Steel and Aluminum Tariffs: Agencies Should Ensure Section 232 Exclusion Requests Are Needed and Duties Are Paid

Fast Facts

In March 2018, the President placed tariffs on certain imported steel and aluminum products. Companies can apply to the Department of Commerce to be excluded from paying these tariffs. Commerce then tells Customs and Border Protection how to administer approved exclusions.

Companies didn't use the majority of the exclusions, and CBP generally administered them as instructed. However, weaknesses in CBP's process allowed some exclusions to be used incorrectly. This resulted in $32 million in unpaid duties, as of November 2021.

We recommended ways for the agencies to better implement the exclusions and collect unpaid duties.

A bundle of steel coils being unloaded from a ship

Highlights

What GAO Found

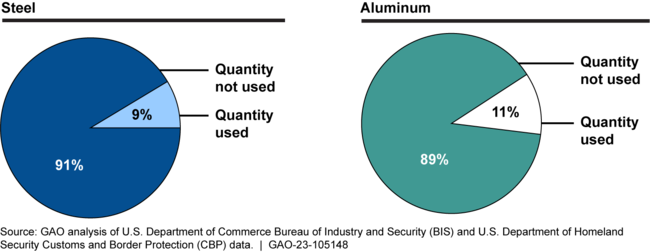

Importers can submit exclusion requests to the Department of Commerce's Bureau of Industry and Security (BIS) to seek relief from Section 232 steel and aluminum tariffs. GAO found that importers had used a small proportion of the quantities that BIS had approved (see figure). BIS implemented measures to ensure exclusion requests are needed, but has not evaluated the results. In December 2020, BIS reported that unneeded exclusion requests burdened the approval process, and began requiring requesters to certify that they expect to use the entire quantity if approved. Without evaluating the requirement's results, BIS lacks key information about whether it has helped ensure exclusion requests are needed and has improved the efficiency of the exclusion approval process.

Use of Approved Section 232 Exclusion Quantities, March 2018–September 2021

Note: This figure presents exclusion use data available as of November 2021.

GAO found that BIS and the Department of Homeland Security's Customs and Border Protection (CBP) had inconsistent data for about 5 percent of the nearly 207,000 exclusions approved through September 2021. BIS transfers data about approved exclusions to CBP for use in the Automated Commercial Environment (ACE), the system importers use to bring goods into the U.S. BIS provides CBP partial data about the parameters, which requires CBP to derive additional information, such as the exclusion's validity period, for use in ACE. Without a more consistent data transfer process, CBP faces challenges in administering exclusions as BIS intends, creating a continuing risk of error and invalid use.

GAO's analysis shows that importers generally used tariff exclusions consistent with BIS's approved parameters. However, GAO identified an estimated $32 million in unpaid duties resulting from invalid exclusion use as of November 2021. CBP officials said that when they programmed the Section 232 functionality in ACE, they did not have the time or resources to program automatic deactivation once the importer reaches the approved quantity. Instead, CBP has manually deactivated exclusions. However, the lag time between when importers reach approved quantities and CBP's manual deactivation allows importers to overclaim exclusions and not pay duties on the overage. Until CBP implements more effective controls to prevent overclaiming and to recover duties owed, the U.S. government is at risk of losing millions of dollars in revenue.

Why GAO Did This Study

In March 2018, citing national security concerns, the President placed tariffs of 25 percent on some imported steel and 10 percent on some imported aluminum products, under Section 232 of the Trade Expansion Act of 1962. At the same time, Commerce established a process to provide relief, or exclusion, from the tariffs. Requesters apply to BIS for tariff exclusion. If BIS approves, the requester may import specific products without paying those tariffs. BIS transmits data about the specific parameters of the approved exclusions to CBP, which determines if an importer may use an exclusion.

GAO was asked to review how Section 232 exclusions are administered. This report examines (1) BIS's measures to ensure Section 232 exclusion requests are needed, (2) the extent to which BIS and CBP maintain consistent data in order to administer the exclusions, and (3) the extent to which importers invalidly used exclusions. GAO defines invalid use as the claiming of an exclusion in ACE in a way that does not comport with BIS's parameters.

GAO analyzed agency data, and reviewed agency documents related to the exclusion approval and import processes. GAO also interviewed BIS and CBP officials and spoke with industry stakeholders.

