COVID-19: Urgent Actions Needed to Better Ensure an Effective Federal Response

Fast Facts

Our oversight of the federal COVID-19 response continues. Findings include:

In our national survey, states and territories were concerned about ongoing shortages of some testing-related and other medical supplies (e.g., nitrile gloves)

As vaccines and therapeutics are approved for use, more transparency around FDA's scientific reviews of safety and effectiveness is needed to strengthen public confidence in them

HHS and CDC have provided little scientific explanation for changing key testing guidelines during the pandemic

In our report, we made 11 recommendations and one suggestion for Congress to consider.

Highlights

What GAO Found

The COVID-19 pandemic has resulted in catastrophic loss of life and substantial damage to the global economy, stability, and security. According to federal data, the U.S. had an average of 116,000 new COVID-19 cases per day from November 1 through November 12, 2020. Between January 2020 and October 2020, at least 237,000 more deaths occurred from all causes, including COVID-19, than would normally be expected, according to data from the Centers for Disease Control and Prevention (CDC).

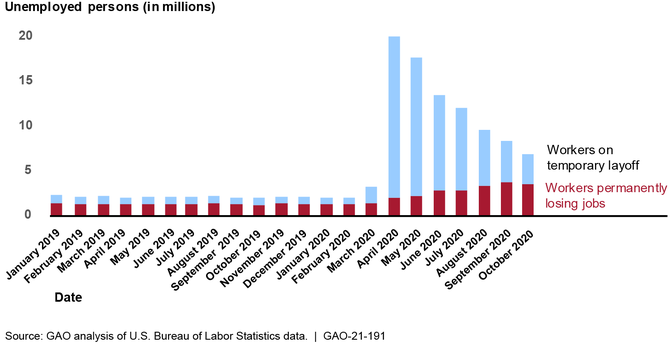

Further, while the economy has improved since July 2020, many people remain unemployed, including both those temporarily laid off and those who have permanently lost their job (see figure). Also, more households have become seriously delinquent on mortgage payments during the pandemic. In addition, GAO’s review of academic studies suggests the pandemic will likely remain a significant obstacle to more robust economic activity.

Number of Unemployed Workers Permanently Losing Jobs and on Temporary Layoff, January 2019 through October 2020

In response to the pandemic and its effects, Congress and the administration have taken a series of actions to protect the health and well-being of Americans. However, as the end of 2020 approaches, urgent actions are needed to help ensure an effective federal response on a range of public health and economic issues.

Medical Supplies

While the Department of Health and Human Services (HHS) and the Federal Emergency Management Agency (FEMA) have made numerous efforts to mitigate supply shortages and expand the medical supply chain, shortages of certain supplies persist. In September 2020, GAO reported that ongoing constraints with the availability of certain types of personal protective equipment (PPE) and testing supplies remain due to a supply chain with limited domestic production and high global demand. In October 2020, GAO surveyed public health and emergency management officials from all states, the District of Columbia, and U.S. territories (hereafter states) and found the following:

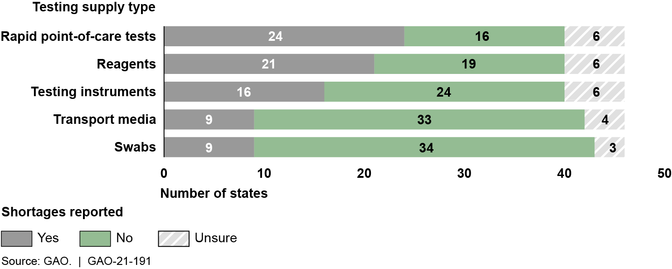

- Testing supplies. Most states reported no shortages of swabs or transport media, but about one-third to one-half reported shortages in other types of testing supplies (see figure).

State-Reported Testing Supply Shortages, as of October 2020

GAO surveyed officials in the 50 states; Washington, D.C.; and the five U.S. territories and received responses from 47 of the 56 locations, representing 41 states; Washington, D.C.; and all five territories. Not all states responded to every question.

- PPE. The majority of states that responded were mainly able to fulfill requests for supplies from organizations and entities within their states. However, availability constraints continue with certain PPE, such as nitrile gloves.

- Supplies for future vaccine needs. About one-third of states that responded stated that they were “greatly” or “completely” concerned about having sufficient vaccine-related supplies to administer COVID-19 vaccines. An additional 21 states indicated that they were moderately concerned.

