Federal Payment Errors, Known As Improper Payments, Are A Continuing Concern

The federal government reported an estimated $247 billion in payment errors during the most recently completed fiscal year (FY 2022). These errors include overpayments or payments that should not have been made—for example, payments to deceased individuals or those no longer eligible for government programs.

Payment errors are a long-standing issue for the federal government. Over the last 20 years, it has made almost $2.4 trillion in payment errors, according to reported estimates. What’s causing these errors and what can be done to prevent them?

Today’s WatchBlog post looks at our latest report on this issue.

Image

What were the payment errors in FY 2022?

Of the estimated $247 billion in government-wide payment errors for FY2022:

- $200 billion were overpayments

- $5.3 billion were underpayments

- $32.7 billion were “unknown payments,” which means it was unclear whether a payment was an error or not

- $9 billion were “technically payment errors,” which means a recipient was entitled to a payment, but the payment failed to follow proper statutes or regulations.

Which programs had the most payment errors?

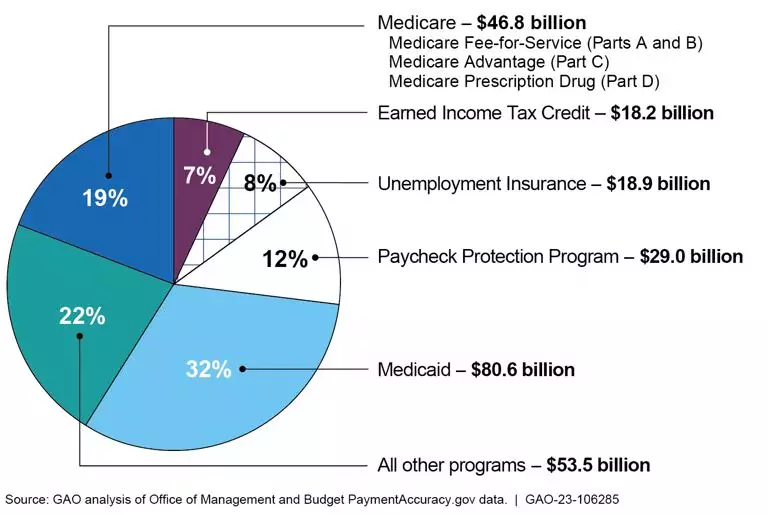

Payment errors were reported by 18 agencies, across 82 federal programs in FY 2022. While a widespread issue, the vast majority of these payment errors (78%) were made under five program areas—Medicaid, Medicare, the Paycheck Protection Program, Unemployment Insurance, and the Earned Income Tax Credit.

Image

We have found, in our previous annual assessments, that some of these program areas have been consistently among those with the highest payment errors—including Medicaid, Medicare, and the Earned Income Tax Credit. These are federal program areas that issue the most payments to individuals and, as a result, are maybe more vulnerable to payment errors. We’ve made recommendations to help reduce payment errors that still require action from agency officials.

For example:

- Medicare could improve communication around its prior authorization program. This program requires that beneficiaries get approval before receiving certain items like powered wheelchairs—and it could reduce expenses and improper payments.

- Medicaid could improve oversight to ensure that claims aren’t paid to ineligible medical providers, including those who have suspended or revoked medical licenses.

- Earned Income Tax Credit—The Internal Revenue Service could take steps to review more W-2s before issuing tax refunds to reduce the risk of tax refund fraud.

The Paycheck Protection Program (PPP), which was created to help businesses keep their workforce employed during COVID-19, was also vulnerable to payment errors. During the beginning of the pandemic, many agencies—including the Small Business Administration, which administered PPP—were able to distribute funds quickly to help businesses, communities and individuals. But the tradeoff was that agencies’ like SBA did not have systems in place to prevent and identify payment errors and fraud.

In November 2020, we recommended that SBA expeditiously estimated PPP payment errors. Our new report shows that for FY 2022, the first year for which an estimate was reported, SBA estimated that the PPP—which helped so many in the workforce—also made about $29 billion in payment errors. We have recommended that SBA develop a strategy that outlines specific actions to monitor and manage fraud risks in the PPP on a continuous basis.

Unemployment Insurance also played an important role during the pandemic. But fraud and potential fraud within the program increased substantially, according to the Department of Labor, which manages the program at the federal level. The causes for payment errors included—claimants continuing to claim benefits after returning to work; employers failing to provide timely and adequate information on reasons for employee departures; and claimants failing to show that they met state requirements to demonstrate they were actively seeking work. We have recommended that the DOL examine the suitability of existing fraud controls in the unemployment insurance program and prioritize residual fraud risks.

We also added the unemployment insurance system to our High Risk List in 2022. Our High Risk List highlights federal programs and operations that are vulnerable to waste, fraud, abuse or mismanagement, or in need of transformation. While payment errors rose during the pandemic, there is an urgent need to address persistent issues that predate the pandemic, which risk unemployment insurance service delivery and expose the system to significant financial losses.

How can we reduce payment errors across the federal government?

Some of our recommendations to reduce payment errors under specific programs are discussed above, but there are more. GAO has made numerous recommendations to agencies and provided suggestions to Congress on ways to help reduce improper payments. Our recommendations for federal agencies include those that would call for better monitoring of federal programs and planning that would help identify risks for payment errors. For Congress, we think agencies could use help identifying susceptible programs, developing reliable methods for estimating improper payments, and implementing effective corrective action.

While some steps have been taken, more action is needed. Eight federal agencies that had reported improper payments in FY 2022 already had unaddressed recommendations from us. As of February 2023, most of our recommendations (37 of 53) remain open. Find out more about our recommendations and actions Congress could take to help agencies by reading our latest report on improper payments.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.