Antidumping and Countervailing Duties: Process Design Helps Ensure Proceedings Are Based on Accurate and Complete Information

Fast Facts

Foreign companies selling unfairly priced, i.e. "dumped," or government-subsidized goods make it hard for U.S. companies to compete in domestic markets. Affected companies can petition U.S. agencies to investigate and impose duties to level the playing field.

In 2021, over $30 billion in imported goods were subject to these duties.

While some claim that U.S. companies may file baseless petitions to block domestic competition, parts of the process—like a public case record with information that agencies verify and parties may challenge—can help ensure agencies do not make decisions based on false or incomplete information.

Highlights

What GAO Found

The U.S. Department of Commerce and the U.S. International Trade Commission (USITC) jointly administer the antidumping and countervailing duties (AD/CVD) investigation process. Typically, Commerce determines whether to initiate an investigation after examining a petition filed on behalf of a domestic industry alleging unfair trade practices by foreign entities. In the investigation phase, Commerce conducts an investigation of dumping or subsidies, and USITC investigates material injury to the domestic industry.

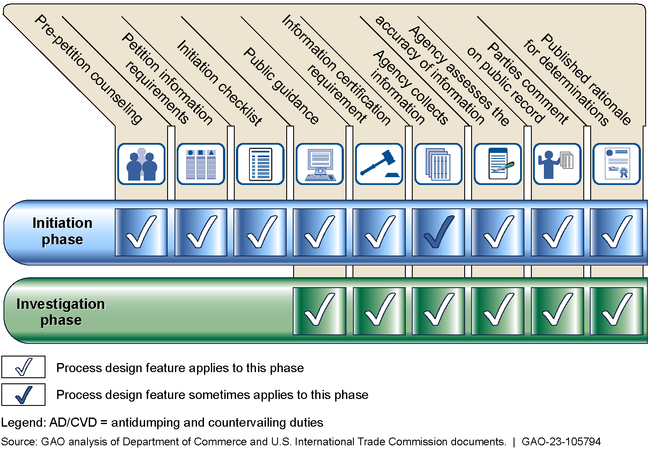

Some features of the AD/CVD process design function as internal controls that may lessen the risk of the agencies initiating or conducting an investigation with inaccurate or incomplete information. These features relate to (1) communication of process requirements through pre-petition counseling and public guidance, (2) petition information requirements, (3) information certification requirements, (4) independent collection and corroboration of information, and (5) transparency of case information and of the rationale supporting agency determinations.

AD/CVD Process Design and Corresponding Features That Function as Internal Controls

AD/CVD law contains no provision for USITC to consider potential negative economic effects of AD/CV duties on downstream purchasers (i.e., industries, retailers and consumers) when determining injury to domestic producers, according to USITC. However, USITC may solicit downstream purchaser information to analyze conditions of competition in the product's domestic market. USITC officials stated that this analysis plays a role in helping the agency determine whether the injury to domestic industry is by reason of the imported products.

Why GAO Did This Study

The United States and many of its trading partners have enacted laws to remedy the unfair trade practices of other countries and foreign companies that cause or threaten to cause material injury to domestic producers and workers. U.S. laws authorize the imposition of duties on certain imports that are dumped (i.e., sold at less than fair market value) and countervailing (offsetting) duties on certain imports subsidized by foreign governments. These duties are among the most commonly applied U.S. trade remedies. In fiscal year 2021, $30.2 billion of imported goods were subject to AD/CV duties. As of March 2022, the United States had 657 active AD/CVD orders, affecting imports from 59 countries.

Some contend that domestic companies may sometimes file petitions without merit to obstruct domestic market competition. Others assert that such duties could have adverse effects on other economic sectors, such as increased costs for downstream purchasers. GAO was asked to review AD/CVD processes and domestic market competition considerations. This report details the processes U.S. agencies have in place to conduct AD/CVD proceedings and ensure the accuracy and completeness of AD/CVD petitions and related information. This report also examines how aspects of market competition factor into the AD/CVD process.

GAO reviewed agency guidance and policy documents. Additionally, GAO reviewed relevant legal documents and related sources and interviewed agency officials. GAO also analyzed data on AD/CVD case outcomes from fiscal years 2011 through 2021.

For more information, contact Kimberly M. Gianopoulos at (202) 512-8612 or gianopoulosk@gao.gov.