Unemployment Insurance: Data Indicate Substantial Levels of Fraud during the Pandemic; DOL Should Implement an Antifraud Strategy

Fast Facts

Congress created 4 new unemployment insurance programs to support workers during the COVID-19 pandemic. Following this expansion, the amount of fraud in these programs increased—with evidence indicating that the total fraud was over $60 billion and perhaps much higher.

The Department of Labor has taken steps to address such fraud. For example, it issued guidance, provided funding to states, and recommended improvements to state unemployment insurance programs. However, the department has yet to develop an antifraud strategy based on leading practices from GAO's Fraud Risk Framework as required by law.

We recommended that it do so.

Highlights

What GAO Found

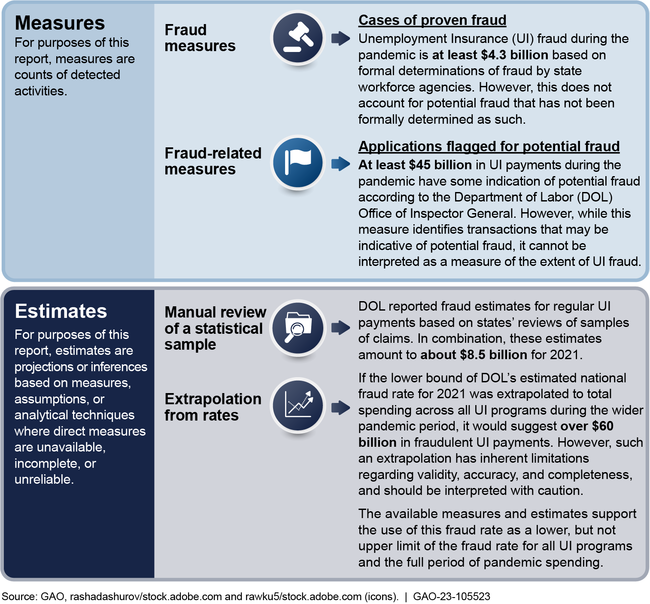

Considered together, measures and estimates indicate substantial levels of fraud and potential fraud in unemployment insurance (UI) programs during the pandemic. However, each measure and estimate has strengths and limitations, and none completely and reliably indicates the extent of fraud in UI programs during the pandemic.

Examples and Definitions of Measures and Estimates

DOL has taken steps to address UI fraud risks. For example, DOL issued guidance, provided funding to states, and deployed teams to recommend improvements to state UI programs. While these steps help prevent, detect, and respond to fraud, as of December 2022, DOL has not yet developed an antifraud strategy based on leading practices in GAO's Fraud Risk Framework. Also, it has not yet addressed the six October 2021 recommendations GAO made including to identify, assess the impact of, and prioritize UI fraud risks. These are essential pieces to inform an overall antifraud strategy. Without an antifraud strategy, DOL is not able to ensure that it is addressing the most significant fraud risks facing the UI system in alignment with the Fraud Risk Framework.

Why GAO Did This Study

The UI system has faced long-standing challenges with program integrity, which worsened during the pandemic. Congress created four new UI programs to support workers during the pandemic. According to DOL data, approximately $878 billion in benefits were paid across all UI programs from April 2020 through September 2022. The unprecedented demand for benefits and the need to implement the new programs quickly increased the risk of financial fraud. Due to this risk and other challenges, GAO added the UI system to its High-Risk List in June 2022.

GAO was asked to review matters relating to the scope and severity of fraudulent activity in the UI system during the pandemic. This report examines what measures and estimates indicate about the extent of UI fraud during the pandemic and the extent to which DOL designed and implemented a strategy to manage UI fraud risks. GAO reviewed information that federal and state entities used to measure and estimate the extent of fraud in UI programs, then evaluated DOL's activities against leading practices in GAO's Fraud Risk Framework. This report is part of an ongoing body of work to better understand and manage federal fraud, including future work to improve estimates of fraud.

Recommendations

GAO recommends that DOL develop and implement an antifraud strategy for UI programs that is consistent with leading practices from GAO's Fraud Risk Framework. DOL partially agreed with the recommendation and noted plans to address it.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Labor | The Secretary of Labor should design and implement an antifraud strategy for UI based on a fraud risk profile consistent with leading practices as provided in the Fraud Risk Framework. (Recommendation 1) | In August 2023, DOL officials provided us with a copy of the 2023 UI fraud risk profile. This fraud risk profile provided a link to the UI Integrity Strategic Plan, which according to DOL, continuously evolves and includes strategies to address emerging fraud threats and integrity risks to UI. In April 2024, DOL provided us with a copy of its "Building Resilience: A plan for transforming unemployment insurance" document. This plan indicated that, in response to GAO's recommendation, DOL will regularly update its assessment of UI fraud risks and incorporate any fraud risk management activities into the Employment and Training Administration's UI Integrity Strategic Plan. The UI Integrity... Strategic Plan for fiscal year 2023-the most recent available as of April 2024-described strategies through which DOL supports states to combat fraud. The strategies include strengthening UI systems, ID verification, and data analytics. The UI Integrity Strategic Plan for fiscal year 2023 outlined the responsibilities of the Office of the Chief Financial Officer, Employment and Training Administration, and state workforce agencies related to UI fraud risk management. It also referenced the UI fraud risk profile and outlined antifraud controls. In July 2024, DOL provided us with the UI Integrity Strategic Plan for the second quarter of fiscal year 2024. This version of the UI Integrity Strategic Plan outlined antifraud controls and linked them to specific fraud risks identified. In September 2024, DOL officials provided us with an updated UI fraud risk profile, which included the priority ranking levels for residual UI fraud risks. Developing and documenting a comprehensive and unified antifraud strategy for addressing prioritized fraud risks will help DOL and state workforce agencies more effectively manage UI fraud risks.

View More |