Assessing hiring and training needs. IRS officials said that between 2010 and 2023, one IRS division lost more than half of its primary high-income/high-wealth audit workforce. IRS plans to hire and train staff for various auditing positions. However, it has not used a data-driven approach to assess what staffing and skills gaps may exist specifically for high-income/high-wealth audits or developed strategies for filling any gaps.

Establishing centralized management. Multiple IRS divisions collaborate on high-income/high-wealth audit efforts. However, IRS divides management responsibilities for these audits across two IRS divisions. Without centralized management for these audits, IRS may be less able to understand and improve audit results.

IRS has acknowledged the need to enhance its high-income/high-wealth audit efforts. Additional focus in the above areas could help IRS better understand the types and prevalence of noncompliance on high-income/high-wealth returns, maintain accountability for achieving objectives, and further its mission to fairly enforce the tax law.

Why GAO Did This Study

IRS audits tax returns to ensure that taxpayers are properly reporting their taxes. In recent years, IRS has audited a decreasing proportion of individual tax returns. GAO was asked to review IRS's audits of high-income/high-wealth individuals. This report examines, among other objectives, the results of these audits and IRS's efforts to audit more high-income/high-wealth individuals.

GAO analyzed IRS data on individual audits closed in fiscal years 2012 to 2022, the most recent complete year available at the time of its analysis. For the purposes of this report, GAO analyzed high-income/high-wealth taxpayer data at two different TPI thresholds—$500,000 or more and $10 million or more—and across four different TPI categories. GAO also reviewed IRS documents related to high-income/high-wealth audit efforts and compared IRS's efforts to key practices. GAO held 10 discussion groups with IRS staff who conduct or manage high-income/high-wealth audits and interviewed IRS officials.

Recommendations

GAO is making eight recommendations to improve IRS's efforts to audit high-income/high-wealth individuals, including taking steps to assess its research efforts, audit selection models, and auditor hiring and training. GAO also recommends that IRS centralize the management of its high-income/high-wealth audit programs. IRS generally agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should assess whether IRS's research data on HI/HW returns have sufficient coverage and quality to understand the complexity and compliance related to HI/HW tax returns. (Recommendation 1) |

IRS agreed with the recommendation. According to IRS, it plans to use data analytics to better understand the filing profile of high-income/high-wealth taxpayers by May 2025. To fully implement this recommendation, IRS needs to assess whether its underlying research data is sufficient to analyze this taxpayer population. We will continue to monitor IRS's efforts to address our recommendation.

|

| Internal Revenue Service | Based on an assessment of the coverage and quality of HI/HW tax return research data, the Commissioner of Internal Revenue should take steps to improve those data, if needed, to better understand the complexity and compliance related to HI/HW tax returns. (Recommendation 2) |

IRS agreed with the recommendation. According to IRS, it plans to improve data analytics to identify cases (tax returns) for high risk of noncompliance by July 2025. To fully implement this recommendation, IRS needs to also improve the underlying data it plans to analyze to ensure that the data reliably reflect complexity of the returns. We will continue to monitor IRS's efforts to address our recommendation.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should develop evaluation plans that include relevant evaluation questions and appropriate evaluation designs to evaluate the effectiveness of IRS's models for selecting HI/HW returns for audit. (Recommendation 3) |

IRS agreed with the recommendation. In its 2024 annual update to its Strategic Operating Plan, IRS stated that it plans to increase audit rates for wealthy individual taxpayers with income of $10 million or more from 11 percent in tax year 2019 to 16.5 percent in tax year 2026 using IRA funds. As we reported in January 2024, IRS is attempting to improve its computer models that help select HI/HW returns for audit. IRS indicated that it will develop plans to evaluate the effectiveness of IRS models for selecting HI/HW returns for audit by October 2025. To fully implement the recommendation, IRS's evaluation plans will need to follow key practices for designing evaluations, such as including relevant evaluation questions. Doing so will help IRS to select returns for audit that have the most significant noncompliance.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should use IRS's evaluation plans to evaluate the effectiveness of its models for selecting HI/HW returns for audit. (Recommendation 4) |

IRS agreed with the recommendation. In its 2024 annual update to its Strategic Operating Plan, IRS stated that it plans to increase audit rates for wealthy individual taxpayers with income of $10 million or more from 11 percent in tax year 2019 to 16.5 percent in tax year 2026 using IRA funds. As we reported in January 2024, IRS is attempting to improve its computer models that help select HI/HW returns for audit. IRS indicated that it will develop evaluation plans on the effectiveness of IRS models for selecting HI/HW returns for audit by October 2025 and that it will begin the related evaluation to update its models by April 2026. To fully implement the recommendation, IRS will need to use these evaluation plans to determine the effectiveness of its selection models. Doing so will help IRS to select returns for audit that have the most significant noncompliance.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop a mechanism for consistently collecting and using feedback from audit staff. (Recommendation 5) |

IRS agreed with the recommendation. According to IRS, it is creating a more formalized structure to receive feedback from audit staff, which it plans to complete by November 2026. We will continue to monitor IRS's efforts to address our recommendation.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should assess IRS's current and future hiring and training needs for HI/HW auditing, including the number of staff and their skills. (Recommendation 6) |

IRS agreed with the recommendation. According to IRS, it is increasing the hiring capacity of its Human Capital Office, as well as increasing its efforts to hire and train individuals with the skill and potential to work more complicated high-income/high-wealth audit cases. IRS plans to assess its current and future hiring and training needs for HI/HW auditing before October 2025. To fully implement this recommendation, IRS needs to determine what skills are needed and the extent to which IRS needs to hire and train for such skills. We will continue to monitor IRS's efforts to address our recommendation.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop and implement a strategy for hiring and training staff to meet IRS's needs for HI/HW auditing. (Recommendation 7) |

IRS agreed with the recommendation. According to IRS, it has several initiatives and projects, such as developing a comprehensive plan and curriculum, focused on training employees who will audit high-income taxpayers. IRS plans to develop and implement a strategy for hiring and training staff to meet IRS's needs for HI/HW auditing by October 2025. To fully implement this recommendation, IRS needs to determine both its hiring and training needs and base its initiatives and projects on meeting those needs. We will continue to monitor IRS's efforts to address our recommendation.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should centralize IRS's management of HI/HW audit efforts and responsibilities. This centralization of management could be implemented as part of IRS's effort to redesign its compliance organization. (Recommendation 8) |

In April 2024, IRS implemented a realignment of its leadership structure and introduced a new IRS chief position overseeing all of tax compliance, including oversight of HI/HW taxpayers. To fully implement this recommendation, IRS will need to clarify who is responsible for daily management of HI/HW audit efforts across IRS's audit units and the related centralized management responsibilities.

|