In September 2020, GAO recommended that HHS, in coordination with FEMA, should

- further develop and communicate to stakeholders plans outlining specific actions the federal government will take to help mitigate supply chain shortages for the remainder of the pandemic;

- immediately document roles and responsibilities for supply chain management functions transitioning to HHS, including continued support from other federal partners, to ensure sufficient resources exist to sustain and make the necessary progress in stabilizing the supply chain; and

- devise interim solutions, such as systems and guidance and dissemination of best practices, to help states enhance their ability to track the status of supply requests and plan for supply needs for the remainder of the pandemic response.

HHS and the Department of Homeland Security disagreed with these recommendations, noting, among other things, the work that they had done to manage the medical supply chain and increase supply availability. In November 2020, HHS repeated its disagreement with GAO’s recommendations and noted its efforts to meet the needs of states.

In light of the surge in COVID-19 cases, along with reported shortages, including GAO’s nationwide survey findings, GAO underscores the critical imperative for HHS and FEMA to implement GAO’s September 2020 recommendations.

Vaccines and Therapeutics

In a recent GAO report (GAO-21-207), GAO found that there has been significant federal investment to accelerate vaccine and therapeutic development, such as through Operation Warp Speed, a partnership between the Department of Defense and HHS that aims to accelerate the development, manufacturing, and distribution of COVID-19 vaccines and therapeutics. Separately, Emergency Use Authorizations (EUA), which allow for the emergency use of medical products without Food and Drug Administration (FDA) approval or licensure provided certain statutory criteria are met, have also been used for therapeutics. As of November 9, 2020, FDA had made four therapeutics available to treat COVID-19 through EUAs. In that report, GAO recommended that FDA identify waysto uniformly discloseinformation from its scientific review of safety and effectiveness data when issuing EUAs for therapeutics and vaccines. By doing so, FDA could help improve the transparency of, and ensure public trust in, its EUA decisions. HHS neither agreed nor disagreed with the recommendation, but said it shared GAO’s goal of transparency.

COVID-19 Testing Guidance

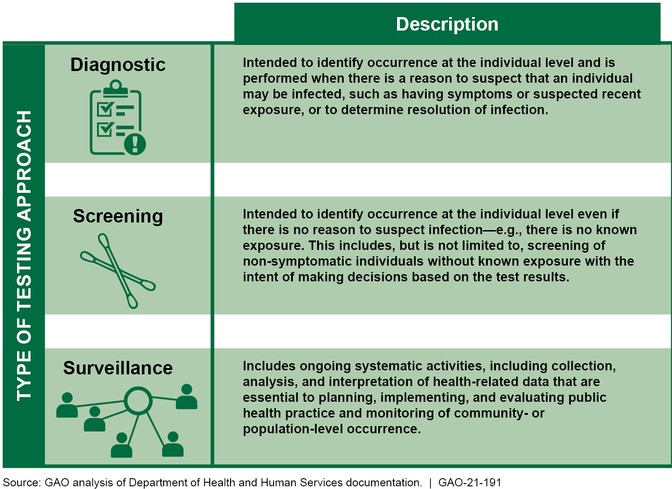

HHS and its component agencies have taken several key actions to document a federal COVID-19 testing strategy and provide testing-related agency guidance. However, this guidance has not always been transparent, raising the risk of confusion and eroding trust in government. In particular, while it is expected that guidance will change as new information about the novel virus evolves, frequent changes to general CDC testing guidelines have not always been communicated with a scientific explanation. GAO recommends that HHS ensure that CDC clearly discloses the scientific rationale for any change to testing guidelines at the time the changeis made. HHS concurred with this recommendation.

Types of COVID-19 Testing Approaches

Nursing Home Care

In September 2020, the Coronavirus Commission on Safety and Quality in Nursing Homes (established by the Centers for Medicare & Medicaid Services (CMS) in June 2020) made 27 recommendations to CMS on topics such as testing, PPE, and visitation. CMS released a response to the commission that broadly outlined the actions it has taken to date, but it has not fully addressed the commission’s recommendations or provided an implementation plan to track and report progress toward implementing them.

While CMS is not obligated to implement all of the commission’s recommendations, the agency has not indicated any areas where it does not plan to take action. GAO recommends that CMS quickly develop a plan that further details how it intends to respond to and implement, as appropriate, the commission’s recommendations. HHS neither agreed nor disagreed with this recommendation and said it would refer to and act upon the commission’s recommendations, as appropriate.

