Credit Cards: Pandemic Assistance Likely Helped Reduce Balances, and Credit Terms Varied Among Demographic Groups

Fast Facts

In 2022, 82% of U.S. adults had at least one credit card. We examined U.S. credit card usage by analyzing a large sample of credit card data from June 2013-December 2021.

We found that many people likely used their pandemic stimulus payments to pay down their credit card balances. Pandemic assistance was also associated with better credit scores and fewer delinquencies.

Our comparison of billing zip codes showed that accounts in majority Black or African American and Hispanic or Latino zip codes generally had lower credit limits, higher interest rates, and smaller balances that were carried longer. These factors can make credit more expensive.

Highlights

What GAO Found

Approximately half of active credit card accounts carried a balance during the period from June 2013 through 2019, according to GAO's analysis of a nongeneralizable sample of more than 650,000 credit card accounts from the Board of Governors of the Federal Reserve System. This included almost 35 percent of all active accounts in the highest credit score category (720 and above) and more than 30 percent of all active accounts in zip codes with median household incomes of $150,000 or more.

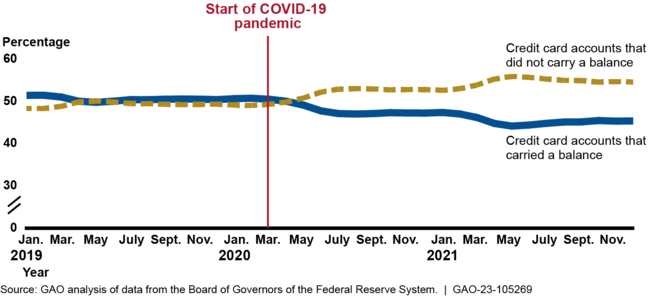

After the onset of the COVID-19 pandemic in March 2020, cardholders in the GAO sample generally paid down credit card balances and carried balances for shorter periods, according to GAO's analysis. Specifically, the share of all active accounts that carried a balance declined from 50 to 45 percent from April 2020 to December 2021 (see figure). Federal pandemic assistance likely contributed to these improvements. GAO analysis suggests that after March 2020, cardholders who carried balances increased their average credit card payments during the months when pandemic assistance payments were disbursed.

Percentage of Active Credit Card Accounts That Carried a Balance, 2019–2021

Note: GAO's analysis was based on a nongeneralizable sample of active general purpose credit card accounts. This figure excludes the percentage of active credit card accounts that were seriously delinquent (90 or more days), which was less than 1 percent during this period.

Cardholder accounts in the sample that were in billing zip codes with a majority of Black or African American or Hispanic or Latino residents likely had higher interest rates and lower credit limits and carried balances longer compared with accounts in predominantly White zip codes, as indicated by GAO analysis. For example, the difference in interest rates was on average about 1.3 percentage points. Cardholders in the sample that were in majority-Black or -Hispanic zip codes continued to face higher interest rates and lower credit limits as compared with cardholders in predominantly White zip codes who had the same credit scores, zip-code income distribution, and revolving status. While accounts in the sample that were in majority-Black or -Hispanic zip codes carried smaller balances than accounts in predominantly White zip codes, higher interest rates combined with carrying balances longer can result in higher credit costs.

Why GAO Did This Study

Credit cards are the most common consumer lending product by number of users, with 82 percent of U.S. adults holding a credit card in 2022. However, credit card adoption rates vary by race, ethnicity, and income. Consumers can use credit cards as a convenient means of payment and source of credit. Some consumers do not always pay off their monthly credit card balances and can accumulate interest and fees over time, which can lead to debt burden and affect their financial health. In addition, the COVID-19 pandemic caused significant economic disruptions and has affected consumers' credit card usage.

GAO was asked to review consumer credit card usage. This report examines (1) consumer credit card usage from 2013 through 2019, (2) how the COVID-19 pandemic and related assistance affected credit card usage from March 2020 through December 2021, and (3) how credit card costs and usage vary among racial/ethnic groups.

GAO analyzed a nongeneralizable sample of credit card data from the Federal Reserve for June 2013–December 2021 and used the Census Bureau's American Community Surveys to estimate the median household income and racial and ethnic composition in cardholders' zip codes. GAO also reviewed research from the Consumer Financial Protection Bureau, Federal Reserve, and academics. Further, GAO interviewed representatives of federal agencies, six large credit card issuers, three credit reporting agencies, a banking association, and a consumer advocacy organization.

For more information, contact Alicia Puente Cackley at (202) 512-8678 or cackleya@gao.gov.