COVID-19: Continued Attention Needed to Enhance Federal Preparedness, Response, Service Delivery, and Program Integrity

Fast Facts

While COVID-19 cases have declined in recent months, the U.S. is still experiencing serious economic and public health repercussions due to the pandemic. In our 7th comprehensive report, we found more ways to improve federal programs related to the pandemic and other future emergencies.

For example, we recommended that the CDC develop a plan to boost laboratory testing capacity, and that the IRS improve its communication on tax refund delays.

This report makes 15 new recommendations. Agencies have agreed to implement most of our 72 previous recommendations on the COVID-19 response and have fully implemented 16.

Highlights

What GAO Found

The nation is concurrently responding to, and recovering from, the COVID-19 pandemic, as the number of cases, hospitalizations, and deaths have declined in recent months. Among the factors that have contributed to the decline in these metrics, the development and administration of multiple vaccines across the nation have been key. About 53.1 percent of the U.S. population 12 years and older—almost 150.7 million individuals—had been fully vaccinated as of June 23, 2021, according to the Centers for Disease Control and Prevention (CDC).

Continuing to deliver “shots in arms” will be a priority for the federal government, as individuals yet to be vaccinated remain at risk from COVID-19 and as new variants of the virus continue to emerge. A successful vaccination program is seen as essential to further stabilizing the economy and safely returning to prepandemic activities, such as in-person learning for students in the 2021–22 school year.

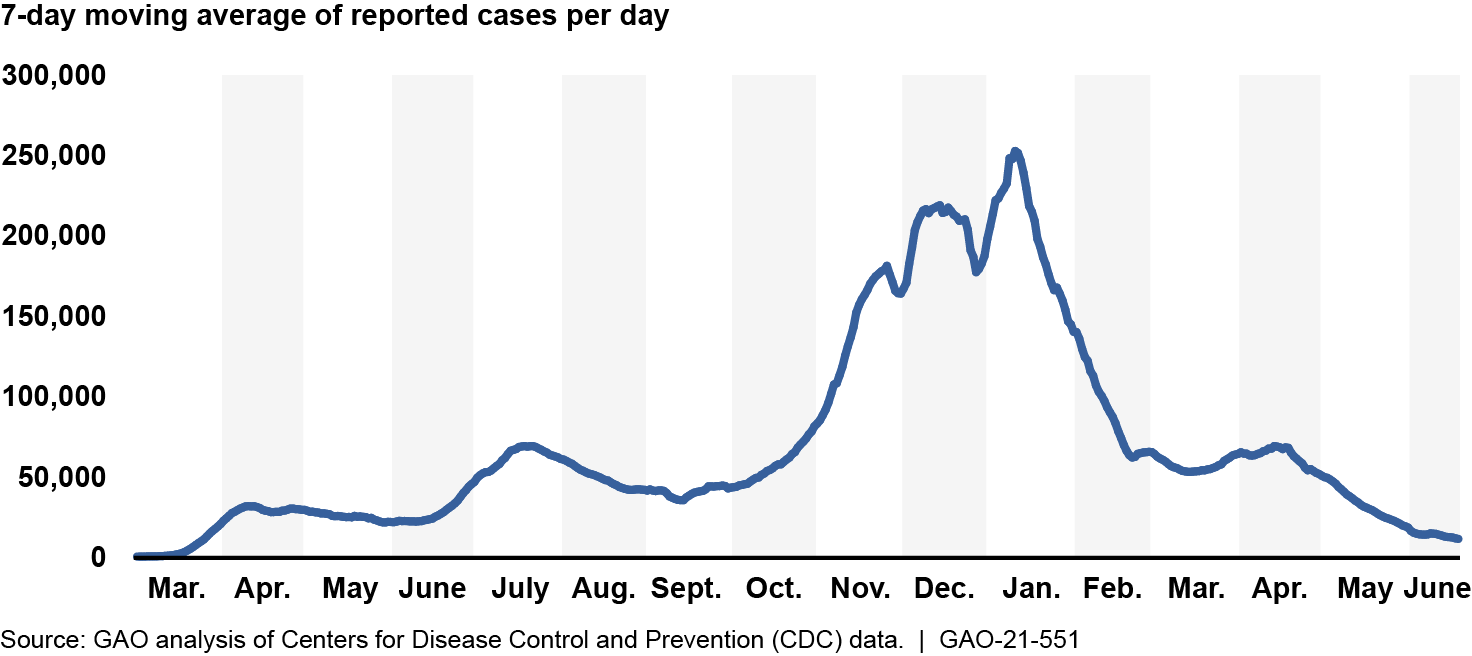

The economic and public health recovery from the pandemic and its effects remains fragile. Data from the Department of Labor show that labor market conditions improved in March, April, May, and June 2021 but remained worse relative to the prepandemic period. Additionally, new reported COVID-19 cases from June 5 to June 18, 2021, averaged about 13,000 per day—less than a tenth of the peak reported in January 2021 (see figure).

Reported COVID-19 Cases per Day in the U.S., Mar. 1, 2020–June 18, 2021

Since GAO began reporting on the federal response to the pandemic in June 2020, it has made 72 recommendations. The agencies generally agreed with 57 of these recommendations and are in the process of implementing a majority of them; 16 of these recommendations have been fully implemented. GAO also made four matters for congressional consideration, three of which remain open. In this report, GAO is making 15 new recommendations in the areas of federal preparedness and response, delivery of benefits and services, and program integrity. GAO’s recommendations, if effectively implemented, can help improve the government’s ongoing response and recovery efforts as well as help it to prepare for future public health emergencies.

GAO’s new recommendations are discussed below.