In addition, the Department of Veterans Affairs (VA) partners with state governments to provide nursing home care to more than 20,000 veterans in over 150 state veterans homes. In March 2020, VA instructed its contractor to stop in-person inspections due to concerns about COVID-19. As of September 2020, these inspections had not resumed, leaving veterans at risk of receiving poor quality care. Additionally, VA does not collect timely data on the number of COVID-19 cases and deaths occurring at each state veterans home, hindering its ability to monitor and take steps to mitigate the spread of COVID-19 in these homes. GAO recommends that VA (1) develop a plan to resume inspections of state veterans homes, which may include using in-person, a mix of virtual and in-person, or fully virtual inspections, and (2) collect timely data on COVID-19 cases and deaths in each state veterans home. VA concurred with both recommendations.

Economic Impact Payments

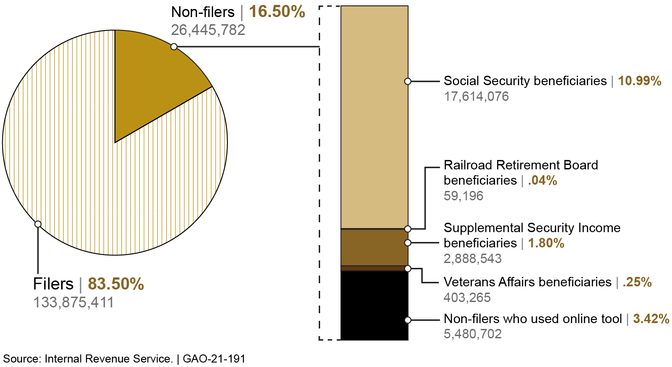

The CARES Act included economic impact payments (EIP) for eligible individuals to address financial stress due to the pandemic. As of September 30, 2020, the Department of the Treasury (Treasury) and the Internal Revenue Service (IRS) had disbursed over 165.8 million payments to individuals, totaling $274.7 billion. According to IRS data, more than 26 million non-filers—individuals who do not normally file a tax return and may be hard to reach—received a payment (see figure). However, everyone that was supposed to receive a payment was not reached. Starting in September 2020, IRS sent notices to nearly 9 million individuals who had not yet received an EIP.

Number of Filers and Non-Filers Issued an Economic Impact Payment, as of September 30, 2020

Treasury and IRS officials did not plan to track and analyze the outcomes of their EIP notice mailing effort until 2021. The lack of timely analysis deprives Treasury and IRS of data they could use to assess the effectiveness of their notice strategy and redirect resources as needed to other outreach and communication efforts. GAO recommends that Treasury, in coordination with IRS, should begin tracking and publicly reporting the number of individuals who were mailed an EIP notification letter and filed for and received an EIP, and use that information to inform ongoing outreach and communications efforts. Treasury agreed with this recommendation.

Unemployment Insurance

The CARES Act created three federally funded temporary programs for unemployment insurance (UI) that expanded benefit eligibility and enhanced benefits. In its weekly news releases, the Department of Labor (DOL) publishes the number of weeks of unemployment benefits claimed by individuals in each state during the period and reports the total count as the number of people claiming benefits nationwide. DOL officials told GAO that they have traditionally used this number as a proxy for the number of individuals claiming benefits because they were closely related. However, the number of claims has not been an accurate estimate of the number of individuals claiming benefits during the pandemic because of backlogs in processing a historic volume of claims, among other data issues.

Without an accurate accounting of the number of individuals who are relying on these benefits in as close to real time as possible, policymakers may be challenged to respond to the crisis at hand. GAO recommends that DOL (1) revise its weekly news releases to clarify that in the current unemployment environment, the numbers it reports for weeks of unemployment claimed do not accurately estimate the number of unique individuals claiming benefits, and (2) pursue options to report the actual number of distinct individuals claiming benefits, such as by collecting these already available data from states. DOL agreed with the recommendation to revise its weekly news releases, and partially agreed with the recommendation to pursue options to report the actual number of distinct individuals claiming benefits.

Tax Relief for Businesses

To provide liquidity to businesses during the pandemic, the CARES Act included tax measures to help businesses receive cash refunds or other reductions to tax obligations. Some taxpayers need to file an amended income tax return to take advantage of these provisions; at the same time, IRS faces an increase in mail and paper processing delays due to the pandemic, which may delay the timely processing of this paperwork and issuance of these refunds. GAO recommends that IRS update its form instructions to include information on its electronic filing capability for tax year 2019. IRS agreed with this recommendation.

