Know the Types of Tax Identity Fraud

Tax filing season will begin soon and the Federal Trade Commission has named January 13-17th Tax Identity Theft Awareness Week to raise awareness and provide people with tips on how to protect themselves. We have done work on tax-related identity fraud, including a 2013 report on the extent of the problem. While the number of taxpayers with tax problems caused by identity theft represent a small percentage of the expected 140 million individual returns filed, for those affected, the problems can be quite serious.

Identity thieves can obtain your information in a variety of ways, including tricking you into revealing it. Once they have it, they can use it for 2 types of tax-related identity fraud: refund fraud and employment fraud. In refund fraud taxpayers can be harmed when identity thieves use stolen names and Social Security numbers (SSN) to fraudulently claim a tax refund. In employment fraud, the thieves use identity information to gain employment.

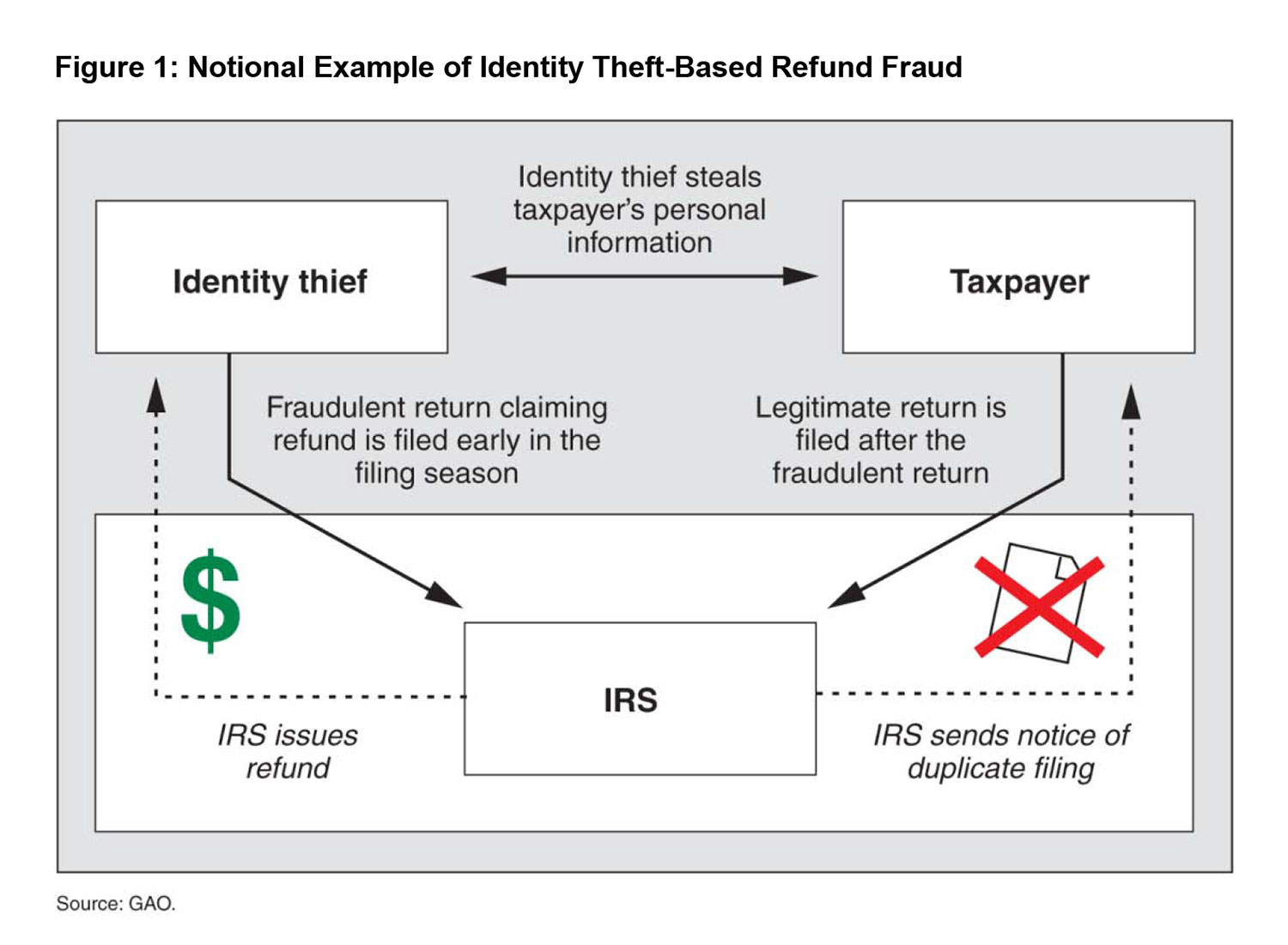

Refund fraud: The thief typically files a fraudulent return claiming a refund early in the filing season, before the victim files. IRS has programs in place to combat refund fraud. However, refund fraud is difficult for IRS to detect, since IRS often becomes aware of the fraud after the victim files a return. At that time, IRS discovers that two returns have been filed using the same name and SSN (see the figure). IRS then notifies the victim that more than one tax return was filed. In this instance, the refund will likely be frozen until IRS can determine the legitimate owner of the SSN.

