How Can Low-Income Renters Find Affordable Housing?

Low-income renters often face difficulties finding housing they can afford. But a federal program—the Low-Income Housing Tax Credit (LIHTC)—helps encourage developing this type of housing. This tax credit program has helped finance about 50,000 affordable rental units annually. The IRS administers the program along with state housing finance agencies.

But how much does it cost to build an affordable rental unit? Today’s WatchBlog explores.

How does the program work?

The program works by attracting private developers to build new or rehabilitate existing projects. Developers get funding for the projects by finding investors who can then claim tax credits for their financing. The private investments lower the debt burden for LIHTC project development, making it possible for project owners to offer lower, more affordable rents. The amount of the tax credit that investors receive depends largely on a project’s costs.

What does it cost to build affordable rental housing?

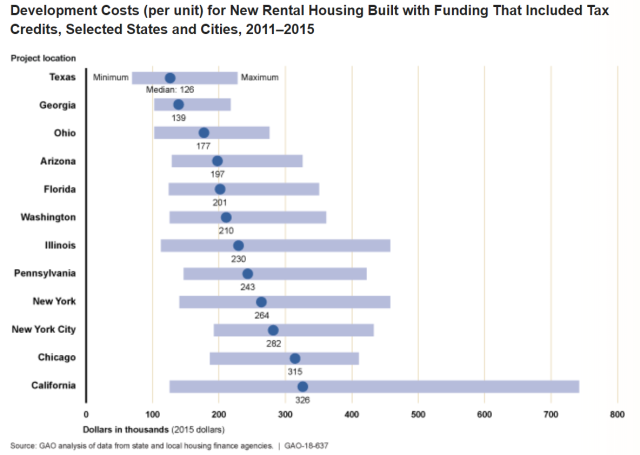

Costs for developing affordable rental housing vary widely across the United States. We analyzed the per-unit cost of LIHTC projects in selected locations as part of our recent study. We found that costs differ vastly among and within state locations:

- Among state locations, the median per-unit cost for new construction projects was $218,000 but ranged from $126,000 in Texas to $326,000 in California.

- Within each state location, costs could vary widely. The difference between the least and most expensive projects in Georgia was $104,000 per unit, while the cost range increased to $606,000 per unit in California.

Why do costs vary so much?

The LIHTC program gives states the flexibility to address local housing needs, where conditions, such as land prices, construction type, and tenant characteristics, vary widely as well.

More specifically, we found that a number of characteristics help explain some of the cost variation. For example, controlling for other factors:

- New construction projects had higher per-unit costs than rehabilitation projects

- Larger projects (more than 100 units) had lower per-unit costs than smaller projects (fewer than 37 units)

- Projects in urban areas had higher per-unit costs than those in suburban areas

- Projects serving seniors had lower per-unit costs (due to smaller residential square footage) than non-senior projects

Greater understanding of the factors that affect affordable housing costs may help states better manage the expenses involved in developing affordable rental projects using the LIHTC program.

Check out our full report to learn more.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.