Program Integrity

Although the extent and significance of improper payments associated with COVID-19 relief funds have not yet been determined, the impact of these improper payments, including those that are the result of fraud, could be substantial. For example, numerous individuals are facing federal charges related to attempting to defraud the Paycheck Protection Program (PPP), UI program, or other federal programs, and many more investigations are underway. To address the risk of improper payments due to fraud and other causes, GAO previously recommended the following:

- The Small Business Administration (SBA) should develop and implement plans to identify and respond to risks in the PPP to ensure program integrity, achieve program effectiveness, and address potential fraud.

- The Office of Management and Budget (OMB), in consultation with Treasury, should issue timely guidance for auditing new and existing COVID-19-related programs, including Coronavirus Relief Fund payments, as soon as possible. Audits of entities that receive federal funds are critical to the federal government’s ability to help safeguard those funds.Also, Congress should amend the Social Security Act to explicitly allow the Social Security Administration to share its full death data with Treasury for data matching to prevent payments to ineligible individuals.

GAO maintains that implementing these recommendations fully is critically important in order to protect federal funds from improper payments resulting from fraud and other risks.

In this report, GAO also identifies new concerns about the timely reporting of improper payments for COVID-19 programs. The COVID-19 relief laws appropriated over a trillion dollars that may be spent through newly established programs to fund response and recovery efforts, such as SBA’s PPP. However, unlike the supplemental appropriations acts that provided for disaster relief related to the 2017 hurricanes and California wildfires, the COVID-19 relief laws did not require agencies to deem programs receiving these relief funds that expend more than a threshold amount as "susceptible to significant improper payments." In addition, based on OMB guidance, improper payment estimates associated with new COVID-19 programs established in March 2020 may not be reported until November 2022, in some instances. GAO is making two recommendations:

- OMB should develop and issueguidance directingagencies to include COVID-19 relief funding with associated key risks, such as changes to existing program eligibility rules, as part of their improper payment estimation methodologies, especially for existing programs that received COVID-19 relief funding.

- SBA should expeditiously estimate improper payments and report estimates and error rates for PPP due to concerns about the possibility that improper payments, including those resulting from fraudulent activity, could be widespread.

GAO is also suggesting that Congress consider, in any future legislation appropriating COVID-19 relief funds, designating all executive agency programs and activities making more than $100 million in payments from COVID-19 relief funds as “susceptible to significant improper payments.”

Aviation Assistance and Preparedness

GAO identified concerns about efforts to monitor CARES Act financial assistance to the aviation sector. Treasury’s Payroll Support Program (PSP) provides $32 billion in payroll support payments and loans to help the aviation industry retain its employees. While recipients have begun submitting required compliance reports, Treasury has not yet finalized a monitoring system to identify and respond to the risk of noncompliance with PSP agreement terms, potentially hindering its ability to detect program misuse in a timely manner. GAO is recommending that Treasury finish developing and implement acompliance monitoringplan that identifies and responds to risks in the PSP. Treasury neither agreed nor disagreed with this recommendation, but committed to reviewing additional measures that may further enhance its compliance monitoring and ensure that PSP funds are used as intended.

In June 2020, GAO suggested that Congress take legislative action to require the Secretary of Transportation to work with relevant agencies, such as HHS, the Department of Homeland Security, and other stakeholders, to develop a national aviation-preparedness plan to limit the spread of communicable diseasethreats and minimize traveland trade impacts. GAO originally made this recommendation to the Department of Transportation in December 2015. GAO urges Congress to take swift action to require such a plan, without which the U.S. will not be as prepared to minimize and quickly respond to ongoing and future communicable disease events.

Why GAO Did This Study

As of November 12, 2020, the U.S. had over 10.3 million cumulative reported cases of COVID-19 and about 224,000 reported deaths, according to federal agencies. The country also continues to experience serious economic repercussions.

Four relief laws, including the CARES Act, were enacted as of November 2020 to provide appropriations to address the public health and economic threats posed by COVID-19. As of September 30, 2020, of the $2.6 trillion appropriated by these acts, the federal government had obligated a total of $1.8 trillion and expended $1.6 trillion of the COVID-19 relief funds, as reported by federal agencies.

