401(k) Plans: Industry Data Show Low Participant Use of Crypto Assets Although DOL's Data Limitations Persist

Fast Facts

Some 401(k) plans now offer the option to invest in crypto assets like bitcoin. While all investments have risks, our analysis shows that investment in selected crypto assets is uniquely volatile. The potential for high returns can come with considerably high risk.

Available industry data suggests that 401(k) investment in crypto assets remains low. But the Department of Labor still doesn't have the data to systematically measure crypto assets in 401(k) plans.

Our open recommendation from 2014 would improve the data the Department uses to identify 401(k) plans with investments in crypto assets.

Highlights

What GAO Found

Available industry data and stakeholder interviews suggest crypto assets are a small part of the 401(k) market. Crypto assets are generally private-sector digital instruments that depend primarily on encryption and distributed ledger or similar technology to conduct transactions without a central authority, such as a bank. Limited Department of Labor (DOL) data prevent systematic measurement of crypto assets in 401(k) plans. Based on available information, crypto assets are a small part of the 401(k) market. GAO identified 69 crypto asset investment options available to 401(k) participants. Participants may have multiple ways to access these options. Some may have access through their 401(k) plans' core investment options. Participants may also have access to crypto assets outside these core options, through arrangements like self-directed brokerage windows.

GAO's analysis of investment returns indicates crypto assets have uniquely high volatility—a measure of their riskiness to participants—and their returns can come with considerable risk. GAO's simulation found a high allocation (20 percent) to bitcoin, the crypto asset with the longest price history, can lead to higher volatility than smaller allocations (1 and 5 percent). Further, GAO's interviews with researchers and firms that develop crypto asset investment options indicate there is no standard approach for projecting the potential future returns of crypto assets.

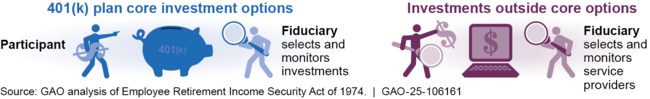

DOL guidance states that 401(k) fiduciary responsibility does not change when crypto assets are offered as investment options. ERISA requires fiduciaries to be prudent in selecting and monitoring their 401(k) plans' core investment options, including any crypto asset investment options. DOL officials told GAO they generally had not required fiduciaries to select and monitor all options offered outside this core—for example, through self-directed brokerage windows—in accordance with ERISA's fiduciary standards. Thus, participants who invest outside their plan's core may have to take primary responsibility for selecting and monitoring crypto asset investment options (see figure).

401(k) Participants May Assume Greater Responsibility When Investing outside Core Investment Options

Lack of comprehensive data, along with regulatory uncertainty GAO has previously identified, limits federal oversight of participant investment in crypto assets in 401(k) plans. DOL does not have comprehensive data to identify 401(k) plans that give participants access to crypto assets. For example, the forms 401(k) plan fiduciaries file to meet federal reporting requirements do not identify crypto asset investment options in plans with fewer than 100 participants. Plans with 100 or more participants aggregate self-directed brokerage window investments, hindering DOL's ability to isolate investments in crypto assets. Additionally, federal regulatory gaps GAO identified in June 2023 remain unaddressed. As a result, certain crypto assets continue to trade in markets that do not have investor protections or comprehensive oversight.

Why GAO Did This Study

Retirement savings in 401(k) plans totaling more than $6.7 trillion in 2022 are a key component of the U.S. retirement system. Since 2022, some investment firms have offered options for participants to invest in crypto assets, raising questions among regulators and some in industry. GAO was asked to review crypto asset investment options in 401(k) plans.

This report examines (1) the presence of crypto asset investment options in 401(k) plans, (2) the potential effects of crypto assets on participant savings, (3) how fiduciaries meet ERISA responsibilities when offering crypto assets in 401(k) plans, and (4) the extent of federal oversight of crypto asset investment options in 401(k) plans.

GAO reviewed data from firms that serve 401(k) plans, forms filed by 401(k) plans, and relevant federal statutes, regulations, and guidance. GAO conducted 28 interviews with government officials, researchers, and associations of plan fiduciaries, participants, service providers, and crypto asset companies. GAO also performed a simulation analysis to estimate potential retirement savings.

Recommendations

In prior work, GAO recommended DOL improve the form for fiduciary reporting on 401(k) plans (GAO-14-441). DOL improved some aspects of the form but has yet to determine what additional actions it will take. GAO also reported that Congress should consider legislation to fill federal regulatory gaps over crypto assets (GAO-23-105346). Legislation has been introduced but no bill has become law as of October 2024.