High-Risk Series: Key Practices to Successfully Address High-Risk Areas and Remove Them from the List

Fast Facts

Every 2 years, we update our High Risk List of federal programs and operations vulnerable to waste, fraud, abuse, or mismanagement, or needing broad reform. Working on the problems we've flagged has saved more than $626 billion for the government over FYs 2006–2021.

We often get asked what agencies can do to get off the list. In this report, we discuss cases in which agencies took actions to improve programs and yield financial and other benefits. In some of these cases, we narrowed the scope of the High Risk areas or removed them from the list.

As a guide for future action, we describe how these actions met our progress criteria (shown below).

We measure progress on High Risk issues in these 5 areas

Highlights

What GAO Found

Congressional attention, Office of Management and Budget (OMB) engagement, and federal agencies' sustained leadership, planning, and execution are key practices for successfully addressing high-risk areas. Such practices have contributed to hundreds of billions of dollars saved since the High-Risk List was established. Further progress to narrow or remove the 37 areas remaining on GAO's High-Risk List can contribute to saving additional billions of dollars, improving services to the public, and enhancing trust in government.

Key Practices for High-Risk Progress and Selected Benefits Achieved

Leadership commitment to initiate and sustain progress. For example:

- To facilitate terrorism information sharing after the 9/11 terrorist acts, legislation was enacted that required the President to establish an Information Sharing Environment (ISE). Through ISE, agency leaders established policies, procedures, and technologies that strengthened the sharing of terrorism-related information among federal, state, local, tribal, international, and private-sector partners. These actions put our country in a better position to protect against terrorist threats and contributed to nearly $531 million in savings and removal of this area in 2017.

- To address federal excess and underutilized properties, Congress passed and the President signed two reform bills and OMB developed a strategic framework to guide agencies' real property management. Such efforts resulted in decreased lease costs, leading to a narrowing in scope of this high-risk area in 2011 and 2021. Benefits include nearly $3.6 billion in savings and estimated additional savings of $4.7 billion in lease cost avoidances through 2023.

Capacity (i.e., skilled staff, adequate funding, internal controls, technology, and management and organization infrastructure) to resolve key risks. For example:

- To address turmoil in the savings and loan industry in the late 1980s and early 1990s, Congress created the Resolution Trust Corporation (RTC) in 1989 to resolve failed thrifts and dispose of their assets. Subsequently, Congress provided RTC with additional funding; mandated management reforms; and established an interagency transition task force to facilitate the transfer of RTC's workload, personnel, and operations to the Federal Deposit Insurance Corporation. With adequate capacity and management improvements, RTC substantially completed its mission and was removed from the list in 1995.

An action plan to define the root causes and solutions and provide an approach for substantially completing corrective measures. For example:

- To address interagency contracting abuses, OMB established a working group that addressed root causes GAO had identified—unclear roles and responsibilities for interagency contract managers and government customers, weak internal controls, and inadequate training for acquisition personnel. Congress also required management controls and set agency reporting requirements. These actions, among others, contributed to nearly $5 billion in savings and the area's 2013 removal.

- To address contract and project management problems at the Department of Energy (DOE), OMB directed DOE officials to develop a corrective action plan and performance measures for the National Nuclear Security Administration and Office of Environmental Management. DOE actions have led to nearly $14.5 billion in benefits, strengthened oversight, and resulted in narrowing the scope of this area in 2009 and 2013.

Monitoring to help agency leaders track and independently validate effectiveness and sustainability of corrective measures. For example:

- To mitigate Department of Defense (DOD) supply chain management issues, Congress established statutory requirements for DOD to submit comprehensive plans for improved monitoring of asset visibility. DOD leaders subsequently developed detailed corrective action plans and a process for monitoring progress. These actions contributed to nearly $3.7 billion in savings from fiscal years 2006 through 2019 and the area’s removal in 2019.

Demonstrated progress in implementing corrective measures that address the root causes of high-risk areas. For example:

- To better manage its excess infrastructure, DOD reduced its support infrastructure footprint and use of leases, improved its use of installation agreements, and implemented a set of key actions and outcomes. As a result, in fiscal year 2016, DOD accounted for 68 percent of governmentwide office and warehouse space reductions and 75 percent of other property reductions. GAO removed this area in 2021.

- To resolve funding challenges facing the Bank Insurance Fund (a precursor to the Deposit Insurance Fund), Congress took action to rebuild the Fund and reform corporate governance, regulatory, and accounting practices. As a result, the Federal Deposit Insurance Corporation rebuilt the Fund’s reserves and addressed risky banking activities that contributed to record numbers of bank failures and insurance losses during the late 1980s and early 1990s. The Fund’s balance became positive in 1993 and it was fully capitalized by May 1995. GAO removed this area in 1995. Since that time, the Deposit Insurance Fund has protected insured depositors, including those at the nearly 500 banks that failed as a result of the 2007-2009 financial crisis.