COVID-19 Testing

CDC has opportunities to improve collaboration and communication with stakeholders. Prior to the COVID-19 response, CDC had not developed a plan for enhancing laboratory testing capacity that identifies objectives and outlines agency and stakeholder roles and responsibilities for achieving these objectives within defined time frames. Doing so would be consistent with the stated goal of its own memorandum of understanding with public health and private laboratory partners and would also be consistent with other leading principles on sound planning that GAO has identified in its prior work. GAO recommends that CDC work with appropriate stakeholders to develop a plan to enhance surge capacity for laboratory testing. CDC agreed with this recommendation.

CDC initially developed a flawed COVID-19 diagnostic test, which caused challenges for the rollout of testing nationwide. CDC has taken steps to improve its process for developing tests, but additional actions could help strengthen CDC’s preparedness and enhance the nation’s testing capacity during a future infectious disease outbreak. For example, establishing contracts with test kit manufacturers prior to a public health emergency could allow CDC to supplement the supply produced by CDC and aid in the rapid manufacturing and deployment of test kits during a future public health emergency. GAO recommends that CDC assess the agency’s needs for goods and services for the manufacturing and deployment of diagnostic test kits in public health emergencies, including the potential role of establishing contracts in advance of an emergency. CDC agreed with this recommendation.

Strategic National Stockpile

The Strategic National Stockpile (SNS) contains a multibillion dollar inventory of medical countermeasures—drugs, vaccines, supplies, and other materials—to respond to a broad range of public health emergencies. The SNS can be used as a short-term stopgap buffer when the supply of materials may not be immediately available in affected areas during a public health emergency. The Department of Health and Humans Services’ (HHS) Office of the Assistant Secretary for Preparedness and Response (ASPR) oversees the SNS.

The Public Health Emergency Medical Countermeasures Enterprise (PHEMCE), an interagency group of experts, advises the Secretary of Health and Human Services in prioritizing, developing, procuring, deploying, and effectively using medical supplies and other countermeasures for the SNS. In the years before the COVID-19 pandemic, ASPR began restructuring the PHEMCE. This led to concerns from interagency partners regarding the effectiveness of interagency collaboration and transparency, such as a lack of clarity on how ASPR makes decisions about medical countermeasure issues, including for the SNS inventory. In addition, while the PHEMCE was being restructured, ASPR did not conduct SNS annual reviews from 2017 through 2019; these reviews result in recommendations to HHS regarding SNS procurement and are provided to Congress.

According to the former Assistant Secretary who initiated the restructure, although PHEMCE was successful in advancing the development of medical countermeasures, its consensus-driven process did not reflect the urgency needed and PHEMCE proceedings created security vulnerabilities. ASPR officials acknowledged that the changes ASPR made to the PHEMCE from 2018 to 2020 did not fully achieve the desired aims and created other challenges. The office is in the process of reassessing and reestablishing new organizational processes for the PHEMCE, but it has not yet finalized planning documents, including an organizational charter and implementation plan, to guide those efforts. GAO recommends that ASPR develop and document its plans for restructuring the PHEMCE. The plans should describe how ASPR will ensure a transparent and deliberative process that engages interagency partners in PHEMCE responsibilities outlined in the Pandemic and All-Hazards Preparedness and Advancing Innovation Act of 2019, including those related to SNS annual reviews. These plans should also incorporate GAO’s leading practices to foster more effective collaboration, while ensuring that sensitive information is appropriately protected. HHS—which includes ASPR—agreed with this recommendation.

PHEMCE interagency partners raised concerns about the transparency of PHEMCE activities and deliberations, and ASPR lacked documentation of PHEMCE activities and deliberations after 2017. ASPR was unable to provide documentation to GAO regarding PHEMCE decisions or recommendations made from 2018 to 2020; the rationale for the changes to the PHEMCE; or PHEMCE meeting agendas and minutes from 2018 to 2020. Not maintaining such documentation is inconsistent with HHS’s policy for records management and leaves Congress and key stakeholders without assurance that steps taken are advancing national preparedness for natural, accidental, and intentional threats. GAO recommends that ASPR implement records management practices that include developing, maintaining, and securing documentation related to PHEMCE activities and deliberations, including those related to the SNS. HHS, including ASPR, agreed with this recommendation.

The nationwide need for supplies to respond to COVID-19 quickly exceeded the quantity of supplies contained in the SNS. Thus, ASPR used procurement processes in addition to its standard process, including direct shipment of supplies from vendors. Through this direct shipment process, supplies purchased by ASPR were not used to replenish the SNS but instead were primarily distributed from vendors directly to state, local, territorial, and tribal governments.

Although ASPR has documented policies and procedures for its standard procurement process, ASPR did not have documented policies and procedures, including related control and monitoring activities, to address payment integrity risks for its direct shipment procurement process. Without written policies and procedures documenting how ASPR tracks the direct shipment and receipt of supplies before issuing payments, there is an increased risk that ASPR may make improper payments to vendors for incorrect supplies or quantities or for supplies that the intended recipients did not receive. In addition, it is difficult for management to assess the adequacy of controls over the direct shipment procurement process, and ASPR lacks assurance that its staff fully understand the process and properly and consistently perform their duties. GAO recommends that, to strengthen the current procedures for the SNS, HHS update its policies and procedures for the SNS, including related control and monitoring activities, to document the direct shipment procurement process and address payment integrity risks. Although HHS, including ASPR, did not agree with GAO regarding the need to address payment integrity risks, it stated that HHS will update its policies and procedures, including related control and monitoring activities to document the direct shipment procurement process.

