Small Business Administration: Use of Supplemental Funds for Administering COVID-19-Related Programs

Fast Facts

In response to the COVID-19 pandemic, Congress dramatically increased the amount of loans, grants, and other financial assistance available from the Small Business Administration.

SBA received about $3.4 billion in FY 2020 to administer this assistance. That is about 7 times what SBA typically receives for administration.

SBA had spent about half of this money as of January 2021. It reported hiring over 6,000 temporary employees—more than half of them loan specialists—for the office that runs the Economic Injury Disaster Loan program. It also reported hiring about 400 temporary employees for the office that runs the Paycheck Protection Program.

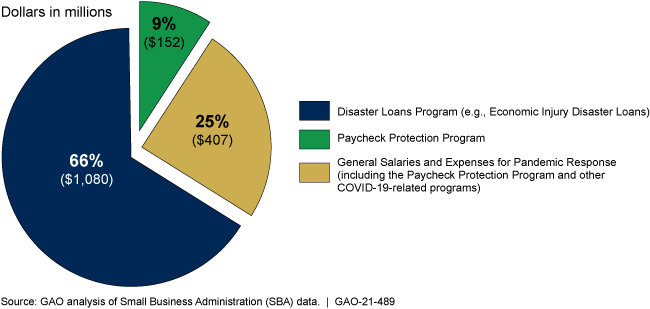

SBA FY 2020 Supplemental Funds Spent for Administrative Expenses, as of Jan. 31

Highlights

What GAO Found

In fiscal year 2020, Congress provided the Small Business Administration (SBA) about $3.4 billion in supplemental appropriations to administer small business assistance during the COVID-19 pandemic, including loan programs such as the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL). That amount is seven times greater than SBA's typical annual resources for salaries and expenses (a budget category encompassing many administrative costs). SBA spending plans show that the agency planned to use the supplemental administrative funds primarily for contract and personnel costs.

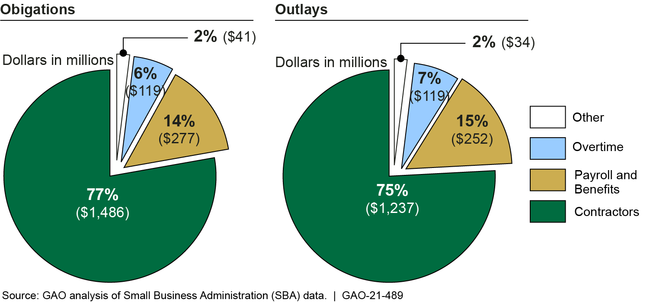

As of January 31, 2021, SBA had obligated about 57 percent ($1.9 billion) and expended 49 percent ($1.6 billion) of the supplemental appropriations. SBA used about three-quarters of those funds for contractual services and about one-fifth for personnel (payroll, benefits, and overtime) costs (see figure).

SBA's Obligations and Outlays of Fiscal Year 2020 Supplemental Appropriations for Administrative Expenses as of January 31, 2021, by Use Category

Note: Percentages may not sum to 100 because of rounding.

SBA has used the supplemental funds for a variety of contractual services, including (1) loan processing and other loan administration services and (2) information technology products and services. For example, as of January 31, 2021, SBA had obligated about $750 million in supplemental funds for a contract for processing EIDL loan applications and providing recommendations on loan decisions. As of that date, SBA also had obligated about $150 million for a contract to enhance SBA's technology for implementing PPP loan forgiveness provisions. Regarding personnel costs, SBA determined that it needed large, temporary staff increases to manage the greater volume of assistance during the pandemic. According to SBA, the agency hired more than 6,000 temporary employees—almost one-half of them for loan specialist positions—for the office that administers the EIDL program. SBA also reported hiring close to 400 temporary employees—about two-thirds of them for loan specialist positions—for other SBA components, including the office that administers PPP.

Why GAO Did This Study

The COVID-19 pandemic disrupted small businesses and generated an immediate need for emergency funding to keep businesses operating. In response, Congress dramatically increased the amount of loans, grants, and other financial assistance available from SBA. To help SBA manage the large volume of assistance, Congress provided the agency additional funds for administrative expenses.

Congress included a provision in statute for GAO to report on SBA's use of supplemental appropriations provided in fiscal year 2020 for administrative expenses. This report discusses (1) the amount of supplemental appropriations SBA received in fiscal year 2020 for administrative expenses and SBA's planned uses for these funds, and (2) the extent to which SBA had obligated and expended these funds as of January 31, 2021, and for what purposes.

To conduct this work, GAO reviewed appropriations legislation, analyzed SBA spending plans and financial data, and interviewed SBA officials.

For more information, contact William B. Shear at (202) 512-8678 or shearw@gao.gov.