Anti-Money Laundering: Opportunities Exist to Increase Law Enforcement Use of Bank Secrecy Act Reports, and Banks' Costs to Comply with the Act Varied

Fast Facts

Many law enforcement agencies use Bank Secrecy Act reports for investigations of money laundering or other crimes, such as drug trafficking, fraud, and terrorism. The Financial Crimes Enforcement Network granted direct access to the reports for certain federal, state, and local law enforcement agencies. Other law enforcement agencies can submit requests for individual reports.

Some of the law enforcement agencies without direct access may be underutilizing these reports—to the detriment of their investigations.

We recommended that FinCEN develop policies and procedures to promote greater law enforcement use of Bank Secrecy Act reports.

Highlights

What GAO Found

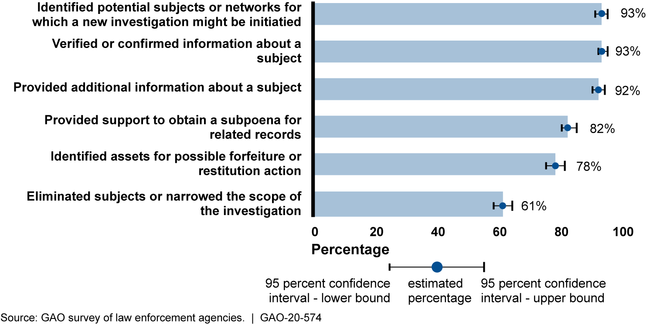

Many federal, state, and local law enforcement agencies use Bank Secrecy Act (BSA) reports for investigations. A GAO survey of six federal law enforcement agencies found that more than 72 percent of their personnel reported using BSA reports to investigate money laundering or other crimes, such as drug trafficking, fraud, and terrorism, from 2015 through 2018. According to the survey, investigators who used BSA reports reported they most frequently found information useful for identifying new subjects for investigation or expanding ongoing investigations (see figure).

Estimated Frequency with Which Criminal Investigators Who Reported Using BSA Reports Almost Always, Frequently, or Occasionally Found Relevant Reports for Various Activities, 2015–2018

Notes: GAO conducted a generalizable survey of 5,257 personnel responsible for investigations, analysis, and prosecutions at the Drug Enforcement Administration, Federal Bureau of Investigation, Homeland Security Investigations, Internal Revenue Service-Criminal Investigation, Offices of U.S. Attorneys, and U.S. Secret Service. The margin of error for all estimates is 3 percentage points or less at the 95 percent confidence interval.

As of December 2018, GAO found that the Financial Crimes Enforcement Network (FinCEN) granted the majority of federal and state law enforcement agencies and some local agencies direct access to its BSA database, allowing them to conduct searches to find relevant BSA reports. FinCEN data show that these agencies searched the BSA database for about 133,000 cases in 2018—a 31 percent increase from 2014. FinCEN created procedures to allow law enforcement agencies without direct access to request BSA database searches. But, GAO estimated that relatively few local law enforcement agencies requested such searches in 2018, even though many are responsible for investigating financial crimes. GAO found that agencies without direct access may not know about BSA reports or may face other hurdles that limit their use of BSA reports. One of FinCEN's goals is for law enforcement to use BSA reports to the greatest extent possible. However, FinCEN lacks written policies and procedures for assessing which agencies without direct access could benefit from greater use of BSA reports, reaching out to such agencies, and distributing educational materials about BSA reports. By developing such policies and procedures, FinCEN would help ensure law enforcement agencies are using BSA reports to the greatest extent possible to combat money laundering and other crimes.