Domestic Medical Supply Manufacturing

Before the pandemic, the U.S. generally depended on foreign suppliers for certain types of personal protective equipment (PPE), including nitrile gloves and surgical gowns. Multiple stakeholders representing manufacturers, distributors, and other purchasers noted that meaningful, transparent federal engagement with industry could enhance the resilience of domestic manufacturing and the supply chain. According to some stakeholders, such engagement with the private sector could help ramp up private investment in domestic PPE manufacturing, among other things.

In January 2021, GAO reported that HHS had not developed a process for engaging with key nonfederal stakeholders and Congress for development of a supply chain strategy for pandemic preparedness, including the role of the SNS. GAO recommended that HHS do so, and the department generally agreed with GAO’s recommendation. However, as of May 2021, HHS had not implemented this recommendation. GAO continues to underscore that engaging with key nonfederal stakeholders—in meaningful, proactive ways to obtain their business and industry expertise—and with Congress is critical for developing strategies to build a sustainable domestic medical supply manufacturing base.

HHS COVID-19 Funding

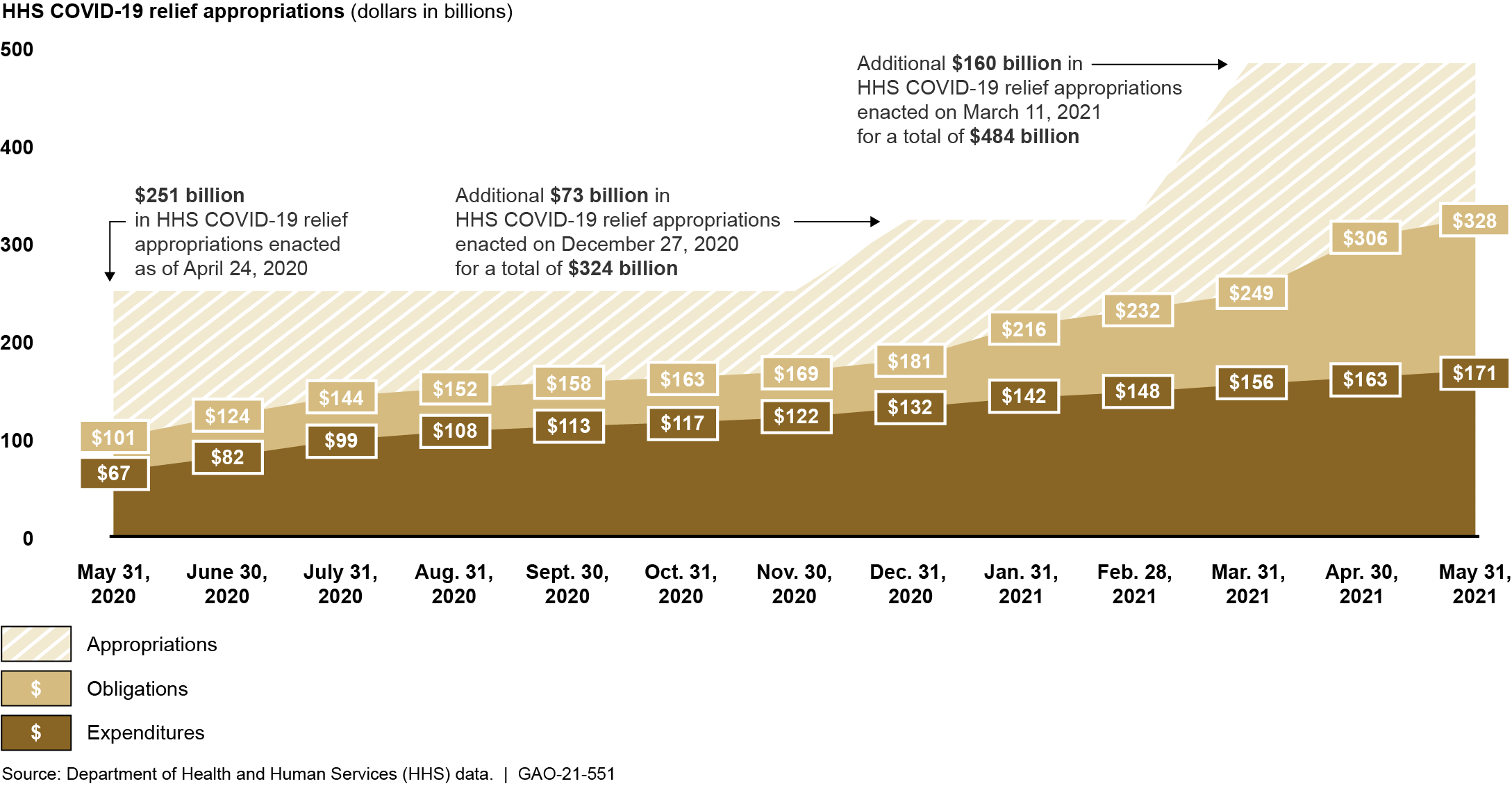

As of May 31, 2021, Congress had appropriated to HHS approximately $484 billion in COVID-19 funds in six relief laws. The majority of HHS’s appropriations from the first five relief laws had been obligated and about half had been expended. Specifically, as of May 31, 2021, the department reported the following (see figure):

- Of the $324 billion appropriated in the first five COVID-19 relief laws, about $253 billion had been obligated (about 78 percent) and about $168 billion had been expended (about 52 percent).

- Of the $160 billion appropriated in the sixth law, the American Rescue Plan Act of 2021 (ARPA), about $75 billion had been obligated (about 47 percent) and about $3 billion had been expended (about 2 percent).

HHS’s Reported COVID-19 Relief Appropriations, Obligations, and Expenditures from COVID-19 Relief Laws, as of May 31, 2021

The percentage of obligations and expenditures varied across selected COVID-19 response activities for a variety of reasons, including the nature of the activities, their planned uses, and the timing of the funds provided through the six COVID-19 relief laws.

