Sugar Program: Alternative Methods for Implementing Import Restrictions Could Increase Effectiveness

Fast Facts

The Department of Agriculture administers the U.S. sugar program to support domestic sugar production through tools such as limiting the supply of sugar.

The program creates higher sugar prices, which cost consumers more than producers benefit, at an annual cost to the economy of around $1 billion per year.

The program also restricts the amount of sugar entering the U.S. at a low tariff. The tariff restrictions are applied using a method based on 40-year-old data that doesn't reflect current market conditions. This has led to fewer sugar imports than expected.

We recommended that USDA evaluate its method for restricting imports.

Highlights

What GAO Found

The U.S. sugar program, administered by the U.S. Department of Agriculture (USDA), provides substantial benefits to sugar producers. Because the program guarantees relatively high prices for domestic sugar, sugar farmers benefit significantly, and sugar farms are substantially more profitable per acre than other U.S. farms. Research GAO reviewed suggests the U.S. sugar program results in an increase in domestic sugar production and higher profits for farmers, totaling an estimated $1.4 billion to $2.7 billion in additional benefits annually.

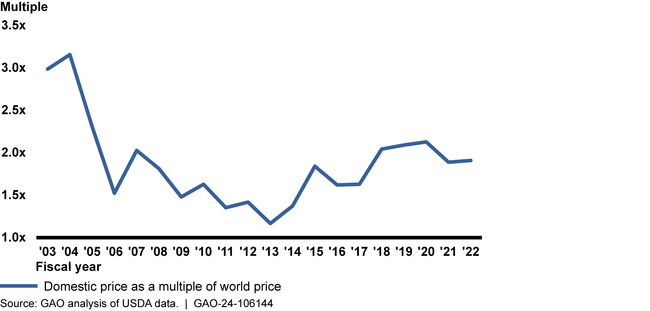

The U.S. sugar program creates net costs to the economy, because higher sugar prices created by the program cost consumers more than producers benefit, according to research GAO reviewed. According to some studies, the program costs consumers an estimated $2.5 billion to $3.5 billion per year, yielding net costs to the economy of approximately $1 billion per year. Other studies estimate that the program leads to declines in U.S. employment in industries that rely heavily on sugar, such as confectionery manufacturing. In 2022 U.S. consumers, including food manufacturers, paid twice the world price for sugar.

Difference between U.S. and World Raw Sugar Prices, 2003 to 2022

Nearly half of U.S. imports of sugar come from Mexico, and according to studies these imports have a significant effect on the U.S. market. Beginning in 2008, sugar imported from Mexico became duty-free and quota-free. In 2014, the U.S. and Mexico agreed to set a minimum price and quantity limits on Mexican imports. Subsequently, imports of Mexican sugar fell and prices rose, benefiting U.S. sugar producers but increasing the cost to consumers and the economy.

Almost half of U.S. sugar imports are subject to trade commitments made through the World Trade Organization (WTO) and free trade agreements. The U.S. Trade Representative (USTR) allocates WTO tariff rate quotas, with input from USDA, among sugar-importing countries using a method based on 40-year-old data. In practice, this has led to fewer sugar imports than planned and delays in obtaining sugar. USDA and USTR have not considered alternatives to their allocation method. Without considering new methods, USDA and USTR may be missing opportunities to make sugar allocations more effective and efficient.

Why GAO Did This Study

The U.S. is among the world's largest sugar producers and consumers. The Agriculture and Food Act of 1981 contained provisions to support the price of U.S. sugar and, according to USDA, established the current structure of the U.S. sugar program. The program was reauthorized most recently in 2018.

GAO was asked to review the effects of the U.S. sugar program. This report examines (1) the benefits of the U.S. sugar program and groups likely to benefit, (2) the costs of the U.S. sugar program and groups likely to bear the costs, (3) how agreements with Mexico on sugar affect imports and the overall U.S. economy, and (4) how other trade agreements affect the U.S. sugar program, and how they are implemented.

GAO reviewed agency documents and data and interviewed federal officials, academics, and industry stakeholders including groups representing sugar producers and sugar using industries. GAO also conducted a literature review on the effects of the U.S. sugar program on the economy and trade.

Recommendations

GAO is recommending that (1) USDA evaluate the effectiveness of the current method and alternative methods for allocating raw sugar tariff-rate quotas, (2) USTR evaluate alternative allocation methods for consistency with U.S. law and international obligations, and (3) USTR use the results of these evaluations to validate or change its quota allocation method. USDA and USTR concurred with our recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Agriculture | The Secretary of Agriculture should evaluate the effectiveness of the WTO raw sugar tariff-rate quota allocation method versus other tariff-rate quota allocation methods to determine which would most effectively maintain an adequate sugar supply and minimizes costs to the government. (Recommendation 1) |

USDA concurred with GAO's recommendation and stated that USDA will evaluate the effectiveness of the WTO raw sugar tariff-rate quota allocation method versus other TRQ allocation methods and provide such evaluation to USTR within two years. As of November 2024, USDA expected to complete its evaluation in early 2025, according to USDA. GAO continues to monitor agency actions related to this recommendation.

|

| Office of the U.S. Trade Representative | The U.S. Trade Representative should evaluate alternative WTO raw sugar tariff-rate quota allocation and reallocation methods to determine their consistency with international obligations and U.S. law, and whether they have any foreign policy implications. (Recommendation 2) |

USTR concurred with GAO's recommendation. As of November 2024, USTR stated it is continuing to compile a list of alternative allocation and reallocation methods, which will be informed by the methods identified by USDA. Within the next two years, USTR plans to evaluate each alternative method for consistency with U.S. international obligations under the WTO Agreement, and U.S. law. USTR also stated it will evaluate any foreign policy implications of the alternative methods identified, in consultation with interagency partners, as appropriate. GAO continues to monitor agency actions related to this recommendation.

|

| Office of the U.S. Trade Representative | The U.S. Trade Representative should use its completed evaluation and USDA's completed evaluation of WTO raw sugar tariff-rate quota allocation methods to determine whether they should continue using the current method, or select an alternative method. (Recommendation 3) |

USTR concurred with GAO's recommendation. Once the evaluations are completed by USDA and USTR in response to the first two recommendations, USTR plans to determine whether to continue using the current allocation and reallocation methods, according to USTR. USTR also stated that they will be able to provide information on their expected timeframe for addressing this recommendation following the completion of the USDA and USTR evaluations. GAO continues to monitor agency actions related to this recommendation.

|