Highlights of a Forum: Data Analytics to Address Fraud and Improper Payments

GAO-17-339SP

Published: Mar 31, 2017. Publicly Released: Mar 31, 2017.

Skip to Highlights

Highlights

What the Participants Said

During the GAO-sponsored forum, panelists discussed the following topics related to analytics to address improper payments, including fraud:

► Opportunities for Collaboration

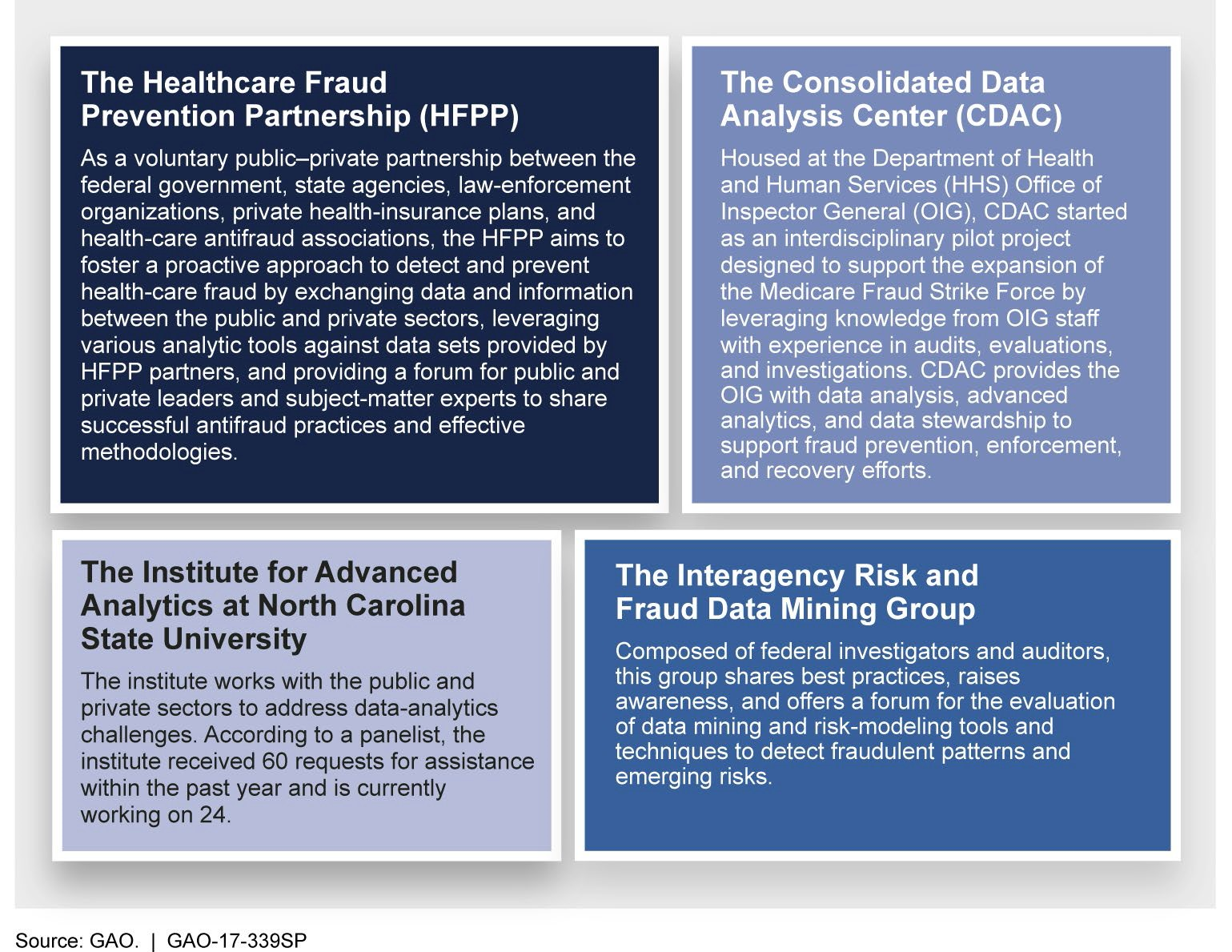

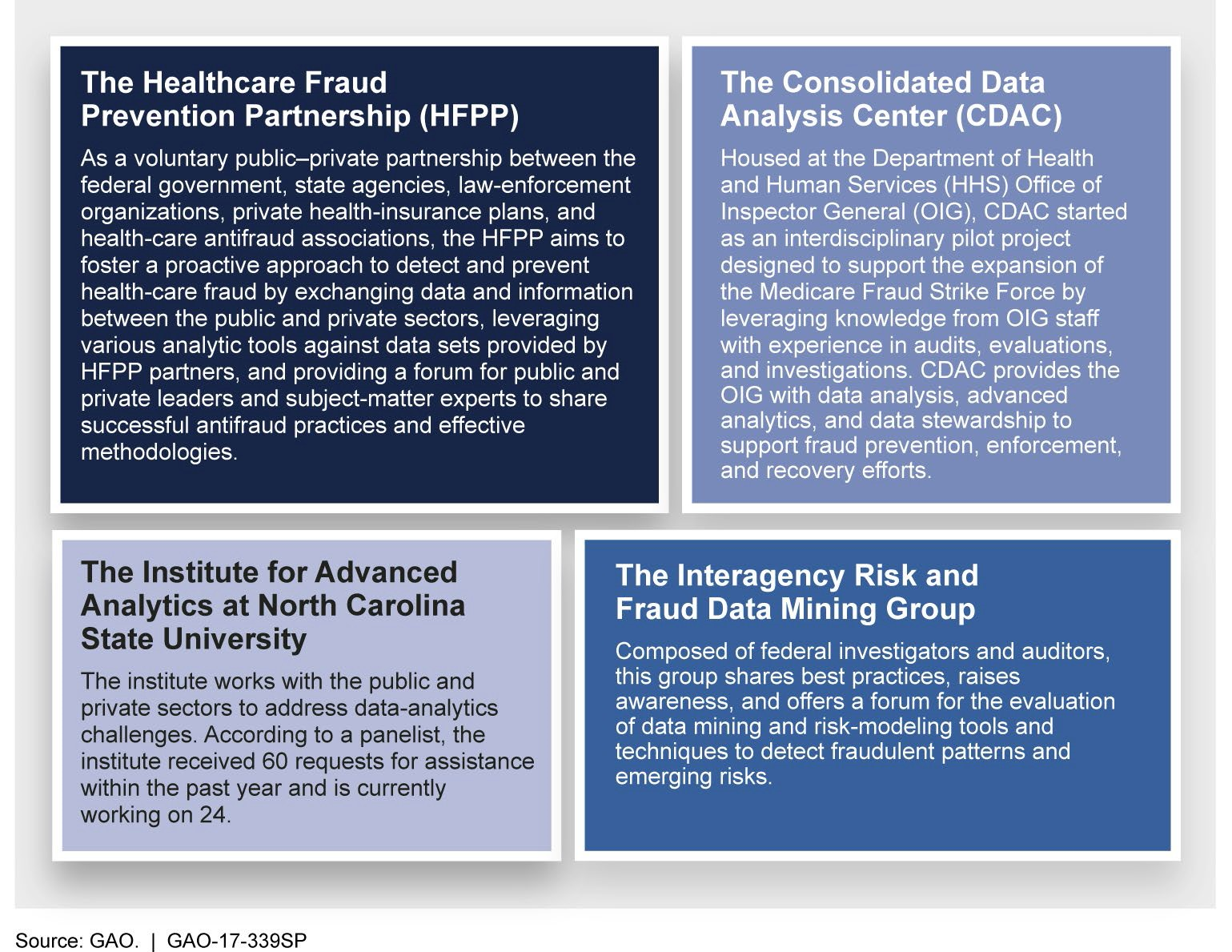

Collaboration between the government, private sector, public–private partnerships, and academia may allow entities to share analytics-related resources and knowledge to address the challenge of improper payments, as shown in the figure below. To foster collaboration, entities in a prospective collaboration should identify the defined objectives and desired outcomes of their partnership, according to panelists. Further, entities should work to build trust with each other and demonstrate a willingness to collaborate. Panelists stated that many commonly cited barriers to collaboration, including potential legal and data-sharing barriers, may be overcome through communication and research.

Examples of Partnerships and Resources Provided by the Panelists

► Considerations for Establishing Analytics Programs

Forum panelists identified several considerations for entities in the early stages of developing an analytics program to address improper payments, including (1) identifying specific objectives and aligning analytics programs with those objectives; (2) conducting an inventory of existing technology, techniques, data, and staff, and identifying new opportunities to leverage existing capabilities; and (3) demonstrating the value of analytics to obtain entity-wide support.

► Considerations for Refining Analytics Programs

Panelists highlighted the importance of continuously improving analytics programs by revisiting and reassessing analytics tools, techniques, and available data sets. Additionally, panelists stated that entities should identify staff with knowledge of both analytics and the business of the entity to further the entity’s mission and meet objectives.