HHS uses spend plans to communicate information about its COVID-19 spending. The first five COVID-19 relief laws generally require the department to develop, update, and provide these spend plans to Congress every 60 days. The sixth relief law, ARPA, does not require a spend plan, but according to HHS officials, the department is preparing a consolidated plan that captures the first five relief laws and a separate spend plan for funding provided through ARPA. The consolidated spend plan is under internal review at HHS and the ARPA spend plan is still being finalized. As of May 2021, GAO had received and reviewed a total of 15 spend plans—the original spend plans and subsequent updates—provided by HHS. GAO found that the most current spend plans generally do not include time frames for obligating the remaining funds, which is useful information for oversight and informing future funding decisions by Congress.

Guidance from the Office of Management and Budget to federal agencies, including HHS, noted the importance of spending transparency and regular reporting to help safeguard taxpayer dollars. GAO recommends that HHS communicate information about, and facilitate oversight of, the department’s use of COVID-19 relief funds by providing projected time frames for its planned spending in the spend plans it submits to Congress. HHS partially concurred with the recommendation and stated that the department would aim to incorporate some time frames on planned spending where that information may be available such as time frames for select grants to states.

Higher Education Grants

The Department of Education (Education) has faced inherent challenges that increase the risk of improper payments for its Higher Education Emergency Relief Fund (HEERF) grants to institutions of higher education to prevent, prepare for, and respond to COVID-19. For example, funding needed to be processed and distributed expeditiously because of health and economic threats to institutions of higher education posed by the COVID-19 pandemic. GAO tested Education’s procedures for approving and processing HEERF grants through a sample of obligations and found that the department had not effectively designed and implemented procedures needed to identify erroneous obligations after awarding the grants. GAO estimated that for 5.5 percent of schools receiving HEERF grants (about 262 of 4,764 schools in GAO’s sample), Education awarded grants that exceeded the amounts allocated—including three instances in GAO’s sample for which Education obligated $20 million more than was allocated.

Officials from Education’s Office of Postsecondary Education stated that because of time and staffing constraints and the high volume of grants administered, they did not regularly perform quality assurance reviews after obligation to identify and correct erroneous obligations. GAO recommends Education design and implement procedures for regularly conducting quality assurance reviews of obligated amounts for higher education grants, including HEERF, to help identify and correct erroneous obligations in a timely manner. Education agreed with this recommendation.

Coronavirus State and Local Relief and Recovery Funds

COVID-19 relief laws appropriated $500 billion to the Department of the Treasury (Treasury) to provide direct funding to states, localities, tribal governments, the District of Columbia, and U.S. territories to help them respond to, and recover from, the COVID-19 pandemic. This amount includes $150 billion that the CARES Act appropriated to Treasury for the Coronavirus Relief Fund (CRF) in March 2020 as well as $350 billion that ARPA appropriated to Treasury for the Coronavirus State and Local Fiscal Recovery Funds (CSLFRF) in March 2021. Recipients can use CRF payments to offset costs related to either the pandemic’s direct effects (e.g., public health needs) or its indirect effects (e.g., harm to individuals or businesses as a result of COVID-19-related closures). The CSLFRF provides payments to these recipients to cover a broader range of costs stemming from the fiscal effects of the COVID-19 pandemic.

The Single Audit Act establishes requirements for states, localities, Indian tribes, the District of Columbia, U.S. territories, and nonprofit organizations that receive federal awards to undergo single audits of those awards annually when their expenditures meet a certain dollar threshold. Single audits are critical to the federal government’s ability to help safeguard the use of the billions of dollars distributed through the CRF and CSLFRF. Auditors who conduct single audits follow guidance in the Single Audit Act’s Compliance Supplement, which provides guidelines and policy for performing single audits. After consultation with federal agencies, OMB annually updates and issues the supplement. Auditors have reported that the timing of the supplement is critical in allowing them to effectively plan their work.

The timely issuance of single audit guidance is critical to ensuring timely completion and reporting of single audits to inform the federal government about actions needed to help safeguard the use of the billions of dollars distributed through the CRF and CSLFRF. GAO recommends that OMB, in consultation with Treasury, issue timely and sufficient single audit guidance for auditing recipients’ uses of payments from the CSLFRF. OMB neither agreed nor disagreed with this recommendation.