The CARES Act included a provision for GAO to report on its ongoing monitoring and oversight efforts related to the COVID-19 pandemic. This report examines the federal government’s continued efforts to respond to and recover from the COVID-19 pandemic.

GAO reviewed data, documents, and guidance from federal agencies about their activities and interviewed federal and state officials. GAO also sent a survey to public health and emergency management officials in the 50 states, Washington, D.C., and the five U.S. territories regarding medical supplies.

Recommendations

GAO is making 11 new recommendations for agencies that are detailed in this Highlights and in the report. GAO is also raising one matter for congressional consideration.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| To hold agencies accountable and increase transparency, Congress should consider, in any future legislation appropriating COVID-19 relief funds, designating all executive agency programs and activities making more than $100 million in payments from COVID-19 relief funds as "susceptible to significant improper payments" for purposes of 31 U.S.C. § 3352. | No new legislation designating executive agency programs and activities making more than $100 million in payments from COVID-19 relief funds as "susceptible to significant improper payments" has been enacted as of February 2025. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Health and Human Services | The Secretary of Health and Human Services should ensure that the Director of the Centers for Disease Control and Prevention clearly discloses the scientific rationale for any change to testing guidelines at the time the change is made. (Recommendation 1) |

HHS agreed with our recommendation and has taken steps to implement it. Specifically, CDC has posted links to studies related to changes in testing-related guidance. In addition, CDC created a public health guidance development framework that is intended to increase uptake of evidence-based public health actions applied during agency-wide responses. The framework includes a section that describes the importance of providing scientific evidence to support public health guidance when formulating the guidance. These actions fulfill the intent of the recommendation that CDC clearly disclose the scientific rationale for any change to testing guidelines at the time the change is made.

|

| Centers for Medicare & Medicaid Services | The Administrator of the Centers for Medicare & Medicaid Services should quickly develop a plan that further details how the agency intends to respond to and implement, as appropriate, the 27 recommendations in the final report of the Coronavirus Commission on Safety and Quality in Nursing Homes, which the Centers for Medicare & Medicaid Services released on September 16, 2020. Such a plan should include milestones that allow the agency to track and report on the status of each recommendation; identify actions taken and planned, including areas where the Centers for Medicare & Medicaid Services determined not to take action; and identify areas where the agency could coordinate with other federal and nonfederal entities. (Recommendation 2) | HHS neither agreed nor disagreed with our recommendation. HHS officials highlighted actions that CMS has taken related to Commission recommendations and said it would refer to and act upon the Commission's recommendations, as appropriate. As of May 2021, CMS had developed an internal tracking document that notes the status of each of the Nursing Home Commission's recommendations, the responsible agency for each recommendation, and planned actions for CMS-related recommendations. According to CMS, the agency will be conducting quarterly reviews of the tracking document, holding interim meetings to discuss the recommendations, and conducting outreach to other federal agencies to engage...

|

| Office of the Under Secretary for Health | The Department of Veterans Affairs Under Secretary for Health should develop a plan to ensure inspections of state veterans homes occur during the COVID-19 pandemic—which may include using in-person, a mix of virtual and in-person, or fully virtual inspections. (Recommendation 3) |

On December 7, 2020, VA developed an interim process for reviewing records from State Veterans Homes (SVH), such as evidence that previous corrective action plans were implemented and documentation of infection control assessments, to assess the SVH's compliance with federal regulations. VA reported it implemented this process until a new inspection contract could be awarded and completed 25 of these record reviews. VA awarded a contract in January 2021, to conduct full virtual, blended virtual or on-site SVH inspections, and reported that the contractor began conducting inspections on January 19, 2021, which are ongoing.

|

| Office of the Under Secretary for Health |

Priority Rec.

The Department of Veterans Affairs Under Secretary for Health should collect timely data on COVID-19 cases and deaths in each state veterans home, which may include using data already collected by the Centers for Medicare & Medicaid Services. (Recommendation 4) |

As of September 2021, VA is publicly reporting on its website data on COVID-19 cases and deaths among residents and staff at 158 out of 158 state veterans homes. We are closing the recommendation as implemented.

|

| Department of the Treasury | The Secretary of the Treasury, in coordination with the Commissioner of Internal Revenue, should begin tracking and publicly reporting the number of individuals who were mailed an economic impact payment notification letter and subsequently filed for and received an economic impact payment, and use that information to inform ongoing outreach and communications efforts. (Recommendation 5) |

