Payment Integrity: Federal Agencies' Estimates of FY 2019 Improper Payments

Fast Facts

In fiscal year 2019, agencies across government made an estimated $175 billion in improper payments—payments that should not have been made or were made in the incorrect amount. But this total comes from individual agency estimates, which aren’t all reliable.

We also looked at inspectors general reports on agencies’ compliance with a law intended to address improper payments. The law has several requirements, including assessing improper payment risk for agency programs, and publishing and meeting targets for improper payment rates. Based on the reports, about half of the major agencies complied with all the requirements in fiscal year 2018.

Smashed piggy bank with $100 bills

Highlights

What GAO Found

Agency-reported improper payment estimates for fiscal year 2019 totaled about $175 billion, based on improper payment estimates reported by federal programs, an increase from the fiscal year 2018 total of $151 billion. Of the $175 billion, about $121 billion (approximately 69 percent) was concentrated in three program areas: (1) Medicaid, (2) Medicare, and (3) Earned Income Tax Credit. About $74.6 billion (approximately 42.7 percent) of the government-wide estimate was reported as monetary loss, an amount that should not have been paid and in theory should or could be recovered. However, the federal government's ability to understand the full scope of its improper payments is hindered by incomplete, unreliable, or understated agency estimates; risk assessments that may not accurately assess the risk of improper payment; and agencies not complying with reporting and other requirements in the Improper Payments Elimination and Recovery Act of 2010 (IPERA).

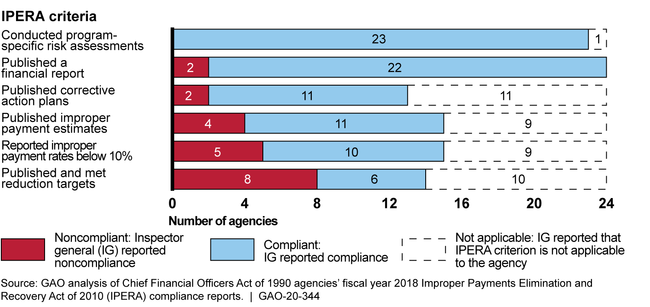

Eight years after the implementation of IPERA, half of the 24 Chief Financial Officers Act of 1990 (CFO Act) agencies—whose estimates account for over 99 percent of the federal government's reported estimated improper payments—complied with IPERA overall for fiscal year 2018, as reported by their inspectors general (IG). Based on the IGs' fiscal year 2018 compliance reports, agencies were most frequently reported as noncompliant with the requirement to publish and meet annual targets for improper payment reduction. Out of the 14 agencies for which this requirement was applicable, eight agencies were noncompliant. The second most-frequently reported area of noncompliance related to the requirement for agencies' reported improper payment rates to be below 10 percent for programs that published estimates. Out of the 15 agencies for which this requirement was applicable, five agencies were noncompliant.

Chief Financial Officers Act of 1990 Agencies' Fiscal Year 2018 Compliance with IPERA Criteria, as Reported by Their IGs

The IGs reported that 21 programs were noncompliant with IPERA for each of the past 3 fiscal years (2016–2018). These programs represented about $78 billion, or approximately 52 percent of the $151 billion government-wide reported improper payment estimates for fiscal year 2018.

Why GAO Did This Study

Improper payments—payments that should not have been made or that were made in incorrect amounts—continue to be an area of fiscal concern in the federal government. Improper payments have been estimated to total almost $1.7 trillion government-wide from fiscal years 2003 through 2019.

From fiscal year 2003 through 2016, a government-wide estimate and rate had been included in government-wide financial reports based on the programs and activities that reported estimates. However, financial reports for fiscal years 2017 and 2018 did not include a government-wide improper payment estimate or rate. Agency-reported improper payment estimates are posted on the Office of Management and Budget's Paymentaccuracy.gov website.

IPERA requires IGs to annually determine and report on whether executive branch agencies complied with six IPERA criteria, such as conducting risk assessments and publishing and meeting improper payment reduction targets.

This report summarizes (1) federal agencies' reported improper payment estimates for fiscal years 2018 and 2019, and reasons for substantial changes between years, and (2) CFO Act agencies compliance with IPERA criteria for fiscal year 2018, as determined by their IGs, and overall compliance trends for fiscal years 2016 through 2018. GAO summarized (1) improper payment estimates from agency financial reports and Paymentaccuracy.gov and (2) information on CFO Act agencies' IPERA compliance reported in IGs' fiscal year 2018 IPERA compliance reports and prior GAO reports.

For more information, contact Beryl H. Davis at (202) 512-2623 or davisbh@gao.gov.