Fraud and Its Consequences—Who Steals from Federal Programs and What’s the Cost?

Hundreds of billions of dollars are lost to fraud each year. Fraud can happen at any time. But during emergencies, such as the COVID-19 pandemic, there’s a heightened risk of fraud where spending is increased, and funds go out faster than usual.

Bringing fraudsters to justice is a vital step in restoring public trust in federal spending. It’s also essential to understanding how fraud was committed in the first place so that it can be prevented in the future.

Today’s WatchBlog post looks at our latest work on how individuals and organized groups defrauded federal COVID-19 relief and other programs.

Image

By the numbers: How big was fraud within pandemic-relief funds?

Pandemic-relief programs were crucial to protecting public health and keeping the economy stable during the national emergency. But fraudsters saw funds as attractive targets and an easy way to pilfer money from the government. Here’s how it shakes out:

19 pandemic-relief programs targeted. According to the Department of Justice (DOJ), at least 19 different programs were defrauded, as of December 2024. These programs included everything from child nutrition programs to rental assistance and restaurant revitalization programs.

Among these programs, three stood out as the most commonly defrauded: Unemployment Insurance, the Paycheck Protection Program, and the COVID-19 Economic Injury Disaster Loan program. So just how much money was involved? And what happened to those who committed fraud?

Over $300 billion in fraudulent payments. We estimated fraud for unemployment insurance programs between $100-135 billion from April 2020 through May 2023. The Small Business Administration’s (SBA) Office of Inspector General reported about $200 billion in potentially fraudulent pandemic-relief loans under the Paycheck Protection Program and the COVID-19 Economic Injury Disaster Loan program.

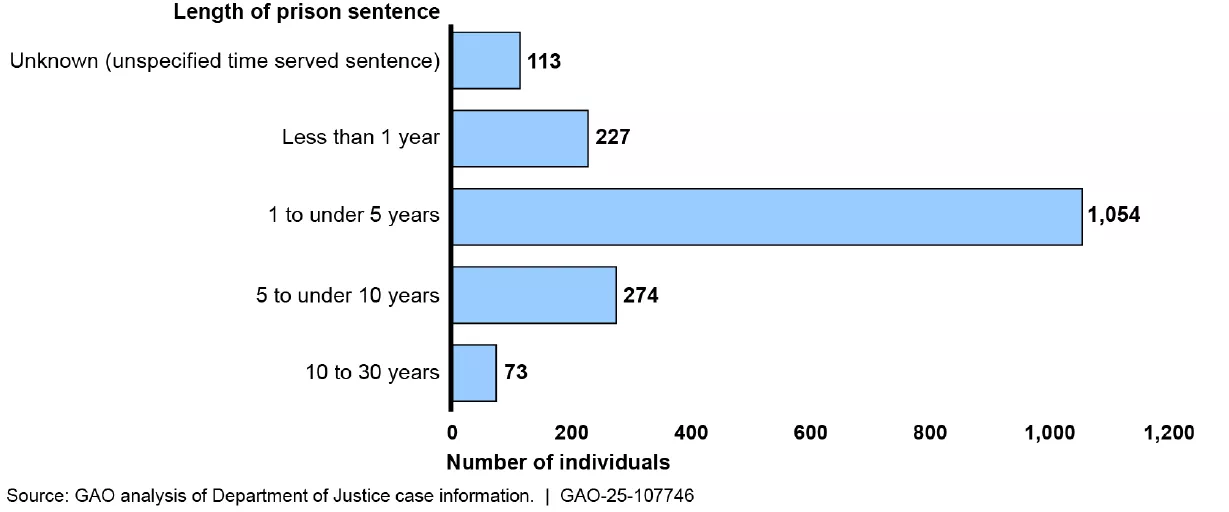

2,532 criminal convictions. Through the end of last year, about 82% of defendants were found guilty of criminal fraud-related charges involving pandemic-relief programs. Sentencing varied depending on the offense and defendants’ prior records. But most faced prison time. And most were fined and ordered to pay back the stolen money. Thousands of fraudsters faced civil penalties as well.

Prison Sentences for Defendants Found Guilty of Fraud-Related Charges Involving Pandemic-Relief Programs, as of December 31, 2024

Image

Who defrauds federal programs?

People from all walks of life have defrauded COVID-19 relief and other federal programs. Some fly solo in targeting federal funds.

Types of Opportunists GAO Identified in Pandemic-Relief Program Fraud Cases

Image

Some fraudsters also worked as part of organized groups to target federal programs. Nearly half of the defendants convicted of pandemic fraud-related offenses had conspiracy charges, indicating an organized fraud group.

