Health Insurance Marketplaces: CMS Has Limited Assurance That Premium Tax Credits Exclude Certain State Benefit Costs

Fast Facts

Millions of Americans buy health insurance from their state marketplaces. Marketplace plans must cover essential health benefits, such as hospital stays. Many people can get a federal tax credit—paid directly to their insurance companies—to offset the part of the premium that pays for these benefits.

States may require plans to cover additional benefits, but federal funds can't be used to offset the part of the premium that pays for those.

Federal oversight of this rule is usually done via technical assistance, e.g., helping states if they ask whether certain benefits are essential. We recommended determining whether this is enough oversight.

Highlights

What GAO Found

Marketplace plans are statutorily required to cover essential health benefits (EHB). These benefits include items and services in 10 categories, such as emergency services and hospitalization. The federal advance premium tax credit (APTC) is available to help eligible enrollees afford their marketplace plans.

States may mandate additional benefits for marketplace plans to cover. States are responsible for identifying these non-EHB mandated benefits based on the standard established by the Centers for Medicare & Medicaid Services (CMS). CMS does not collect information on states that have identified non-EHB mandated benefits. Through interviews with relevant national organizations, GAO found at least six states that identified non-EHB mandated benefits. These states' mandated benefits included pediatric hearing aids and fertility care.

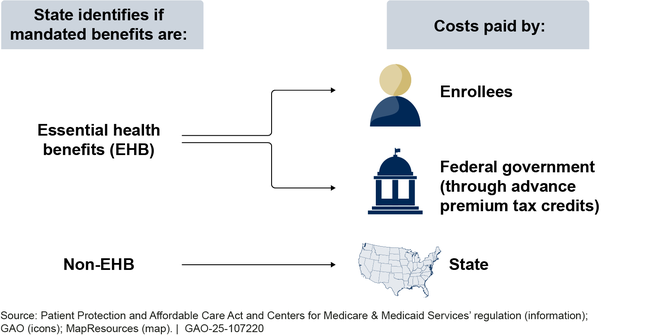

APTCs must exclude the costs of non-EHB mandated benefits, so that federal funds are not used to subsidize their costs. To calculate APTCs, CMS relies on insurers to report premium data that excludes the cost of these benefits.

Entity Responsible for Premium Costs of Mandated Benefits

CMS oversees the requirements related to non-EHB mandated benefits primarily through technical assistance, according to agency officials. CMS officials said that states frequently reach out to them for assistance, including asking them for advice on whether a benefit requirement they are considering would be a non-EHB mandated benefit.

However, CMS has not assessed whether its oversight approach is sufficient, and thus, has limited assurance that APTC amounts exclude the costs of non-EHB mandated benefits. This poses a risk to its oversight objective and is inconsistent with federal internal control standards that call for identifying, analyzing, and responding to risks related to achieving agency objectives. Conducting such an assessment of its oversight approach and making changes as appropriate would provide greater assurance that the APTC is appropriately excluding these costs.

Why GAO Did This Study

In February 2024, over 20 million Americans purchased health insurance coverage through the marketplaces established by the Patient Protection and Affordable Care Act. In 2022, 90 percent of marketplace enrollees were eligible for federal APTC payments, which totaled over $75 billion.

CMS has expressed concerns that states may not identify non-EHB mandated benefits and that the APTCs do not exclude the costs of these benefits, resulting in improper federal payments.

GAO was asked to review states' non-EHB mandated benefits and CMS efforts to ensure that federal funds do not subsidize their costs. This report (1) describes what is known about states' non-EHB mandated benefits and (2) examines CMS efforts to ensure that APTCs exclude the costs of states' non-EHB mandated benefits.

GAO reviewed federal law, regulations, and CMS documentation; and interviewed CMS officials and stakeholders from three national organizations with insight on state-mandated benefits.

Recommendations

GAO is recommending that CMS conduct a risk assessment to determine whether its oversight approach is sufficient to ensure that APTCs exclude the costs of non-EHB mandated benefits or whether additional oversight is needed. The Department of Health and Human Services (HHS) agreed with the recommendation. HHS also provided technical comments, which GAO incorporated as appropriate.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Centers for Medicare & Medicaid Services | The Administrator of CMS should conduct a risk assessment to determine whether its oversight approach is sufficient to ensure that APTCs exclude the costs of non-EHB mandated benefits or whether additional oversight is needed. CMS should make changes as appropriate based on the results of this assessment. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|