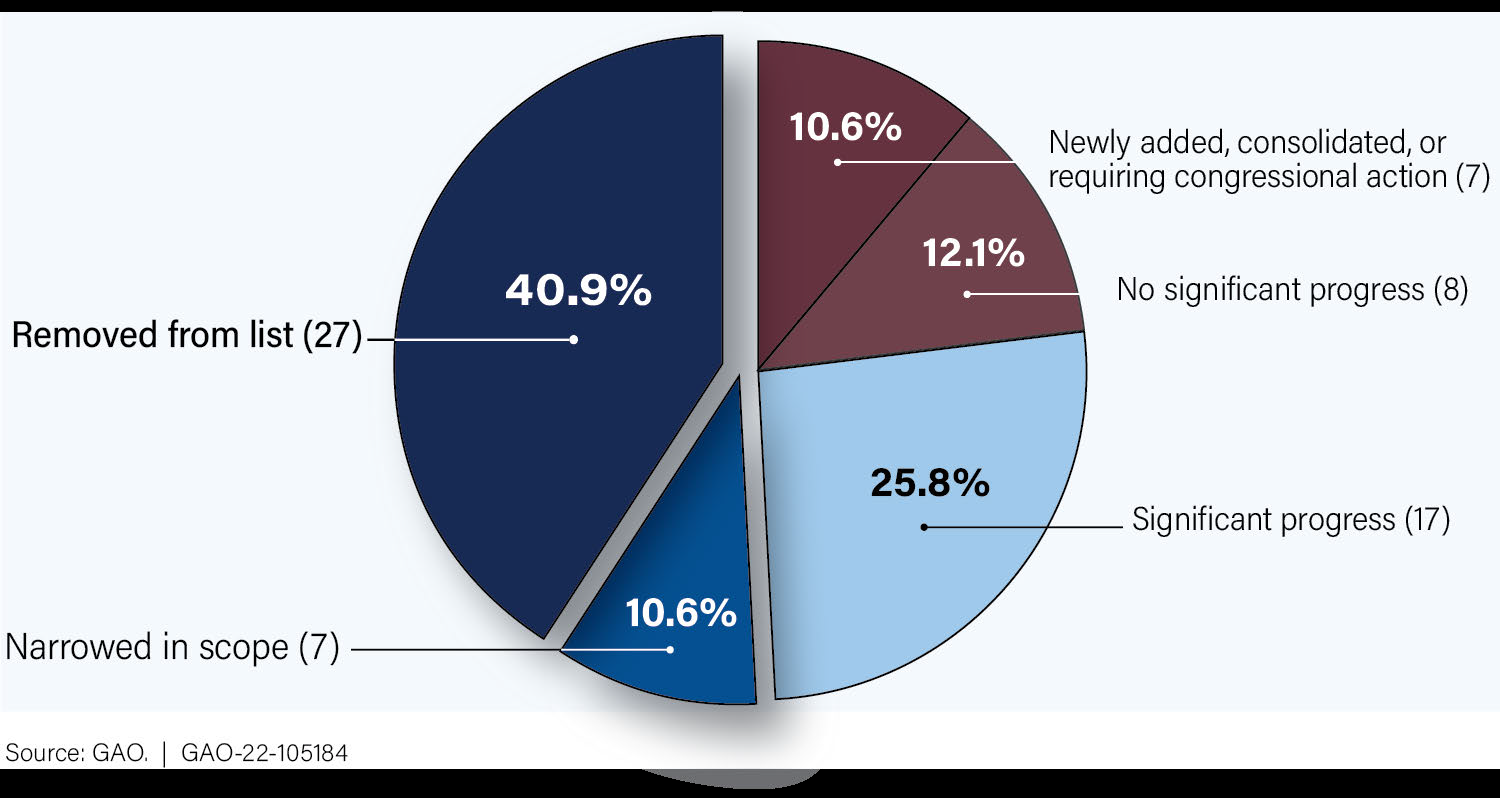

As shown below, most high-risk areas (nearly 52 percent) have either been removed from the list or narrowed in scope. Many others have shown significant progress in other ways, having met or partially met all five criteria for removal.

Status of All Areas on GAO’s High-Risk List, 1990–2021

Note: Some high-risk areas were narrowed in scope more than once and may have been removed after they were narrowed. They are only counted once. Significant progress means the high-risk areas were rated as met or partially met on all criteria in our 2021 High-Risk report (GAO-21-119SP). Some areas were not rated because they were very recently added to the list, primarily involve congressional actions rather than agency actions, or were consolidated with other high-risk areas.

Why GAO Did This Study

This report discusses key practices for successfully addressing federal programs and operations vulnerable to waste, fraud, abuse, or mismanagement, or in need of transformation. Since the inception of GAO's High-Risk List in 1990, GAO has removed more than 40 percent of the areas on the list in response to demonstrated progress.

Five practices, which align with GAO's criteria for removal from the list, have led to this progress and contributed to billions of dollars in savings. Federal financial benefits due to progress in addressing high-risk areas during the past 16 years (fiscal years 2006 through 2021) totaled more than $626 billion.

This report explains the relationship between the key practices and significant improvements to reduce risks. The examples of progress in this report can serve as a guide for federal action to successfully address areas that remain on the High-Risk List.

GAO reviewed prior high-risk reports to determine criteria and actions that contributed to the removal, narrowing, or sustained progress for selected highrisk areas. GAO also interviewed former and current agency officials to obtain their views on practices that resulted in progress on high-risk areas and corresponding achievement of related benefits.

For more information, contact Michelle Sager at (202) 512-6806 or sagerm@gao.gov.