Recommendations

GAO is making four recommendations, for BIS to evaluate the results of the certification requirement and develop a more consistent data transfer process, and for CBP to implement controls to prevent overclaiming of exclusions and to recover duties owed. The agencies concurred with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Commerce | The Secretary of Commerce should ensure that the Under Secretary for Industry and Security fully assesses the effectiveness of the quantity certification requirement BIS put in place and takes further actions, as needed, to improve the Section 232 exclusion request process. (Recommendation 1) |

In commenting on the report, Commerce concurred with this recommendation. The comments noted the known challenges in administering the Section 232 Exclusions Portal and stated that Commerce had proactively begun to take steps to limit the amount of unutilized and underutilized exclusions prior to the release of the report. In January 2024, Commerce stated that it would conduct an internal analysis of unutilized or underutilized quantities since mid-2019 in order to understand the impact of the quantity certification and volume certification reviews. This analysis will review the number of exclusions and quantities requested to determine whether the reviews have had an impact on requestor behavior. Finally, Commerce will also incorporate regular tracking of exclusion quantities and volume certification reviews into its existing weekly Key Performance Indicators (KPIs) so trends can be better monitored in real-time. Commerce expects to complete this by June 30, 2024. GAO continues to monitor Commerce's actions in response to this recommendation.

|

| Department of Commerce | The Secretary of Commerce should ensure that the Under Secretary for Industry and Security, in consultation with CBP, explores the development of a data transfer process that reduces the potential for inconsistencies between the two respective agency systems. (Recommendation 2) |

In commenting on the report, Commerce concurred with this recommendation. The comments noted the known challenges in administering the Section 232 Exclusions Portal, and said that Commerce had proactively begun to take steps to improve the transfer of information with U.S. Customs and Border Protection prior to the release of the report. In January 2024, Commerce stated that it would establish a staff-level working group with members of CBP's Trade Remedy Branch to further improve the transfer of exclusion data between the Bureau of Industry and Security (BIS) and CBP. This group is expected to meet monthly, and additionally on an ad hoc basis as needed. Commerce proposed several other potential steps, including: (1) making process refinements to ensure accurate Importer of Record information; (2) considering regulatory changes that would facilitate data transfer between the agencies; (3) drafting public guidance to clarify Importer of Record requirements; and (4) creating a shared formal log of changes made to granted exclusions. Commerce reported that it expects to establish the BIS-Trade Remedy Branch working group by March 31, 2024, but did not provide dates for other proposed actions. GAO continues to monitor Commerce's actions in response to this recommendation.

|

| United States Customs and Border Protection | The Commissioner of CBP should ensure that additional steps are taken, as appropriate, to recover the duties owed by importers as a result of invalid use of Section 232 exclusions, including for liquidated entries beyond CBP's 90-day re-liquidation period. (Recommendation 3) |

CBP concurred with GAO's 2023 recommendation. In commenting on the report, officials said that CBP will issue guidance on the appropriate steps to recover duties owed when an importer makes any invalid use of Section 232 exclusions. As of February 2025, CBP's draft guidance on recovering duties owed is undergoing internal review. CBP officials said this guidance includes separate approaches for: (1) duties owed on unliquidated entries; (2) duties owed on entries within CBP's 90-day reliquidation window; and (3) duties owed on entries that are past the 90-day reliquidation window. Until CBP implements more effective controls to recover duties owed, the U.S. government is at risk of losing millions of dollars in revenue.

|

| United States Customs and Border Protection | The Commissioner of CBP should ensure that controls are implemented either to prevent importers from exceeding the approved quantities of their Section 232 exclusions or to promptly assess duties owed because of overages before CBP's 90-day re-liquidation period expires. (Recommendation 4) |

CBP concurred with GAO's 2023 recommendation and took steps to address it. In April 2024, CBP developed and implemented controls to collect, within CBP's 90-day re-liquidation period, unpaid duties resulting from importers exceeding the approved quantities of their Section 232 exclusions and not paying duties on the overage. As of October 2024, CBP estimated that it had collected $1.8 million (in fiscal year 2025 dollars using a net present value calculation) in unpaid Section 232 duties in the 4 months since implementation of the new controls. By taking steps to recoup duties owed, CBP should be better positioned to ensure that millions of dollars in revenue is protected. In February 2025, the process for requesting Section 232 exclusions was terminated; therefore, there will be no new exclusions and related overages.

|