During COVID-19, Access to Federal Emergency Rental Assistance Increased, but Some Challenges and Risks Remain Unaddressed

Early in the pandemic, Congress appropriated $47 billion in funding to help struggling renters who lost jobs or income due to COVID-19. The Department of the Treasury (Treasury) managed Emergency Rental Assistance funding, providing grants to state, local, and tribal governments. The grantees then cut checks to renters, landlords, and utility providers to cover past-due rent payments or utility bills.

But some renters faced challenges accessing the assistance, and there have been cases where funds have been misused.

Today’s WatchBlog post looks at our new report about how Emergency Rental Assistance was used and risks to the program resulting from Treasury actions to speed up spending.

Assistance helped thousands of households, but some struggled to gain access

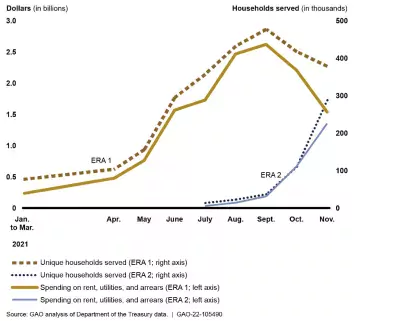

At the peak of rental assistance, just under 500,000 households a month were receiving it. But some renters struggled to access the assistance, particularly when it first became available, because they had trouble demonstrating financial hardship or housing instability. In order to receive assistance, renters were required to provide documentation such as a paystub or signed lease. Providing this documentation was particularly difficult for people who were in-and-out of work, gig workers, or workers who were paid in cash. Because of this, the grantees said they had a hard time quickly approving many renters’ requests for funding.

Emergency Rental Assistance Program Spending and Number of Households Served Each Month

Image

Treasury sought to address this challenge by allowing renters to self-attest their eligibility to the grantees. Alternatively, renters could be approved for assistance if their income had already been verified by another government program meant to support low-income Americans, or if the average income of their geographical area was low enough to qualify.

These additional flexibilities allowed grantees to spend their allocations more quickly and help more people. Getting assistance to renters more quickly was particularly important after the national eviction moratorium ended in August 2021.

Risks of misused funding

While additional flexibilities improved access, they also presented an increased risk of fraud. Treasury Inspector General officials are investigating several instances of potential and significant misuse of funds—including several incidents where as much as $100,000 may have been misused. Misuse can include payment errors such as overpaying recipients or paying ineligible recipients.

We found that Treasury hasn’t taken the necessary steps to prevent and address potential payment errors when administering Emergency Rental Assistance. Treasury largely relies on grantees to prevent, investigate, and address instances of misused funds. However, Treasury hasn’t evaluated these efforts or provided grantees with sufficient guidance on mitigating risks, including fraud risks.

We recommended that Treasury design and implement procedures to monitor and evaluate grantees’ programs and controls. In another report, we recommended that Treasury put in place processes to help the timely identification and recovery of grantees’ overpayments. That report also showed that self-attestation increased the risk of payments going to ineligible households.

Find out more

Today’s blog highlights some findings from our latest report. Since the beginning of our coronavirus-related reporting, we have identified several other opportunities to address housing issues, including improvements to Emergency Rental Assistance payments and the housing finance system.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.