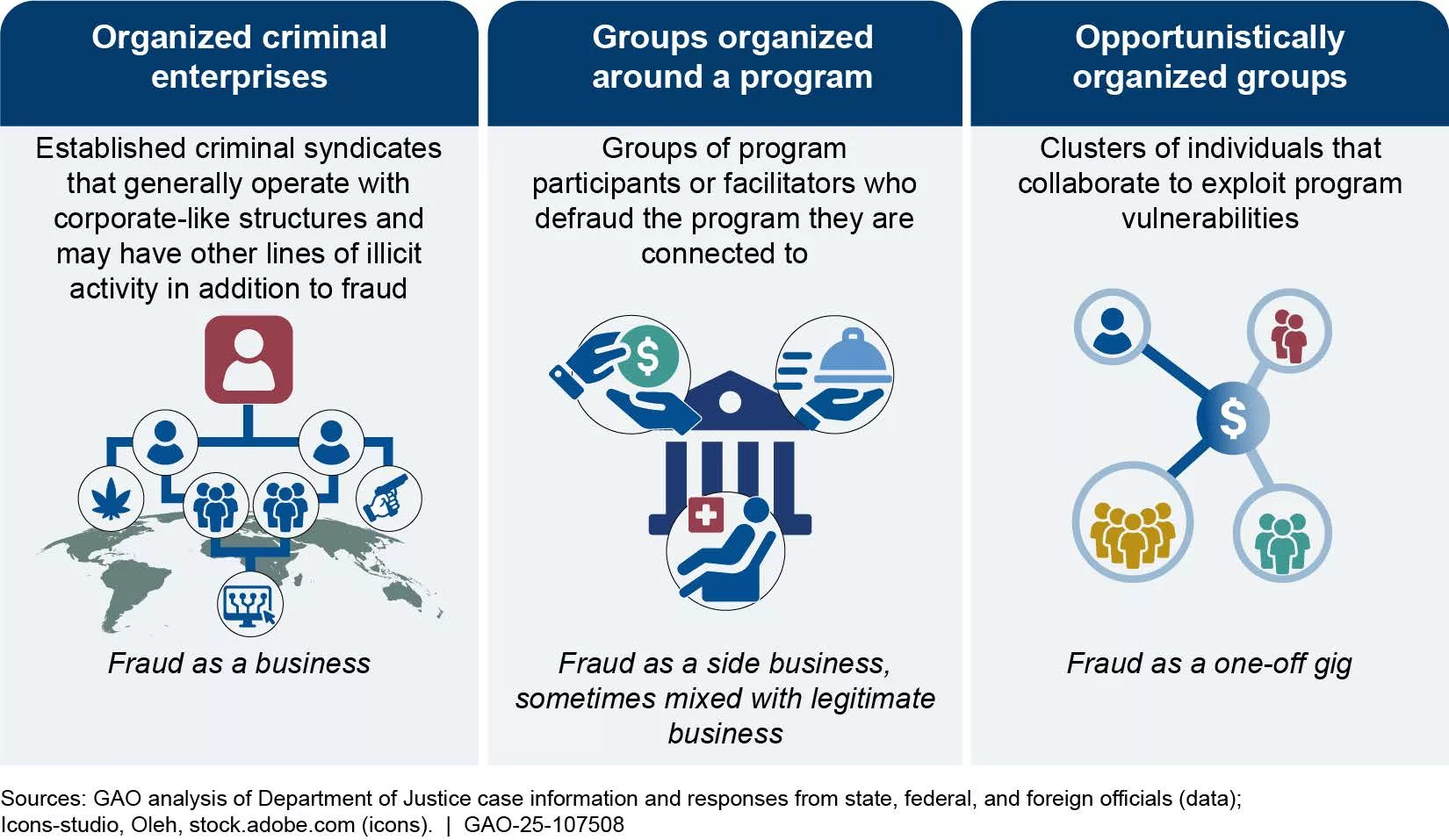

What is an organized fraud group? Organized groups range in size from two fraudsters to hundreds. They can be home grown or from abroad. They may be simple—with a mastermind assisted by someone who produces and sells fraudulent program documentation. Or they can be more complex—involving multiple cells within the group, each responsible for different tasks to carry out the fraud.

These groups include cartels, groups of people and businesses associated with the program, and opportunists who come together when they see a chance to commit fraud.

Types of Organized Fraud Groups Targeting Government Programs

Image

Organized groups are able to target federal programs at a greater scale and speed than individuals. These groups have used technology, program knowledge, stolen or fictitious personally identifiable information (PII), forged documentation, and other means to commit fraud.

For example, from January 2018 through May 2021, a hospice owner and a conspirator filed fraudulent claims and paid kickbacks to steal over $9 million from Medicare. The same group also carried out additional schemes to obtain funds from three pandemic-relief programs.

What’s being done to prevent future fraud?

Federal programs are no longer disbursing pandemic-relief funds. But DOJ and its law enforcement partners are still prioritizing the investigation and prosecution of defendants who committed these crimes. For example, Congress extended the statute of limitations from 5 to 10 years for fraud committed against the two SBA loan programs. Congress also extended the Pandemic Response Accountability Committee (PRAC) through 2034. PRAC was established to combat pandemic-relief program fraud, and their investigative leads have supported over a hundred criminal charges and over $16 million in recoveries, as of 2024.

Our recent reports also suggest actions federal agencies can take to further deter and prevent future fraudsters. These include publicizing consequences fraudsters will face and putting safeguards in place to prevent fraud from happening in the first place. Over the past several years, we’ve made more than 170 recommendations to more than 40 agency or program offices that would address fraud. Agencies have taken actions to address some of them, but more work needs to be done.

To learn more, see our pandemic-relief fraud report. And be sure to check out our report on organized groups and their fraud of government programs.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

- Got a comment, question? Email us at blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.