Currency Transaction Reports: Improvements Could Reduce Filer Burden While Still Providing Useful Information to Law Enforcement

Fast Facts

Financial institutions must file currency transaction reports for any cash transactions in amounts greater than $10,000 a day. Law enforcement agencies can use the reports to investigate drug trafficking, terrorist acts, fraud, and other criminal activities.

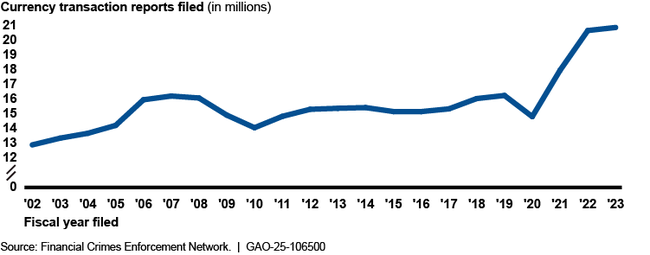

The number of reports filed has increased by about 62% since FY 2002. The reporting threshold hasn't been updated for inflation since it was set in the 1970s—which may have contributed to the increase. Law enforcement only used a small portion of total reports during our review.

Our recommendations include ways to reduce unused reports—such as raising the reporting threshold—and more.

Highlights

What GAO Found

Currency transaction reports (CTR) must be filed by financial institutions for cash transactions exceeding $10,000 in a day and are intended to provide law enforcement with highly useful information. The $10,000 threshold, set in regulation by the Department of the Treasury in 1972, has not been adjusted for inflation. Inflation may have contributed to the increase in volume of CTRs filed, which has increased by about 62 percent since fiscal year 2002 (see figure). The inflation-adjusted threshold in 2023 would have been about $72,880. Using an inflation-adjusted threshold would have reduced the number of CTRs filed by at least 90 percent annually since 2014.

Currency Transaction Reports Filed, Fiscal Years 2002–2023

GAO identified key challenges and potential inefficiencies in the CTR system:

- Unused reports. Law enforcement agencies accessed a small percentage of CTRs through either the Financial Crimes Enforcement Network's (FinCEN) BSA Portal or agencies' internal systems, leaving most unused. From 2014 through 2023, law enforcement agencies accessed about 5.4 percent of CTRs filed in FinCEN's BSA Portal during that period. For CTRs accessed in either FinCEN's BSA Portal or agencies' internal systems in 2023 (the most recent full year), law enforcement agencies accessed less than 3 percent of CTRs filed from 2014 through 2023.

- Difficult and infrequently used fields. Filers GAO interviewed reported difficulty completing certain fields, some of which law enforcement agencies reported infrequently using.

- Unclear or unhelpful aggregation requirements. FinCEN's requirements for aggregating related transactions exceeding $10,000 in 1 day was sometimes unclear to filers GAO interviewed. Further, some law enforcement agencies noted that large aggregated CTRs of unrelated parties do not provide useful information.

By taking steps to reduce the number of unused CTRs—such as through adjusting the reporting threshold—and by eliminating rarely used fields and clarifying aggregation requirements, FinCEN could reduce unnecessary filer burden without affecting CTRs' usefulness to law enforcement.

Why GAO Did This Study

Financial institutions filed roughly 167 million CTRs in fiscal years 2014–2023. The Anti-Money Laundering Act of 2020 includes a provision for GAO to review CTR requirements and issue a report by December 2025. GAO has issued four prior reports in response to the act, including one on law enforcement's use of reports about suspicious financial transactions.

This report examines (1) the potential effects of changing the CTR threshold, (2) the extent that CTR requirements align with statutory objectives, and (3) the extent that CTR requirements provide useful information to law enforcement.

GAO analyzed data from FinCEN on CTRs filed in fiscal years 2014–2023 and conducted a survey of all 327 federal, state, and local law enforcement agencies that can directly access CTRs (60 percent response rate). GAO also interviewed officials of tribal, federal, state, and local agencies; industry groups representing CTR filers; and 13 financial institutions (selected to represent different asset sizes and types of institutions), as well as privacy and compliance experts. GAO also reviewed relevant laws and regulations.

Recommendations

GAO is making four recommendations, including that FinCEN take steps to reduce the number of unused CTRs, eliminate infrequently used fields, and simplify and clarify aggregation requirements. FinCEN agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should ensure that the Director of FinCEN takes steps to eliminate CTR data fields that are unnecessarily burdensome for filers and of little use to law enforcement. This could be done as part of FinCEN's AMLA review or through a different method. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Department of the Treasury | The Secretary of the Treasury should ensure that the Director of FinCEN takes steps to simplify and clarify aggregation requirements. This could be done as part of FinCEN's AMLA review or through a different method. (Recommendation 2) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Department of the Treasury | The Secretary of the Treasury should ensure that the Director of FinCEN establishes a performance management process that defines performance goals and measures for monitoring the usefulness of CTRs. (Recommendation 3) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Department of the Treasury | The Secretary of the Treasury should ensure that the Director of FinCEN takes steps to reduce the number of CTRs filed that are not used by law enforcement, such as by raising the reporting threshold or expanding criteria to allow for further exemptions. These actions should be informed by an analysis of the characteristics of CTRs that have been less likely to be accessed by law enforcement. (Recommendation 4) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|