Why GAO Convened This Forum

In fiscal year 2016, federal agencies estimated making over $144 billion in improper payments, a number that has increased considerably in recent years. Improper payments, including those resulting from fraud, are a significant and pervasive government-wide issue and have presented a continuing challenge to the federal government. Reducing improper payments is critical to safeguarding federal funds, and could help achieve cost savings and help improve the government’s fiscal position.

GAO’s previous work has shown that implementing preventive and detective controls, including data-analytics tools and techniques, is one strategy to address improper payments, including fraud.

On September 21, 2016, GAO convened a group of data-analysis experts to discuss: (1) opportunities for collaboration, (2) considerations for establishing a data-analytics program, and (3) considerations for refining a data-analytics program. GAO selected 12 forum panelists from the government, private sector, public– private partnerships, and academia based on their demonstrated ability to provide examples of their work and discuss topics related to using data analytics to address improper payments, including fraud. This report summarizes the discussion by forum panelists. Comments expressed in the report do not necessarily represent the views of all participants, their organizations, or GAO. Panelists reviewed a draft of this report, and GAO incorporated their comments, as appropriate.

For more information, contact Vijay D'Souza at (202) 512-2700 or dsouzav@gao.gov, or Seto Bagdoyan at (202) 512-6722 or bagdoyans@gao.gov.

Full Report

GAO Contacts

Public Inquiries

Topics

Improper paymentsAuditsBest practicesErroneous paymentsOverpaymentsReporting requirementsRisk managementPublic health emergenciesHousingInventory