Treasury and IRS took actions that were consistent with this recommendation including Treasury analyzing data in January 2021 on those individuals who received a notice and subsequently filed for, and received, a first-round EIP (EIP 1).

|

| Internal Revenue Service | The Commissioner of Internal Revenue should update the Form 1040-X instructions to include information on the electronic filing capability for tax year 2019. (Recommendation 6) |

On November 10, 2021, IRS posted an update of the Form 1040-X instructions on their website. This revision contains the reminder that taxpayers can file Form 1040-X electronically with tax filing software to amend 2019 or later Forms 1040 or 1040-SR. As a result, taxpayers are more likely to be aware of the electronic filing capability, which enables them to file their amended returns effectively and helps reduce government administrative costs associated with paper submissions.

|

| Department of Labor | The Secretary of Labor should ensure the Office of Unemployment Insurance revises its weekly news releases to clarify that in the current unemployment environment, the numbers it reports for weeks of unemployment claimed do not accurately estimate the number of unique individuals claiming benefits. (Recommendation 7) |

DOL's weekly news release of December 10, 2020, clarified that the numbers reported for weeks of unemployment insurance (UI) benefits claimed do not represent the number of unique individuals claiming benefits.

|

| Department of Labor |

Priority Rec.

The Secretary of Labor should ensure the Office of Unemployment Insurance pursues options to report the actual number of distinct individuals claiming benefits, such as by collecting these already available data from states, starting from January 2020 onward. (Recommendation 8) |

DOL partially agreed with our recommendation and provided documentation of actions taken. In a letter dated March 30, 2021, DOL stated that it had begun developing a new state report that would capture data related to distinct individuals claiming regular UI benefits. In June 2023, DOL said the agency was continuing to work on developing a new state report to collect data on distinct individuals claiming regular UI benefits and other information, including the causes of claims processing backlogs such as ID verification issues. In March 2024, DOL officials said their work on the new data collection report was on hold due to delays in finalizing agency guidance on appropriate ID...

|

| Office of Management and Budget |

Priority Rec.

The Director of the Office of Management and Budget should develop and issue guidance directing agencies to include COVID-19 relief funding with associated key risks, such as provisions contained in the CARES Act and other relief legislation that potentially increase the risk of improper payments or changes to existing program eligibility rules, as part of their improper payment estimation methodologies. This should especially be required for already existing federal programs that received COVID-19 relief funding. (Recommendation 9) |

The Office of Management and Budget (OMB) neither agreed nor disagreed with our recommendation. In March 2021, OMB issued new guidance on improper payments to implement the requirements from the Payment Integrity Information Act of 2019. In addition, in January 2022, OMB added further clarification in its platform's question and answer section for agencies and their Offices of lnspector General regarding their consideration of payment integrity risks. Specifically, it states that agencies are encouraged to ensure that significant payment integrity risks are part of the sampling methodology so that the estimates can be used to assist in the process of identifying the root causes of...

|

| Small Business Administration |

Priority Rec.

The Administrator of the Small Business Administration should expeditiously estimate improper payments and report estimates and error rates for the Paycheck Protection Program due to concerns about the possibility that improper payments, including those resulting from fraudulent activity, could be widespread. (Recommendation 10) |

SBA neither agreed nor disagreed with our recommendation at the time of our report. In response to our recommendation, SBA stated that it was planning to conduct improper payment testing for PPP and that it takes improper payments seriously. In November 2022, SBA reported an estimated improper payment amount of $29 billion and error rate of 4.2 percent for the Paycheck Protection Program in its fiscal year 2022 agency financial report. We believe SBA has addressed our recommendation.

|

| Department of the Treasury | The Secretary of the Treasury should finish developing and implement a compliance monitoring plan that identifies and responds to risks in the Payroll Support Program to ensure program integrity and address potential fraud, including the use of funds for purposes other than for the continuation of employee wages, salaries, and benefits. (Recommendation 11) | In April 2021, GAO confirmed that Treasury had developed, documented, and implemented a risk-based approach to monitor PSP recipients' compliance with the terms of the assistance. Treasury's risk-based approach entails a two level compliance review. In the first level review, automated testing is conducted on all recipients' quarterly reports using factors/thresholds that can trigger recipients being moved to the next review. In the second level review, Treasury analysts conduct a more detailed review of recipients that failed the first level review or were selected for other reasons. Treasury has also developed penalties and a process for remediating noncompliance with PSP agreement...

|