How Did State and Local Governments Fare During the Pandemic?

COVID-19 took a toll on the U.S. economy, impacting businesses’ revenues and individuals’ earnings. These losses also impacted state and local governments, which rely on funding generated by sales and income taxes (among others) to fund everything from roads to schools.

Today’s WatchBlog post explores our new report on the financial pressures state and local governments faced during the pandemic.

Image

Effects on tax revenues

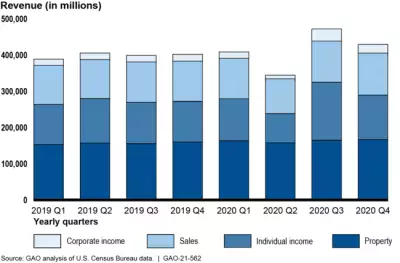

Together, state and local government revenues from individual, corporate, and sales taxes declined about $61 billion in the second quarter (April-June) of 2020, compared to the same period in 2019. However, it then rebounded through the remainder of 2020. State and local tax revenues during this period varied by source:

- Income Taxes: Decreased by 30.5% during the second quarter of 2020, but then recovered by more than double—99.7%—in the third quarter. Income tax revenue from higher wage earners remained strong during the pandemic, supporting states that rely on income tax revenue from high-income earners. Higher-wage earners —who pay more income tax than lower wage earners—were able to telework throughout the pandemic, while lower-wage earners, largely in service industries, experienced significant job losses.

- Sales Taxes: Decreased by 14% in the second quarter, but then increased by 18% in the third quarter. After an initial shock, consumer spending remained resilient as people purchased more online, which contributed to sales tax revenue.

- Property Taxes: Compared to the other 3 taxes, revenue from property taxes experienced a lower rate of decline after the onset of the pandemic due, in part, to the amount of time it takes state and local governments to reassess the amount of taxes owed on property.

- Corporate Income Taxes: Decreased by 44% in the second quarter and then nearly tripled in the third quarter. Many states extended the deadline for corporations to file taxes, which may explain why the timing of this income shifted.

State and Local Government Revenues, First Quarter 2019 through Fourth Quarter 2020

Image

How states responded to losses

In our new report, we looked at how 8 regionally and economically diverse states were affected and responded to revenue losses. These included: Arizona, Florida, Michigan, Nevada, New Hampshire, North Carolina, North Dakota, and Pennsylvania.

On the whole, states that relied more on revenue from energy and tourism were particularly vulnerable to the pandemic’s economic effects.

While state and local governments spent more on public health and education to address the pandemic, they also reduced spending in other areas through hiring freezes and furloughs to balance their budgets. And half of the 8 states we looked at used all or part of their reserve funds to help cover expenses during the pandemic.

And while revenues were down, states did not necessarily look to increase taxes or fees as a way to generate revenue. Officials from 4 of the 8 states we looked at told us that their proposed budgets for FY 2021 would not include increases in taxes or adoption of new taxes as a way to generate revenues.

Similarly, while states incurred additional expenses in response to the pandemic, 5 of the 8 states said that federal financial assistance helped bolster their state’s capacity to implement COVID-19-related programs and respond to increased demand for certain services.

Find out more about how state and local governments were affected by the pandemic by checking out our new report.

- Questions on the content of this post? Contact the WatchBlog team at blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.