Small Business Administration: Procedures for Reporting on Veteran-Owned Businesses Need Improvement

Fast Facts

Many veterans face challenges with raising capital to start small businesses—such as establishing credit and developing business relationships if they move to a new area after military service.

The Small Business Administration must give special consideration to veterans for its lending programs. But the agency hasn't developed policies and procedures to do so. For example, SBA committed to processing applications for veteran-owned businesses promptly. However, it doesn't define what "promptly" means in this regard.

We recommended that SBA establish specific procedures to ensure veterans are given special consideration.

Highlights

What GAO Found

The characteristics of small businesses owned by veterans generally were similar to those owned by nonveterans, according to GAO analysis of 2020 Annual Business Survey data. For both types, most businesses had fewer than 10 employees and were in urban areas. Among the most common challenges to accessing capital that veteran-owned businesses cited were long wait times for credit decisions, difficulty with application processes, and high interest rates, according to GAO analysis of Small Business Credit Survey data.

The Small Business Administration (SBA) provides training and education on small business ownership through veterans business outreach centers, which state and local agencies and other eligible organizations operate. SBA requires the centers to submit quarterly performance reports. GAO found that some of the reports did not include all the required information, such as the number of counseling sessions. By developing procedures for ensuring compliance with reporting requirements, SBA would have better information with which to oversee centers.

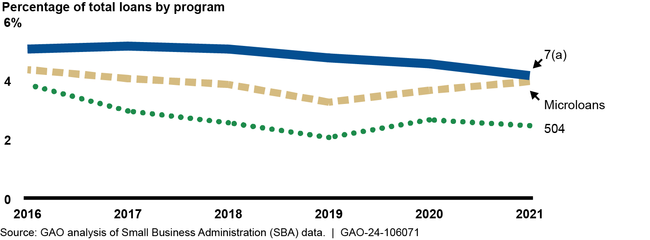

SBA facilitates access to capital for small business owners, including veterans, through three loan programs. The 7(a) program provides financing through commercial lenders, the 504 program provides financing for fixed assets (such as buildings or machinery), and the Microloan program provides financing up to $50,000 and technical assistance. Veteran-owned small businesses received about 2–5 percent of all loans in the three programs in fiscal years 2016–2021.

Percentage of Loans to Veterans, for SBA's 7(a), 504, and Microloan Programs, Fiscal Years 2016–2021

SBA does not have policies and procedures for complying with selected statutory requirements concerning veterans. For instance, SBA's standard operating procedures did not explain how the agency will provide special consideration to veterans in accordance with the Small Business Act and SBA's implementing regulation. SBA also lacked procedures for reporting to congressional committees and could not demonstrate compliance in recent years. Establishing policies and procedures for these requirements would provide greater assurance that SBA is keeping Congress informed and providing special consideration to veterans, as required by law.

Why GAO Did This Study

Approximately 6 percent of businesses with paid employees were veteran-owned in 2020, but veteran entrepreneurs may face challenges in accessing small business capital. The Small Business Act authorizes certain SBA small business lending programs, requires SBA to give special consideration to veterans, and authorizes SBA to establish veterans outreach programs.

GAO was asked to examine capital access for veteran-owned small businesses and SBA's role in serving these businesses. This report (1) describes characteristics of veteran-owned businesses and their challenges in accessing capital, (2) examines SBA performance data on its veterans outreach program, (3) examines SBA lending to veteran-owned small businesses in 2016–2021, and (4) assesses SBA policies and procedures for complying with selected statutory requirements concerning veterans. GAO reviewed national small business data and SBA policies, procedures, and data on lending programs and also interviewed agency officials, 22 veterans outreach center directors, and 11 veterans who participated in SBA programs.

Recommendations

GAO recommends that SBA (1) develop guidance for veterans outreach center quarterly reporting, (2) establish procedures to comply with statutorily required annual reporting, and (3) establish procedures to give special consideration to veterans in its lending programs. SBA agreed with all the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Small Business Administration | The Administrator of SBA should ensure that the Associate Administrator of SBA's Office of Veterans Business Development develop and implement policies and procedures for ensuring VBOCs' full compliance with quarterly year-end reporting requirements. (Recommendation 1) |

SBA agreed with this recommendation. In its comment letter on our December 2023 report, SBA described plans to revise its VBOC standard operating procedure and complete a standardized summary report template to ensure consistency and minimize reporting errors and omissions in VBOC quarterly reports. To fully implement this recommendation, SBA would have to revise the standard operating procedure and develop and implement the report template. Doing so would help provide SBA better and more comprehensive information with which to oversee and assess the VBOC program.

|

| Small Business Administration |

Priority Rec.

The Administrator of SBA should ensure that the Associate Administrator of SBA's Office of Veterans Business Development develop and implement policies and procedures to ensure SBA's compliance with Section 603 of the Veterans Entrepreneurship and Business Development Act of 1999. (Recommendation 2) |

SBA agreed with this recommendation. In its comment letter on our December 2023 report, SBA described plans to implement policies and procedures to submit an annual report to congressional committees. To fully implement this recommendation, SBA would have to develop and implement these policies and procedures. Doing so would help SBA meet its statutory responsibilities and provide Congress with information needed to conduct effective oversight of SBA programs.

|

| Small Business Administration |

Priority Rec.

The Administrator of SBA should ensure that the Associate Administrator of SBA's Office of Capital Access develop and implement policies and procedures to ensure SBA gives special consideration to veterans in its lending programs in accordance with the Small Business Act and SBA's implementing regulation. (Recommendation 3) |

SBA agreed with this recommendation. In its comment letter on our December 2023 report, SBA described incorporating specific guidance on giving special consideration to veterans in its lending platform and standard operating procedures. To fully implement this recommendation, SBA would have to complete these efforts to develop and incorporate policies related to veterans. Doing so would help ensure that SBA complies with the statutory requirement and provide better assurance that veterans receive the special consideration they are due.

|