Federal COVID Relief for Small Businesses Arrived Quickly, But With Risks to Loan Programs

Many of the more than 30 million small businesses in the U.S. experienced decreased revenue or closure as a result of the pandemic. In response to these economic strains, the Small Business Administration (SBA) quickly issued low-interest loans to small businesses affected by COVID-19 through 2 loan programs. These loans helped businesses and employees, but were vulnerable to fraud and other losses.

In today’s WatchBlog post, we look at how these 2 loan programs worked, their benefits, and challenges SBA faced in administering them.

Economic Injury Disaster Loan Program

The Economic Injury Disaster Loan Program (EIDL) provides grants and low-interest loans to help borrowers pay for operating expenses. Prior to the pandemic, EIDL had been used to support small businesses in communities affected by disasters like hurricanes or wildfires. Between March 2020 and May 2021, the program provided about $230 billion in loans and grants to small businesses and nonprofits affected by the COVID-19 pandemic.

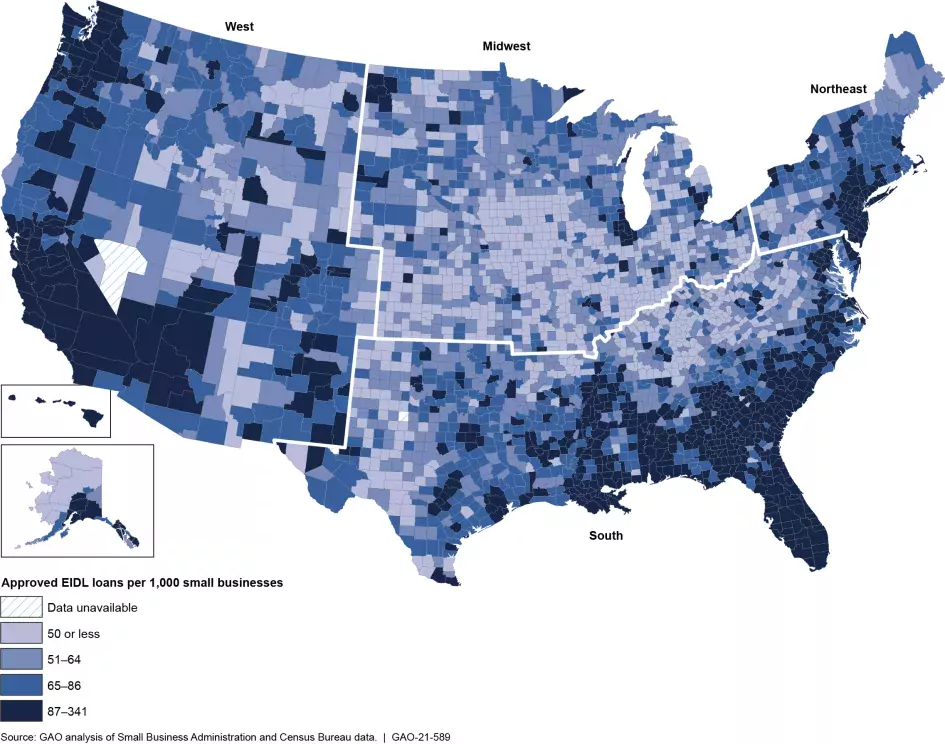

Approved EIDL Per 1,000 Small Businesses by County, March 2020-February 2021

Image

Paycheck Protection Program

The Paycheck Protection Program (PPP) was a new program designed specifically to respond to the pandemic by providing low-interest loans, made by approved lenders, to small businesses that could be used for payroll and other eligible expenses, such as rent and utility payments.

As of May 31, the SBA had guaranteed more than 11.8 million loans, worth about $800 billion. Small businesses that received PPP loans can request that their loans be forgiven—meaning they don’t need to pay them back if they meet conditions, like maintaining employee compensation levels and spending 60% or more of the loan on payroll costs.

In general, small businesses with 500 or fewer employees were eligible for loans. As of May about 77% of loan forgiveness applications submitted to SBA were from businesses with 1 to 10 employees, while 22% were from businesses with 11 to 100 employees. In contrast, less than 1% of loan forgiveness applications came from businesses with more than 500 employees.

What challenges did SBA face in administering EIDL and PPP?

Lack of clear communication between SBA and lenders or small businesses and vulnerabilities to fraud are among the challenges EIDL and PPP have faced.

Communication gaps. EIDL applicants said their greatest concerns were a lack of information and uncertainty about their application status. Additionally, we found that until February, SBA didn’t provide critical information to potential applicants such as limits on loan amounts and definitions of certain program terms. As a result, SBA’s customer service lines experienced call surges and many small businesses filed multiple applications because they hadn’t heard back on their initial application. SBA’s data showed that 5.3 million applications were duplicates.

To help address challenges like these, we recommended in our July report that SBA develop a comprehensive communication strategy that includes details about how and when it will reach out to the public about its disaster response programs.

Similarly, PPP lenders said the communication they received from SBA was insufficient. While SBA has developed a web portal to communicate with lenders on the status of loan forgiveness applications, it has not developed a process to ensure its responses to lenders are timely. This informational gap has created confusion and uncertainty for lenders and borrowers and has made it difficult for them to make management decisions. As a result, we recommended that SBA develop and implement a process to ensure timely communication with lenders.

Fraud and other integrity issues. Another challenge facing these 2 loan programs was that because they were implemented quickly to meet demand, the programs became vulnerable to potential fraud, and the risk of providing funding to ineligible applicants increased. For example in January, we reported that SBA had approved at least $156 million in EIDL loans to businesses that were potentially ineligible for the program. As a result, we recommended that SBA conduct data analytics across the EIDL portfolio to detect fraud and ineligible applications.

Similarly, SBA quickly implemented PPP by allowing borrowers to self-certify their eligibility for funding and requiring limited lender review of borrower documents to determine the qualifying loan amount and eligibility for loan forgiveness. This left the program vulnerable to fraud risks. As a result, we recommended in June 2020 that SBA do more to oversee PPP. SBA subsequently developed procedures for a loan review process.

For both programs, we found that SBA had not conducted formal fraud risk assessments. As a result, we recommended that SBA respond to risks now and in the future, and conduct a fraud risk assessment.

Want to learn more about our recent reviews of the EIDL and PPP? Check out our reports issued in July (EIDL and PPP), and listen to our podcast with GAO’s small business program expert Bill Shear.

- Questions on the content of this post? Contact the WatchBlog team at blog@gao.gov

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.