Economic Impact Payments

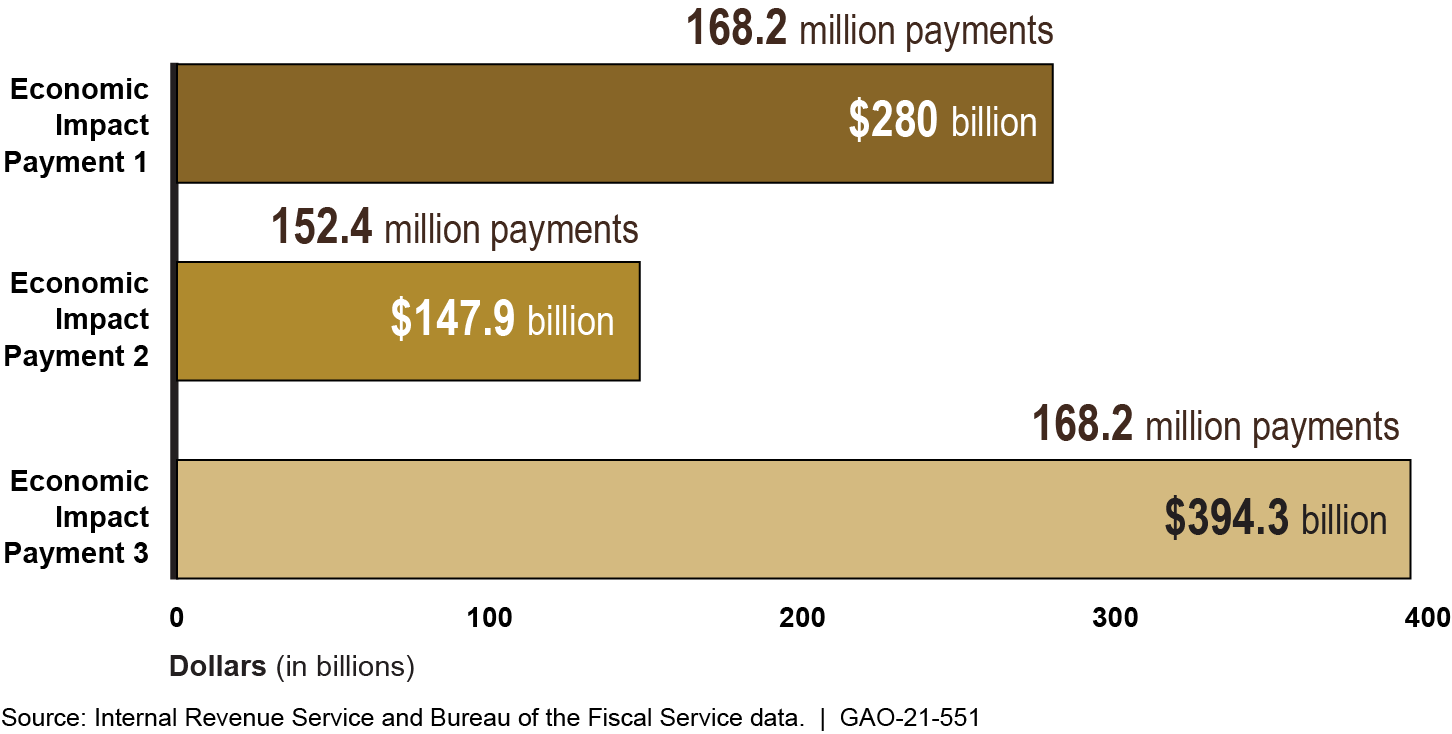

The CARES Act, the Consolidated Appropriations Act, 2021, and ARPA authorized Treasury and the Internal Revenue Service (IRS) to issue three rounds of economic impact payments (EIP) as direct payments to help individuals alleviate financial stress due to the pandemic. (See figure.) To publicize information about how to file a tax return with the IRS to receive an EIP, IRS partners with organizations that work with communities that may not traditionally interact with IRS, such as lower-income families, senior citizens, veterans, tribal communities, and families with mixed-immigration status. According to officials from IRS partner organizations, ensuring eligible nonfilers receive their payments continues to be a challenge. Partners also told GAO their outreach efforts to nonfilers could be more effective if the partners had current data that could help identify specific communities of nonfilers who may need assistance.

Total Number and Amount of Economic Impact Payments (EIP) Disbursed, Rounds 1, 2, and 3, as of May 28, 2021

In January 2021, Treasury began analyzing nearly 9 million notices it had sent to nonfilers who may be eligible for the first round of EIP payments. However, Treasury does not plan to complete this analysis until fall 2021, more than 6 months after the third round of EIP payments began to be issued. This timing would limit the findings’ usefulness for informing EIP outreach efforts. By waiting to complete the analysis, Treasury and IRS are missing an opportunity to identify communities that may have a higher number of nonfilers and to use that information to inform their outreach efforts as well as the efforts of their outreach partners.GAO recommends that Treasury, in coordination with IRS, release interim findings on the effectiveness of the notices it sent in September 2020 to potentially EIP-eligiblenonfilers; incorporate that analysis into IRS outreach efforts as appropriate; and then, if necessary, release an update based on new analysis after the 2021 filing season. Treasury neither agreed nor disagreed with this recommendation.

Tax Relief for Businesses

To provide liquidity to businesses during the COVID-19 pandemic, the CARES Act and other COVID-19 relief laws included tax measures to reduce certain tax obligations, including measures related to net operating loss carryback claims. In some cases, these reductions of obligations led to cash refunds. The Internal Revenue Code and the CARES Act generally require IRS to issue certain refunds within 90 days from the date when a complete application for a tentative carryback adjustment is filed or 90 days from the last day of the month in which the return is due, whichever is later. IRS data show that the agency is not meeting the statutory refund requirement for these relief measures and that as of May 1, 2021, the average processing time for refunds was 154 days, excluding additional time for final processing and distribution.

IRS officials said it is taking longer to process returns because IRS facilities that process paper returns continue to operate at reduced capacity to accommodate social distancing. In the meantime, transparent communication about these issues could help taxpayers know when to expect their refunds. Specifically, an explanation on IRS’s website that processing times for tentative refunds may exceed the expected 90 days because of service disruptions would provide taxpayers with more accurate information and expectations for receiving a refund. GAO recommends that IRS clearly communicate on its website that there are delays beyond the statutory 90-day timeline in processing tentative refunds. IRS neither agreed nor disagreed with this recommendation.

2021 Tax Filing Season

IRS is experiencing delays in processing certain returns received in 2021, resulting in extended time frames for processing returns for some taxpayers. IRS reported that it is taking longer than usual to manually review some of these returns. Specifically, as of the end of the 2021 filing season, IRS had about 25.5 million unprocessed individual and business returns, including about 1.2 million returns from its 2020 backlog, and 13.7 million returns that it had suspended because of errors. IRS staff must manually review these returns with errors. IRS typically has unprocessed returns in its inventory at the end of the filing season, but not to this extent. For example, at the end of the 2019 filing season, IRS had 8.3 million unprocessed individual and business returns, including 2.7 million returns suspended for errors. IRS’s annual tax filing activities include processing more than 150 million individual and business tax returns electronically or on paper.

