Puerto Rico: Fiscal Conditions Have Improved but Risks Remain

Fast Facts

We testified on Puerto Rico’s fiscal and economic conditions before the House Committee on Natural Resources, Subcommittee on Indian and Insular Affairs.

Our testimony is based primarily on the following report: U.S. Territories: Public Debt and Economic Outlook – 2025 Update.

A photo of the U.S. Capitol with the worlds "GAO Testimony to Congress" superimposed over it.

Highlights

What GAO Found

The factors that contributed to the Commonwealth of Puerto Rico’s debt crisis in 2015 included the territory’s persistent deficits and its use of debt to manage these deficits. In 2018, GAO identified specific causes of its deficits based on interviews with Puerto Rico officials, federal officials, and other relevant experts, along with a literature review. These causes included inadequate financial management and oversight practices, policy decisions such as using debt proceeds to balance budgets, and a prolonged economic contraction.

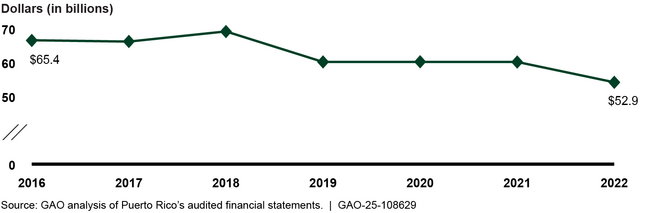

Puerto Rico’s fiscal conditions have improved since 2016. Its most recent audited government-wide financial statements—from fiscal year 2022—show a total net surplus of $1.9 billion, a reversal from prior years which predominantly had net deficits. More recently, in its 2024 fiscal plan for Puerto Rico, the Financial Oversight and Management Board cited the territory’s progress in aligning revenues and expenses and stabilizing its finances. Additionally, the territory has restructured most of its debt using the debt restructuring processes established by the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA), though negotiations and litigation over the debt of its public utility are ongoing. Between fiscal years 2016 and 2022, Puerto Rico’s public debt decreased by $12.5 billion, or 19 percent, as shown below.

Puerto Rico’s Total Public Debt Outstanding Fiscal Years 2016 to 2022

While Puerto Rico’s fiscal condition has improved in recent years, the territory continues to face fiscal and economic risks. These include access to reliable and affordable electricity, increasingly powerful storms and rising temperatures, declining population, and pension liabilities. Additionally, the territory’s financial management and reporting issues, such as delays in issuing audited financial statements, pose risks to its ability to make informed decisions.

Why GAO Did This Study

After accumulating debt for many years, Puerto Rico began defaulting on debt payments in 2015. In response, Congress passed, and the President signed, PROMESA.

This act established a process for Puerto Rico to restructure its debts and created the Financial Oversight and Management Board, with broad powers of budgetary and financial control. PROMESA also includes provisions for GAO to 1) examine factors contributing to Puerto Rico’s debt crisis and federal actions for preventing a future one and 2) study fiscal issues in Puerto Rico and the other U.S. territories and periodically report on their public debt.

This statement summarizes GAO’s key findings from this work related to (1) the factors that contributed to the debt crisis in Puerto Rico, (2) how fiscal and economic conditions have changed since 2016, and (3) the fiscal and economic risks that Puerto Rico faces.

This statement is based on GAO reports issued between October 2017 and June 2025. Detailed information on the objectives, scope, and methodology can be found within each report.

For more information, contact Michelle Sager at sagerm@gao.gov.