Entertainment Venues Have Reopened. We Examined Efforts to Aid Them During the Pandemic

This past summer marked the return to live concerts and movie theaters for many of us. But, the pandemic created significant economic hardships for these venues and many others in the arts and entertainment industry. For example, according to the Bureau of Labor Statistics, the unemployment rate for the industry reached 47% in April 2020, and remained elevated into 2021.

To help these businesses, Congress created the Shuttered Venue Operators Grant (SVOG) program, which provided $14.6 billion in financial assistance to entertainment businesses adversely affected by COVID-19.

Today’s WatchBlog post looks at our new report on who the program helped, and the lessons it offers for future emergency assistance programs.

Image

Who received money and how much?

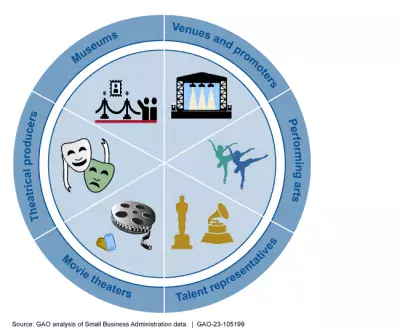

SVOG funding was available to a targeted group of businesses, including live entertainment producers, organizations, and venues. Businesses could use these grants to cover operating expenses such as payroll, rent or mortgage payments, and utility payments. To be eligible for the program, entertainment businesses had to have lost at least 25% of their revenue as a result of the pandemic.

The program was only open to applicants for a short amount of time—from April to August 2021. But during that short time, more than 17,000 businesses applied. The Small Business Administration (SBA), which runs the program, awarded $14.6 billion in grants to over 13,000 of the applicants. Most denied applications didn’t meet the grant program’s eligibility requirements.

Grant amounts were based on each business’s pre-pandemic revenue, capped at $10 million. Over 90% of grant recipients were small businesses with 50 or fewer employees.

Image

How can SBA better ensure emergency funding reaches eligible businesses?

Nationwide, more than 30 million small businesses experienced decreased revenues or closures because of COVID-19. Therefore, SBA had the challenge of providing aid quickly to entertainment venues. But acting quickly could make the program more vulnerable to fraud and related issues.

We have reported on challenges SBA faced implementing these programs, including fraud and inadequate communication.

Our review of the SVOG program revealed that while the program was better managed in some aspects than some other SBA COVID relief programs, SBA could improve its communications and customer support, and improve its efforts to monitor risks to the program, such as identity theft.

In our new report, we made two recommendations to SBA that would help improve communication with businesses that seek emergency assistance and enhance the agency’s efforts to identify and address fraud. Find out more by reading our new report.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.