Financial Company Bankruptcies: Regulators Continued Efforts to Improve the Resolvability of Large Firms

Fast Facts

The 2007-2009 financial crisis led some to question the adequacy of the Bankruptcy Code for reorganizing or liquidating large, complex financial institutions.

Reforms passed after the crisis require us to report periodically on this issue. This is our sixth report on this topic.

The Federal Reserve and Federal Deposit Insurance Corporation now review banks’ bankruptcy plans to identify weaknesses and provide feedback. In recent years, the agencies have found fewer weaknesses.

FDIC also continued to build a bankruptcy alternative program for large banks whose failure would threaten U.S. financial stability.

A close-up of a gavel

Highlights

What GAO Found

Large financial companies may be liquidated or reorganized under a judicial bankruptcy process or resolved under special legal and regulatory resolution regimes created to address insolvent financial institutions. This includes Orderly Liquidation Authority, which allows the Federal Deposit Insurance Corporation (FDIC) to resolve certain financial companies outside the bankruptcy process. Congress has not significantly revised the Bankruptcy Code for resolving financial companies or Orderly Liquidation Authority since GAO's most recent report in 2020. Nevertheless, FDIC has continued to develop its capabilities under this authority in response to a 2023 internal audit and as part of its strategic planning.

Certain large financial companies must periodically file plans describing how they could be resolved under the Bankruptcy Code in an orderly manner in the event of material financial distress or failure. In 2019, the Board of Governors of the Federal Reserve System and FDIC revised their rule governing resolution plans, generally dividing companies into biennial and triennial filers based on their asset size and risk profile.

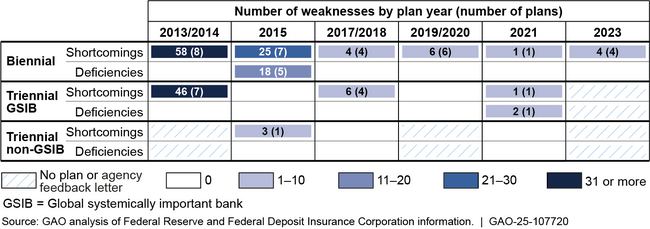

The Federal Reserve and FDIC review companies' resolution plans to identify weaknesses and determine whether they are deficiencies (which could undermine a plan's feasibility) or shortcomings (which are less severe). The agencies then send companies feedback letters outlining weaknesses companies are required to address. For a nongeneralizable sample of 10 filers, GAO found that regulators considered multiple factors when evaluating weaknesses, including the nature of the issue, its potential effect, and the likelihood that the effect would occur.

Federal Reserve and FDIC officials noted that resolution plans have “matured” as companies refined their strategies and addressed vulnerabilities. The number of identified deficiencies and shortcomings declined over time, with most weaknesses identified in 2013–2015 plans. The plans submitted by eight U.S. (biennial) and seven foreign (triennial) global systemically important banks accounted for all the deficiencies and nearly all the shortcomings. As of the last plan submissions, 79 financial companies were required to file plans.

Number of Identified Weaknesses in Resolution Plans of Financial Companies, 2013–2023

Why GAO Did This Study

The failure of systemically important financial companies during the 2007–2009 financial crisis highlighted challenges in resolving them under the Bankruptcy Code.

The Dodd-Frank Wall Street Reform and Consumer Protection Act includes a provision for GAO to report periodically on the effectiveness of the Bankruptcy Code in facilitating orderly liquidation or reorganization of financial companies. GAO issued five prior reports on this topic ( GAO-20-608R , GAO-15-299 , GAO-13-622 , GAO-12-735 , GAO-11-707 ).

This report examines (1) recent legislative changes to the Bankruptcy Code involving financial companies or to Orderly Liquidation Authority, and related agency actions; and (2) efforts by the Federal Reserve and FDIC to improve resolution plans and identify plan weaknesses.

GAO reviewed relevant laws, regulations, guidance, and agency reports. It also reviewed Federal Reserve and FDIC feedback letters on 2013–2023 plans, as well as policies and procedures for reviewing plans. For a nongeneralizable sample of 10 filers—selected because their plans had the most identified weaknesses—GAO reviewed agencies' internal workpapers assessing 2017–2023 resolution plans. GAO also interviewed officials from the Administrative Office of the U.S. Courts, FDIC, and the Federal Reserve.

For more information, contact Michael E. Clements at clementsm@gao.gov.