With significantly more returns currently being held for manual review than in prior years, more taxpayers are trying to get information about the status of their returns and refunds. However, taxpayers have had difficulty obtaining status updates on their refunds from IRS, either by phone or online. IRS’s website does not contain all of the relevant information regarding delays in processing 2021 returns and issuing taxpayers’ refunds. Additionally, IRS’s automated message on its toll-free telephone line for individual taxpayers has not been updated to explain refund delays or to include any other alerts associated with the 2021 filing season.GAO recommends that IRS update relevant pages of its website and, if feasible, add alerts to its toll-free telephone lines to more clearly and prominently explain the nature and extent of individual refund delays occurring for returns that taxpayers filed in 2021. IRS neither agreed nor disagreed with this recommendation.

This report contains additional recommendations related to disseminating information related to leave benefits for employees.

Why GAO Did This Study

As of mid-June 2021, the U.S. had about 33.4 million reported cases of COVID-19 and about 593,000 reported deaths, according to CDC. The country also continues to experience serious economic repercussions from the pandemic.

Six relief laws, including the CARES Act, had been enacted as of May 31, 2021, to address the public health and economic threats posed by COVID-19. As of May 31, 2021, of the $4.7 trillion appropriated by these six laws for COVID-19 relief—including about $1.6 trillion appropriated by ARPA, which was enacted in March 2021—the federal government had obligated a total of $3.5 trillion and had expended $3.0 trillion, as reported by federal agencies.

The CARES Act includes a provision for GAO to report on its ongoing monitoring and oversight efforts related to the COVID-19 pandemic. This report examines the federal government’s continued efforts to respond to, and recover from, the COVID-19 pandemic.

GAO reviewed data, documents, and guidance from federal agencies about their activities. GAO also interviewed federal officials; representatives from organizations for states and localities; and other stakeholders, including manufacturers of PPE (e.g., N95 respirators, surgical masks, and nitrile gloves).

Recommendations

GAO is making 15 new recommendations for agencies that are detailed in this Highlights and in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Centers for Disease Control and Prevention | The Director of the Centers for Disease Control and Prevention should work with appropriate stakeholders—including public health and private laboratories—to develop a plan to enhance laboratory surge testing capacity. This plan should include timelines, define agency and stakeholder roles and responsibilities, and address any identified gaps from preparedness exercises. See the COVID-19 Testing enclosure. (Recommendation 1) |

The Department of Health and Human Services (HHS) agreed with our recommendation and, in collaboration with external partners, developed a plan in May 2022 to enhance laboratory surge testing capacity at laboratories other than CDC and public health laboratories.

|

| Centers for Disease Control and Prevention | The Director of the Centers for Disease Control and Prevention should assess the agency's needs for goods and services for the manufacturing and deployment of diagnostic test kits in public health emergencies. This assessment should evaluate how establishing contracts in advance of an emergency could help the Centers for Disease Control and Prevention quickly and cost-effectively acquire these capabilities when responding to future public health emergencies, including those caused by novel pathogens, and should incorporate lessons learned from the COVID-19 emergency. See the COVID-19 Testing enclosure. (Recommendation 2) |

The Department of Health and Human Services (HHS) agreed with our recommendation that the Director of CDC assess the agency's needs for goods and services for the manufacturing and deployment of test kits in public health emergencies. CDC informed us in March 2022, that the agency had assessed its existing contract mechanisms, flexibilities, and contract options and their ability to address COVID-19 response needs. CDC informed us that lessons learned from the COVID-19 response led the agency to institute additional flexibilities and contract options for existing, new, and future contracts mechanisms. CDC informed us that these changes could support the emergency production of goods and services during an emergency. As a result, we believe CDC's actions address our recommendation.

|

| Office of the Assistant Secretary for Preparedness and Response |

Priority Rec.

To improve the nation's preparedness for a wide range of threats, including pandemics, the Office of the Assistant Secretary for Preparedness and Response should develop and document plans for restructuring the Public Health Emergency Medical Countermeasures Enterprise. These plans should describe how the Assistant Secretary will ensure a transparent and deliberative process that engages interagency partners in the full range of responsibilities for the Public Health Emergency Medical Countermeasures Enterprise outlined in the Pandemic and All-Hazards Preparedness and Innovation Act of 2019, including the annual Strategic National Stockpile Threat-Based Reviews. These plans should also incorporate GAO's leading practices to foster more effective collaboration, while ensuring that sensitive information is appropriately protected. See the Strategic National Stockpile enclosure. (Recommendation 3) |

In June 2021, HHS concurred with this recommendation. In January 2022, HHS developed plans and analyses to support the reformed PHEMCE, which it relaunched in February 2022. In September 2022, HHS reported that it was hiring staff to support the PHEMCE, including by continuing to develop and implement new operating procedures. Further, in October 2022 HHS released the 2022 PHEMCE Strategy and Implementation Plan that provides information on the structure, goals, and timeframes by which the PHEMCE will modernize its efforts to establish and maintain an improved state of medical countermeasure preparedness. In February 2024, HHS reported that the plans it had developed and documented outline the purpose and responsibility of PHEMCE, as well as its structure, some of which are not yet finalized. In addition, HHS reported it had updated the process used to develop the 2022 SNS annual review (now called the Medical Countermeasure Preparedness Review)-a process in which the PHEMCE is to play a key role. The review provides some information regarding the role of the PHEMCE for that particular review, but does not outline a standardized process that will be followed in future reviews. We will update this recommendation after we obtain more information regarding the PHEMCE's finalized operating structure; the process by which HHS ensures transparency in how they engage interagency partners in the full range of PHEMCE responsibilities outlined in the Pandemic and All-Hazards Preparedness and Innovation Act of 2019; the extent to which HHS has implemented the goals and objectives of its 2022 PHEMCE Strategy and Implementation plan, including how it has established feedback mechanisms to ensure two way communication and foster effective collaboration with interagency partners; whether HHS has finalized PHEMCE standard operating procedures, including mechanisms for protecting sensitive information.

