15 Years After the Subprime Meltdown, Renters Could Still Be Feeling the Impacts

The 2007-2009 financial crisis may seem like a distant memory now. But many are still feeling its impact. After millions of homeowners defaulted on their mortgages and lost their homes, investors bought up these properties and converted them to rental housing.

Back in the early 2010s, this “buy-up” helped meet the growing demand for rental housing among those who couldn’t afford to buy. But today, there are concerns that such investment could mean higher rents, higher home prices, and lower homeownership rates.

Today’s WatchBlog post looks at our new report on the impacts of institutional investment in single-family homes.

Image

As foreclosures increased, large investors arrived

“Institutional investors”—companies that own many single-family rental homes—leveraged their access to capital and technologies to purchase large numbers of foreclosed homes in the wake of the 2007-2009 financial crisis. These institutional investors then converted homes to rental housing.

Three key factors significantly contributed to the rise of these investors:

- First, because of the financial crisis, institutional investors were able to buy large numbers of foreclosed homes in concentrated areas in a short period of time. This enabled investors to increase (scale up) their investments very quickly.

- Second, investors had access to low-cost funding sources—such as private equity, public equity and debt securities, and the securitization of rental income. This allowed investors to pay cash for homes, giving them an edge in the competitive housing market.

- Third, technology advancements, such as digital platforms and online management portals, made acquiring and managing large portfolios of homes cost effective.

Where do investors buy properties?

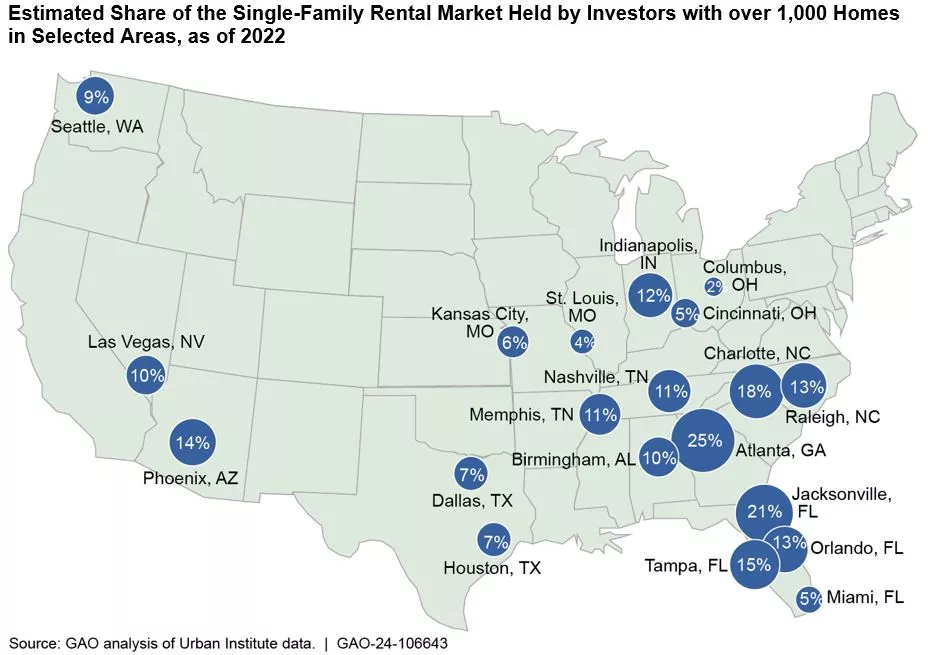

Nationally, institutional investors own about 3% of the single-family rental market. But certain regions have a much heavier presence of them in select markets. This is particularly true in Sunbelt cities—such as Atlanta, Jacksonville, or Charlotte. These areas were also, in many cases, hit hard with foreclosures after the financial crisis. For investors, having heavier concentrations of properties in certain areas resulted in management efficiency and cost savings. Reports from institutional firms found that investors targeted markets experiencing growth in population, employment, and rental demand.

Image

What’s the possible impact of institutional investment?

Some studies have found that institutional investors may have contributed to increased home prices and rents after the financial crisis. This may be particularly true in areas where investors owned a lot of homes. However, the effects on homeownership rates and tenants are less clear because data is limited and there is no agreed-upon definition of institutional investor.

Many other factors also make drawing conclusions about the effect of institutional investors on homeownership rates difficult. For example, much of the literature on this topic focuses on the period after the foreclosure crisis. During this time, fewer homebuyers were able to buy homes because of their financial situation and credit standards had tightened.

Additionally, drawing conclusions about investors’ effects on renters is difficult. There isn’t much research about these investors’ lease terms for renters—such as maintenance responsibilities, fees, and evictions. And research often focuses only on a few companies or a specific geographic area.

We’ll continue looking at this issue for Congress. Learn more about our work so far by checking out our new report.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.