Tracking the Funds: Specific FY 2023 Provisions for Federal Agencies

Fast Facts

As part of FY 2023 appropriations, Members of Congress could request to designate a certain amount of funding for specific projects in their communities.

While agencies often have discretion over how they award funds, Congress has directed them to distribute these funds to the designated recipients. We're tracking these funds to help ensure transparency.

FY 2023 appropriations included about $15.3 billion for 7,234 projects. This report covers:

Which agencies got this funding

Funding purposes, project locations, and recipient types

How long the funds are available to spend

Where did the FY 2023 funding go?

Highlights

What GAO Found

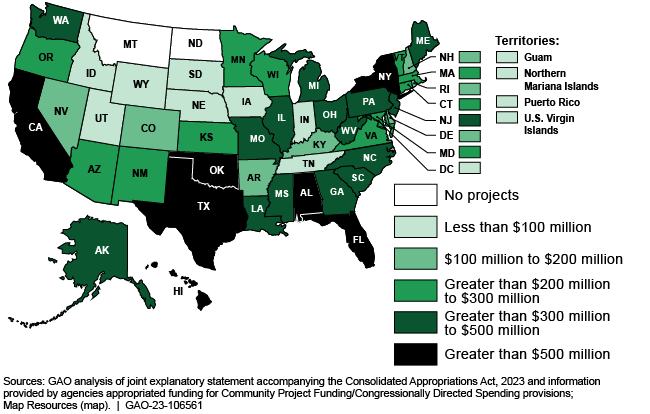

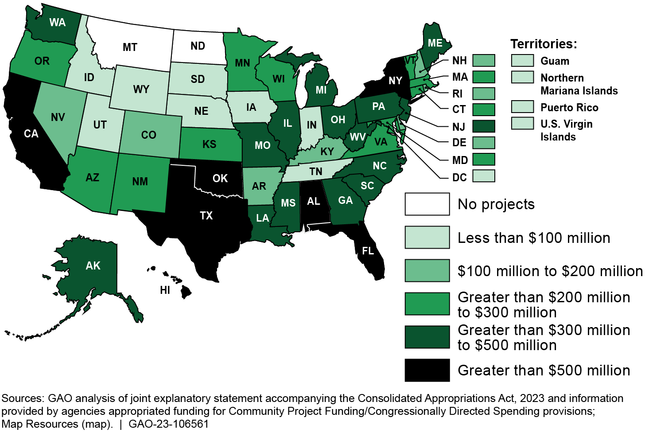

The Consolidated Appropriations Act, 2023 and the accompanying joint explanatory statement designated about $15.3 billion for 7,234 Community Project Funding/Congressionally Directed Spending provisions. The provisions designate funds for particular recipients to use for specific projects. For fiscal year 2022, about $9.1 billion was designated for 4,963 provisions.

Nineteen federal agencies were appropriated funds for these provisions and are responsible for planning and executing projects using these funds. Other than one new agency—the Office of National Drug Control Policy—the same 18 agencies that were appropriated funds for fiscal year 2022 provisions also were appropriated funds for fiscal year 2023 provisions.

While the amount of funding and number of provisions in fiscal year 2023 increased relative to fiscal year 2022, the pattern of total designated funding to various purposes, recipient types, and locations was generally proportionate.

Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023 by Location

When Congress appropriated funds for fiscal year 2023, it specified a time period applicable to each appropriation from which funds were designated for specific recipients. For example, 71 percent of the funds are available for agencies to obligate (for example, by signing a contract or awarding a grant) for a fixed period, ranging from 1 year to 5 years. The remaining 29 percent of funds are not time limited, so the funds are available for obligation at any point in the future. These are about the same percentages as in fiscal year 2022. Once funds are obligated, agencies generally have 5 years to expend (or outlay) the funds.

Why GAO Did This Study

In the 117th Congress, Members of Congress began a new process for requesting funds for specific projects, and Congress established constraints such as prohibiting members from designating funds directly to for-profit entities. Congress has continued this process in fiscal year 2023. These provisions are called “Community Project Funding” in the House of Representatives and “Congressionally Directed Spending” in the U.S. Senate.

Congress included a provision in the joint explanatory statement accompanying the Consolidated Appropriations Act, 2023 for GAO to review the agencies’ implementation of these fiscal year 2023 provisions. This report provides an overview of fiscal year 2023 Community Project Funding/Congressionally Directed Spending and how it compares with fiscal year 2022. Specifically, this report provides information on (1) the agencies that were appropriated these funds; (2) the purpose of the funds, types of designated recipients, and location of projects; and (3) the period of availability of the funds.

GAO analyzed data from the Consolidated Appropriations Act, 2023 and accompanying joint explanatory statement to describe the agencies designated funds and the purpose of the funds. GAO also analyzed this information to provide information on the designated recipients and projects. GAO compared this information to the corresponding information for the fiscal year 2022 provisions.

For more information, contact Allison Bawden at (202) 512-3841 or bawdena@gao.gov, or Heather Krause at (202) 512-2834 or krauseh@gao.gov.