|

| Office of the Assistant Secretary for Preparedness and Response | To improve organizational accountability, the Office of the Assistant Secretary for Preparedness and Response should implement records management practices that include developing and maintaining, and securing documentation related to Public Health Emergency Medical Countermeasures Enterprise activities and deliberations, including those related to the Strategic National Stockpile. Documentation should include information such as the factors considered, the rationale for the action or decision, and the final outcomes of the Public Health Emergency Medical Countermeasures Enterprise processes. See the Strategic National Stockpile enclosure. (Recommendation 4) |

In June 2021, HHS concurred with this recommendation. In September 2022, HHS noted that the Department, since 2015, has had a "robust records management program" in place that meets required federal regulations. For example, HHS provided the medical countermeasure and public health records schedules which indicate record retention requirements that, it noted, all ASPR programs and offices adhere to. However, as our report states, ASPR was unable to provide us with documentation of PHEMCE activities and deliberations during the time of our review and we stated that not maintaining such documentation is inconsistent with HHS's policy for records management. In February 2024, HHS provided interim business rules outlining how documentation for the restructured PHEMCE, which began meeting in February 2022, would be created and distributed. The business rules also state that documents created and distributed should be maintained in accordance with HHS's records retention policy. HHS also provided information on the structure of its documentation management system, implemented in October 2023, that ASPR officials said the agency is now using to maintain PHEMCE records, and described how classified documents are now being maintained and accessed. However, as of April 2024, HHS has not provided key documentation we need to better understand how HHS ensures PHEMCE stakeholders adhere to HHS's policies for records management that have been in place since 2015. Further, it has not provided evidence that the PHEMCE business rules that govern documentation creation and distribution have been finalized. Until HHS demonstrates that moving forward ASPR will follow appropriate records management practices, including by retaining documentation of the outcomes of PHEMCE deliberations, Congress and key stakeholders will lack assurance that ASPR has taken appropriate steps to advance national preparedness for natural, accidental, and intentional threats.

|

| Office of the Assistant Secretary for Preparedness and Response | To strengthen the current procedures, the Assistant Secretary for Preparedness and Response should update policies and procedures, including related control and monitoring activities, for the Strategic National Stockpile to document the direct shipment procurement process and to address payment integrity risks. See the Strategic National Stockpile Payment Integrity enclosure. (Recommendation 5) |

The Department of Health and Human Service did not concur with this recommendation. However, to address the recommendation, HHS updated its invoice processing procedures (effective September 1, 2021) to document the direct shipment procurement process. These updated procedures include activities for reviewing and approving invoice information, including contract numbers, invoice numbers, and specific receiving instructions, prior to issuing payments. These updates which HHS made to its procedures will help provide assurance that SNS payments for direct shipments are properly authorized. Therefore, we are closing this recommendation as implemented.

|

| Department of Health and Human Services | To communicate information about and facilitate oversight of the agency's use of COVID-19 relief funds, the Secretary of Health and Human Services should provide projected time frames for the planned spending of COVID-19 relief funds in the Department of Health and Human Services' spend plans submitted to Congress. See the HHS COVID-19 Funding enclosure. (Recommendation 6) |

As of May 2022, HHS reported that it had incorporated projected time frames of planed spending for certain activities, such as select grants and cooperative agreements. HHS stated that the department is unable to provide specific time frames for all relief funds due to the evolving environment of the COVID-19 response and the need to remain flexible in responding to incoming request for response activities. As of April 2023, HHS did not have updates for this recommendation.

|

| Office of the Assistant Secretary for Postsecondary Education | The Assistant Secretary for Postsecondary Education should design and implement procedures for regularly conducting quality assurance reviews of obligated amounts for higher education grants, including the Higher Education Emergency Relief Fund, to help identify and correct erroneous obligations in a timely manner. See the Higher Education Grants enclosure. (Recommendation 7) |

Education designed and implemented procedures for regularly conducting quality assurance reviews of obligated amounts for higher education grants to help identify and correct erroneous obligations in a timely manner. Specifically, in June 2021, the Office of Postsecondary Education established the Emergency Response Unit (ERU) to monitor Higher Education Emergency Relief Fund (HEERF) grants by performing quality control procedures for HEERF obligations. ERU's procedures include quality control batch reviews of CARES Act HEERF awards to identify potential duplicates for research and quality control checks of American Rescue Plan HEERF awards to identify duplicates, non-compliant institutions, and ineligible institutions. In addition, in December 2021, the Emergency Response Unit developed and implemented an additional post-obligation review process to identify and correct erroneous obligations.

|

| Office of Management and Budget | The Director of the Office of Management and Budget, in consultation with the Secretary of the Treasury, should issue timely and sufficient single audit guidance for auditing recipients' uses of payments from the Coronavirus State and Local Fiscal Recovery Funds. See the Coronavirus State and Local Relief and Recovery Funds enclosure. (Recommendation 8) |