Image excerpted from GAO-13-132T

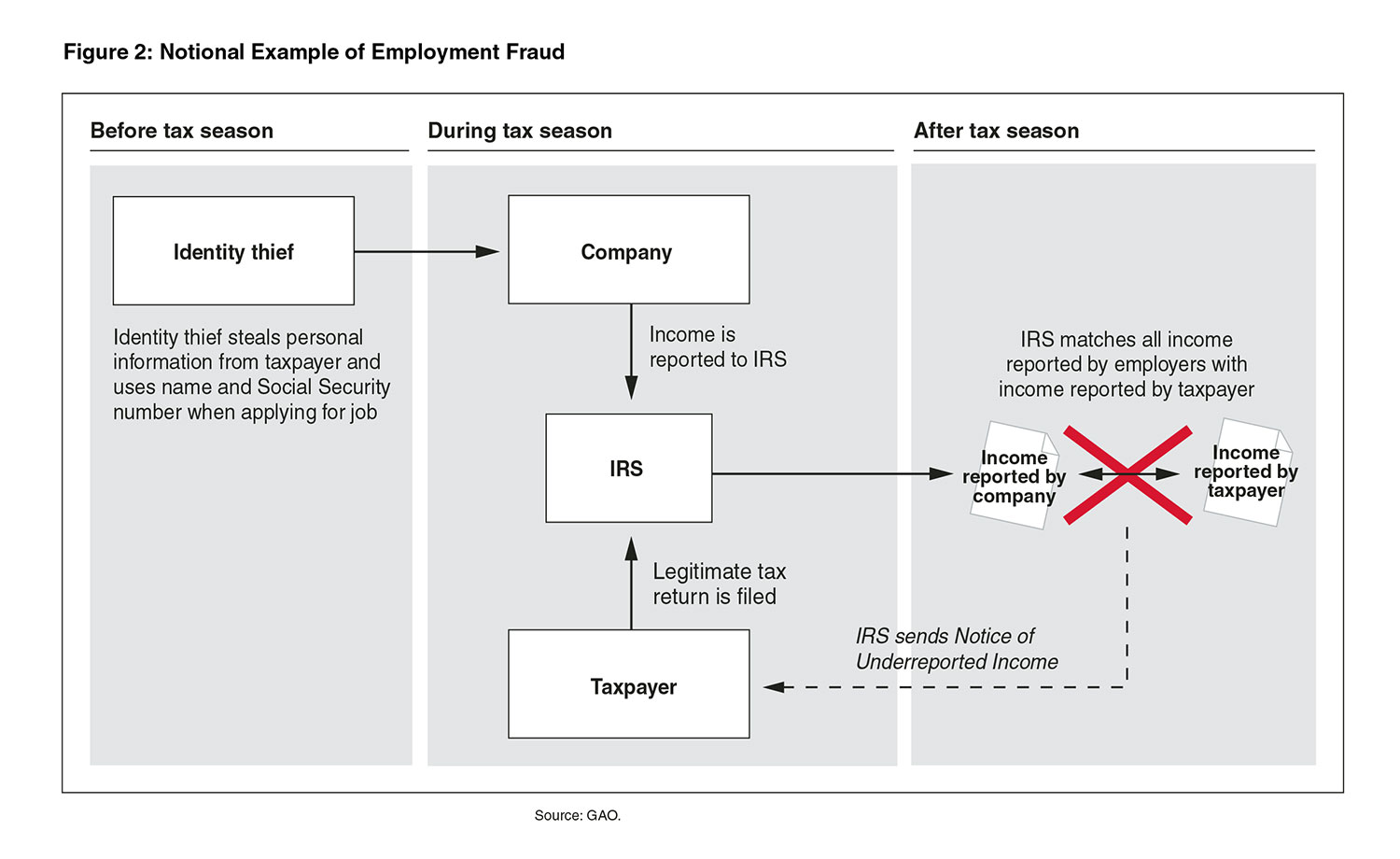

Employment fraud: When identity thieves use a taxpayer’s name and SSN to obtain a job, IRS will receive income information from the identity thief’s employer. After the victim files his or her tax return, IRS matches income reported by the victim’s employer and the thief’s employer to the tax return filed by the victim (see the figure). IRS then notifies the taxpayer of unreported income because it appears the victim earned more income than was reported on the tax return. It is then up to IRS to sort out what income was earned by the victim and what was earned by the identity thief.

Image excerpted from GAO-11-674T

If you’d like to learn more about GAO’s work on tax-related identity theft, check out our past reports:

- IDENTITY THEFT: Total Extent of Refund Fraud Using Stolen Identities is Unknown, GAO-13-132T, Nov. 29, 2012

- TAXES AND IDENTITY THEFT: Status of IRS Initiatives to Help Victimized Taxpayers, GAO-11-674T, May 25, 2011

- TAX ADMINISTRATION: IRS Has Implemented Initiatives to Prevent, Detect, and Resolve Identity Theft-Related Problems, but Needs to Assess Their Effectiveness, GAO-09-882, Sep. 8, 2009

The Federal Trade Commission and IRS also have information available on how to protect yourself from tax-related identity theft.

- Questions on the content of this post? Contact James R. White at whitej@gao.gov.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.