State Small Business Credit Initiative: Treasury Made Progress on Disbursements and Improvements to Project Scheduling

Fast Facts

The Treasury Department's State Small Business Credit Initiative provides funds to states, territories, and tribes to support small business lending and investment programs. Congress appropriated $10 billion for this program in 2021.

We've previously reported that Treasury is taking longer than expected to review applications and disburse funds for this program. In response, Treasury developed a project management tool that helps track, manage, and report on program activities. However, we found that Treasury still needs to improve its processes—including better analyzing staff availability and workloads to efficiently implement this program.

Highlights

What GAO Found

The State Small Business Credit Initiative (SSBCI) provides funds to participating jurisdictions to support small business lending and investment programs through its capital program. The program also includes technical assistance funds that jurisdictions can use to provide legal, accounting, and financial advisory services to support certain businesses applying for SSBCI or another government small business program.

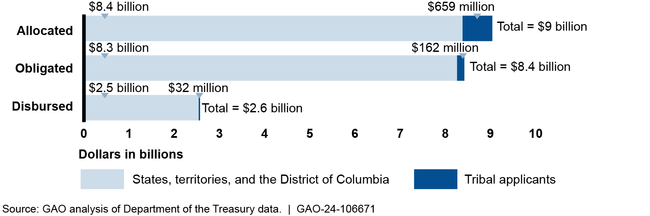

The Department of the Treasury, which administers most SSBCI funding, obligated $8.4 billion and disbursed $2.6 billion in SSBCI capital program funds as of December 31, 2023. (See figure.) As of that date, nearly all states and territories and about one-third of tribal applicants had been approved to participate in the capital program and received funds. Treasury continued to review the remaining applications, which primarily included tribal applicants for which there was a later deadline. The Department of Commerce awarded $117 million in SSBCI technical assistance funds to 43 organizations in September 2023.

Capital Program Funding for the State Small Business Credit Initiative, as of December 31, 2023

Note: Numbers may not sum to the totals due to rounding.

Treasury incorporated additional best practices for project scheduling for SSBCI in line with GAO's 2023 recommendation ( GAO-23-105293 ). For example, Treasury began to use a project management tool that helps track, manage, and report on projects. However, GAO's recommendation remains open until Treasury demonstrates further progress fully incorporating these best practices. For example, Treasury could better analyze staff availability and workloads to help the SSBCI program team efficiently implement the program. By fully addressing GAO's recommendation, Treasury could help ensure timely disbursement of the remaining $6.5 billion of allocated funds.

In December 2023, Treasury finalized performance metrics for SSBCI that track deployment of SSBCI funds to eligible small businesses and the amount of private capital leveraged. These metrics are consistent with key attributes of successful performance metrics GAO identified, such as including measurable targets. Treasury provided templates and training to help jurisdictions meet reporting requirements. Treasury published the first quarterly report on SSBCI (based on data jurisdictions submitted) in December 2023 and plans to issue the first annual report in September 2024.

Why GAO Did This Study

SSBCI was reauthorized by the American Rescue Plan Act of 2021 (ARPA) to support small businesses recovering from the economic effects of the COVID-19 pandemic. Congress appropriated $10 billion for the program. ARPA requires Treasury to complete all disbursements and remaining obligations before September 30, 2030. Any remaining funds unexpended by Treasury are to be rescinded and deposited in Treasury's general fund.

The CARES Act and ARPA include provisions for GAO to monitor and oversee federal efforts to respond to the COVID-19 pandemic. GAO previously examined jurisdictions' planned use of SSBCI funds and Treasury's implementation of the program (GAO-23-105293). This report examines the disbursement of SSBCI funds and Treasury's continuing efforts to manage time frames and measure and report on program performance, among other objectives.

GAO analyzed Treasury data on amounts disbursed to participating jurisdictions and interviewed Treasury and Commerce officials. GAO also reviewed Treasury's planning tools and program guidelines and interviewed representatives of four territories and a nongeneralizable sample of 12 states and 13 tribal applicants. They were selected to represent a range of geographic regions and other characteristics.

For more information, contact Michael Clements at (202) 512-8678 or clementsm@gao.gov.