The Office of Management and Budget (OMB) neither agreed nor disagreed with this recommendation. However, OMB issued single audit guidance for the Coronavirus State and Local Fiscal Recovery Funds in Addendum 1 of the 2021 Compliance Supplement in December 2021 and provided further updates in the 2022 Compliance Supplement in May 2022. We reviewed the guidance and obtained feedback from members of the audit community (e.g., National Association of State Auditors, Comptrollers, and Treasurers; and American Institute of Certified Public Accountants) and determined that OMB provided sufficient guidance to address this recommendation.

|

| Department of the Treasury | The Secretary of the Treasury, in coordination with the Commissioner of Internal Revenue, should release interim findings on the effectiveness of the notices it sent in September 2020 to nonfilers who are potentially eligible for economic impact payments; incorporate that analysis into Internal Revenue Service outreach efforts as appropriate; and then, if necessary, release an update based on new analysis after the 2021 filing season. See the Economic Impact Payments enclosure. (Recommendation 9) |

In May 2023, Treasury, IRS, and the U.S. Census Bureau published a working paper that studied the demographic breakdown of the first round of EIP recipients to examine potential disparities in the receipt of these payments by race and ethnicity. This report meets the intent of our recommendation.

|

| Wage and Hour Division | The Administrator of the Department of Labor's Wage and Hour Division should better monitor data across all statutes that the Wage and Hour Division enforces to ensure the division's case management is consistent with established policies for assigning and prioritizing cases. See the Leave Benefits for Employees enclosure. (Recommendation 10) |

In August 2021, Wage and Hour Division created a report that tracks investigation priority for cases under all statutes. The report is emailed weekly to regional and national leadership for review and may also be run on an ad hoc basis, as needed.

|

| Wage and Hour Division | The Administrator of the Department of Labor's Wage and Hour Division should ensure that the new data system under development includes mechanisms to prevent staff from assigning and prioritizing cases in a manner inconsistent with established policies. See the Leave Benefits for Employees enclosure. (Recommendation 11) |

As of September 2024, the Wage and Hour Division (WHD) continues to develop its next iteration of its case management system, which WHD plans to release in Spring 2025. The relevant modules will include a notification to alert staff of specific policy requirements related to assigning and prioritizing cases.

|

| Wage and Hour Division | The Administrator of the Department of Labor's Wage and Hour Division should expand the Essential Workers, Essential Protections initiative on pandemic-related worker protections to include information about filing a complaint related to paid leave provided under the Families First Coronavirus Response Act. See the Leave Benefits for Employees enclosure. (Recommendation 12) |

As of September 2021, Wage and Hour Division updated the PowerPoint presentation it delivers to stakeholders on the Essential Workers, Essential Protections initiative to include information on filing a complaint related to paid leave provided under the Families First Coronavirus Response Act.

|

| Wage and Hour Division | The Administrator of the Department of Labor's Wage and Hour Division should engage in a comprehensive and timely effort to consult with employers, workers, and organizations that represent them, to identify and document lessons learned from the Wage and Hour Division's administration and enforcement of COVID-19-related paid leave. See the Leave Benefits for Employees enclosure. (Recommendation 13) |

As of September 2021, Wage and Hour Division had participated in 72 listening sessions nationwide to solicit feedback from stakeholders on how the agency can better serve essential workers. Part of this effort includes asking for feedback about the agency's administration and enforcement of the Families First Coronavirus Response Act, and Wage and Hour Division is documenting feedback from each session. Wage and Hour Division has met with stakeholders from various industries, including agriculture, food services, health care, and others. These stakeholders have included, among others, advocates, community health clinics, state agencies, and unions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should clearly communicate on the Internal Revenue Service's website that there are delays, beyond the statutory 90-day timeline, in processing net operating loss and alternative minimum tax tentative refunds. See the Tax Relief for Businesses enclosure. (Recommendation 14) |

IRS neither agreed nor disagreed with our recommendation. In September 2021, IRS updated its website to address our recommendation. Specifically, the update states, "due to the lingering effects of COVID-19, we continue to experience inventory backlogs and processing times longer than the normal 90-day statutory period." This will provide taxpayers with more accurate information and expectations for receiving a refund and helps IRS meet its obligation to provide taxpayers with clear explanations of the laws and IRS procedures, as stated in the IRS Taxpayer Bill of Rights. As of September 2022, Treasury did not provide additional information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should direct the appropriate officials to update relevant pages of irs.gov and, if feasible, add alerts to the Internal Revenue Service's toll-free telephone lines to more clearly and prominently explain the nature and extent of individual refund delays occurring for returns taxpayers filed in 2021. See the 2021 Tax Filing Season enclosure. (Recommendation 15) |

In its formal comments, the Internal Revenue Service (IRS) neither agreed nor disagreed with our recommendation. However, after IRS provided its comments in mid-June 2021, we found that IRS had updated irs.gov to provide clearer information about refund delays. For example, in mid-July 2021, IRS began updating parts of its "IRS Operations and Services" webpage on a weekly basis. These weekly updates included IRS's current volume of unprocessed individual returns, information on why returns with errors were taking longer to process, and how long taxpayers may need to wait before receiving their refund. IRS also added general information about returns processing delays for 2021 to its webpages that provide general refund information. We also found that IRS had removed outdated messaging related to the 2020 filing season from its automated toll-free telephone line for taxpayers. In June 2021, IRS officials said that they did not intend to update automated phone messaging with information on 2021 filing season processing delays because IRS communicated the most current information through irs.gov. IRS's continued efforts to update its website with more timely information on returns processing and refund delays may help reduce the volume of calls to IRS from taxpayers and help reset taxpayers' expectations for when they might receive their refund if their return was stopped for additional review.

|