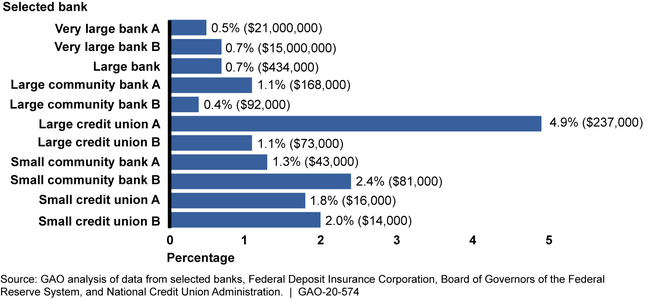

GAO reviewed a nongeneralizable sample of 11 banks that varied in terms of their total assets and other factors, and estimated that their total direct costs for complying with the BSA ranged from about $14,000 to about $21 million in 2018. Under the BSA, banks are required to establish BSA/anti-money laundering compliance programs, file various reports, and keep certain records of transactions. GAO found that total direct BSA compliance costs generally tended to be proportionally greater for smaller banks than for larger banks. For example, such costs comprised about 2 percent of the operating expenses for each of the three smallest banks in 2018 but less than 1 percent for each of the three largest banks in GAO's review (see figure). At the same time, costs can differ between similarly sized banks (e.g., large credit union A and B), because of differences in their compliance processes, customer bases, and other factors. In addition, requirements to verify a customer's identity and report suspicious and other activity generally were the most costly areas—accounting for 29 and 28 percent, respectively, of total compliance costs, on average, for the 11 selected banks.

Estimated Total Direct Costs for Complying with the Bank Secrecy Act as a Percentage of Operating Expenses and Estimated Total Direct Compliance Costs for Selected Banks in 2018

Notes: Estimated total direct compliance costs are in parentheses for each bank. Very large banks had $50 billion or more in assets. Small community banks had total of assets of $250 million or less and met the Federal Deposit Insurance Corporation's community bank definition. Small credit unions had total assets of $50 million or less.

Federal banking agencies routinely examine banks for BSA compliance. FinCEN data indicate that the agencies collectively cited about 23 percent of their supervised banks for BSA violations each year in their fiscal year 2015–2018 examinations. A small percentage of these violations involved weaknesses in a bank's BSA/anti-money laundering compliance program, which could require the agencies by statute to issue a formal enforcement action.

Stakeholders had mixed views on industry proposals to increase the BSA's dollar thresholds for filing currency transaction reports (CTR) and suspicious activity reports (SAR). For example, banks must generally file a CTR when a customer deposits more than $10,000 in cash and a SAR if they identify a suspicious transaction involving $5,000 or more. If both thresholds were doubled, the changes would have resulted in banks filing 65 percent and 21 percent fewer CTRs and SARs, respectively, in 2018, according to FinCEN analysis. Law enforcement agencies told GAO that they generally are concerned that the reduction would provide them with less financial intelligence and, in turn, harm their investigations. In contrast, some industry associations told GAO that they support the changes to help reduce BSA compliance costs for banks.

Why GAO Did This Study

Money laundering and terrorist financing pose threats to national security and the U.S. financial system's integrity. The BSA requires financial institutions to file suspicious activity and other reports to help law enforcement investigate these and other crimes. FinCEN administers the BSA and maintains BSA reports in an electronic database that can be searched to identify relevant reports. Some banks cite the BSA as one of their most significant compliance costs and question whether BSA costs outweigh its benefits in light of limited public information about law enforcement's use of BSA reports.

GAO was asked to review the BSA's implementation. This report examines (1) the extent to which law enforcement uses BSA reports and FinCEN facilitates their use, (2) selected banks' BSA compliance costs, (3) oversight of banks' BSA compliance, and (4) stakeholder views of proposed changes to the BSA. GAO surveyed personnel at six federal law enforcement agencies, collected data on BSA compliance costs from 11 banks, reviewed FinCEN data on banking agencies' BSA examinations, and interviewed law enforcement and industry stakeholders on the effects of proposed changes.

Recommendations

GAO is recommending that FinCEN develop written policies and procedures to promote greater use of BSA reports by law enforcement agencies without direct database access. FinCEN concurred with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Financial Crimes Enforcement Network | The Director of FinCEN should develop and implement written policies and procedures to help promote the greater use of BSA reports by law enforcement agencies that do not have direct access to the BSA database. Such policies and procedures could include outreach strategies and educational or training materials. (Recommendation 1) |

FinCEN agreed with our recommendation but noted it must also ensure that broader access to BSA reports be balanced against security considerations. As of January 2024, FinCEN officials told us that they were developing an education plan to inform law enforcement agencies about its BSA database, particularly those agencies that do not have direct access to the database. However, the FinCEN officials did not have a time frame for implementing the plan. We will continue to monitor FinCEN's efforts to develop an education plan.

|