When it comes to taxes, there’s a transparency gap in the gig economy

July 15 is the deadline for tax return filing and payments and the same deadline for estimated quarterly payments. Workers in the “gig” economy face unique challenges to fulfill these obligations. Today’s WatchBlog looks at a large subset of the gig economy, platform workers who offer goods or services —such as transportation, retail, or short-term lodging— and connect with customers through an app on a phone or other online platform. Studies suggest there could be as many as 1.5 million to 2 million platform workers in the U.S who do this type of work.

Platform workers may be affected by COVID-19 as their customers either increase (package delivery) or decrease (rentals) use of the service. In addition, it is uncertain how many platform workers may receive either the economic impact payment or unemployment benefits available from recent legislation to assist workers during the pandemic—an issue that GAO is currently reviewing.

How do platform economy workers and companies pay taxes?

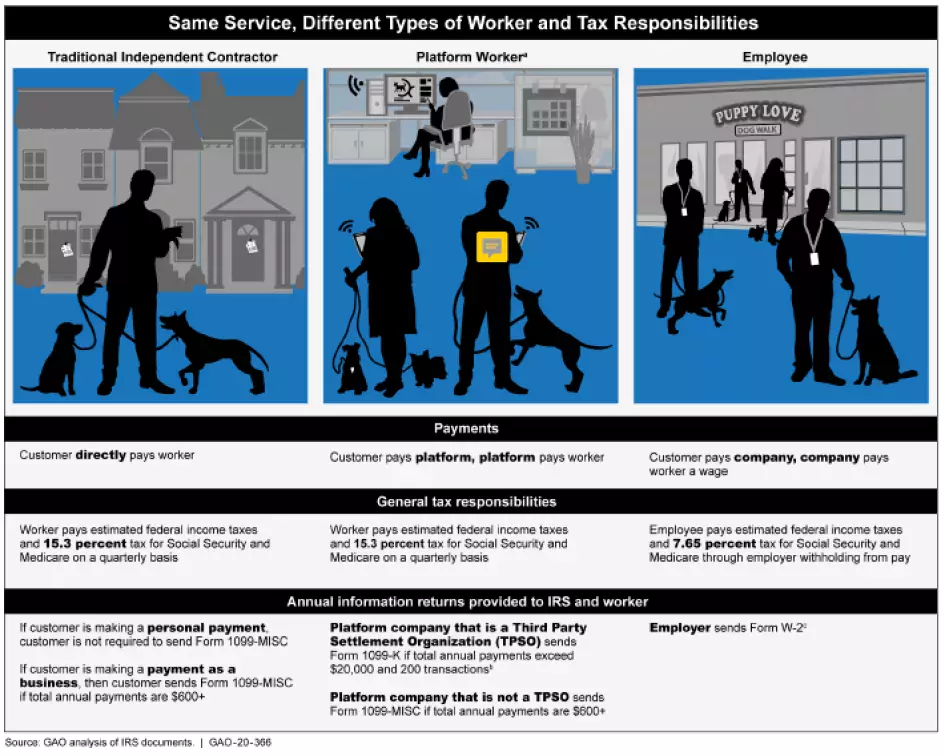

Unfortunately, platform workers may not realize that a company is treating them as independent contractors rather than employees, and as such, these workers have different tax requirements. For example, platform companies generally don’t withhold federal income or employment taxes for independent contractors. Instead, the worker is supposed to pay these taxes each quarter to the Internal Revenue Service.

Additionally, a platform company that only transfers funds between buyers and sellers may have reduced reporting requirements. As a result, GAO found that platform workers may not get information on their earnings, which makes it difficult for them to comply with their tax reporting requirements. It also creates enforcement challenges for IRS. The below graphic shows how workers in the same job might have different tax responsibilities under a platform economy vs. a typical employer.

Image

What is the IRS doing to help platform workers?

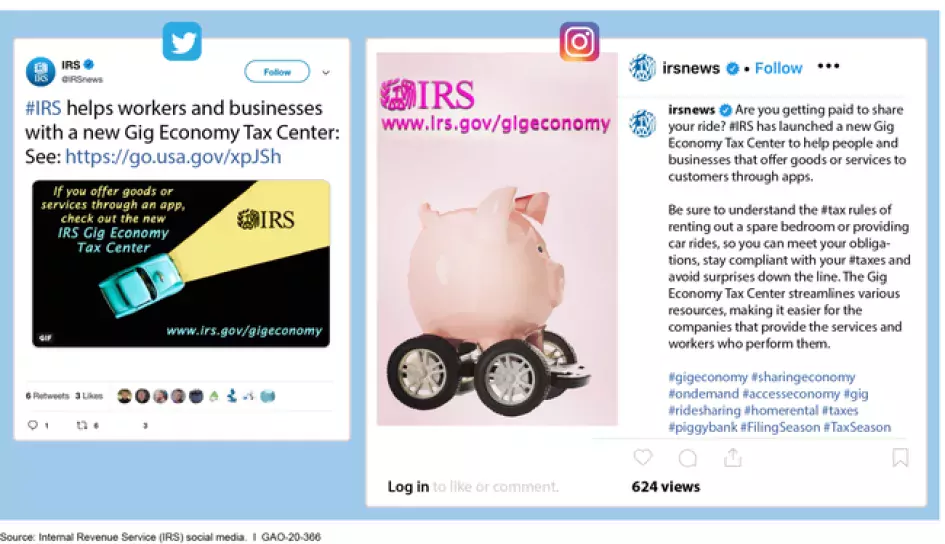

To help raise awareness, the IRS developed a communications plan focused on workers in the platform economy (which IRS calls the gig economy), which is a good start.

Image

Still, GAO identified seven actions that could help improve tax compliance for workers. For example, some platform companies only report total annual payments for workers over $20,000 and 200 transactions—an amount well over the average gross pay from a single company for many platform workers. Changing the rule to lower reporting thresholds would provide workers with more information to help them comply with their tax obligations. GAO is also recommending that IRS allow voluntary tax withholding. Be sure to check out the full report.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.