Crop Insurance: Update on Opportunities to Reduce Program Costs

Fast Facts

The federal crop insurance program helps farmers get insurance to protect them when crop prices decline or harvests fall short due to natural causes.

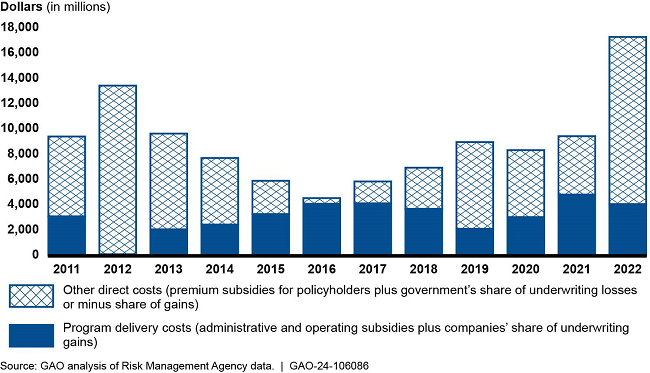

The Department of Agriculture partners with private insurers to run the program. In 2022, federal costs were $17.3 billion—with about $12 billion subsidizing premiums and the rest going toward the insurance companies' administrative costs and government costs for losses related to the policies.

We've found ways to reduce federal costs—for example, by reducing subsidies for the highest-income policyholders. We have recommended that Congress consider revising the program to address this and more.

Highlights

What GAO Found

| High-income policyholders (adjusted gross income (AGI) $900,000 or more) |

Other policyholders (AGI less than $900,000) |

|

|---|---|---|

| Number of policyholders | 1,341 | 457,650 |

| Percentage of policyholders | 0.3% | 99.7% |

| Percentage of premiums | 0.5% | 99.5% |

Why GAO Did This Study

The federal crop insurance program offers subsidized crop insurance to protect producers against financial losses from crop price declines and poor harvests due to natural causes.

In 2022, the program supported about 1.2 million policies that covered 493 million acres and cost the federal government $17.3 billion, according to USDA. The program's cost is projected to total more than $101 billion over the next decade, according to the Congressional Budget Office.

USDA partners with private insurance companies to deliver the program. The federal costs for the program include compensation to these companies and subsidies to pay for part of policyholders' crop insurance premiums.

GAO was asked to review the federal crop insurance program and opportunities to reduce its cost. This report builds on GAO's prior work to provide information on (1) private delivery of the crop insurance program through insurance companies and (2) premium subsidies for crop insurance policyholders.

GAO analyzed agency data and reviewed relevant legislation, regulations, agency documents, and academic studies. GAO also interviewed agency officials and organizations representing those affected by the crop insurance program, such as producers and insurance companies.

Recommendations

GAO has previously recommended and still believes that Congress should consider repealing the 2014 farm bill provision that any revision to the agreement with insurance companies not reduce their expected underwriting gains and consider reducing premium subsidies for the highest-income participants. USDA did not have any comments on the report.