2024 Tax Filing: IRS Improved Live Service and Began to Modernize Some Operations, but Timeliness Issues Persist

Fast Facts

While the IRS has made improvements to its customer service and systems, it continues to face challenges processing tax returns on time.

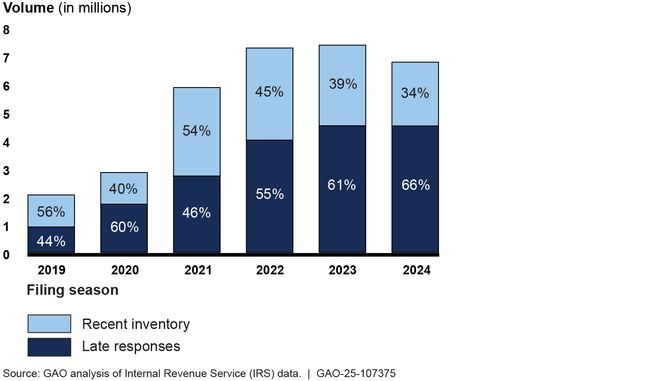

The agency set a 13-day processing goal for individual paper returns but instead averaged 20. In addition, IRS responses to taxpayer mail continued to be delayed, with 66% considered late at the end of filing season. The agency has a webpage showing the receipt date of taxpayer mail it is processing. But the webpage didn't provide timeframes for when taxpayers should expect a response.

We previously recommended that IRS address shortfalls and communicate timeframes for processing its correspondence backlog.

An IRS processing center in Ogden, Utah

Highlights

What GAO Found

During the 2024 filing season the Internal Revenue Service (IRS) processed 98 percent of the nearly 174 million individual and business tax returns it received, as of April 19, 2024. IRS continued to face challenges with timely processing of paper returns. For example, IRS did not meet its 13-day goal for processing individual paper returns, instead averaging 20 days. In January 2024, GAO reported that IRS faced similar challenges processing paper returns during the 2023 filing season and recommended that IRS determine the cause and address processing shortfalls. IRS agreed and changed its reporting methodology in June 2024 to account for days in which IRS is awaiting taxpayer responses. However, IRS has not yet documented the cause for the shortfalls.

IRS generally improved its customer service to taxpayers relative to 2023, serving more taxpayers on the telephone and in person. However, IRS responses to taxpayer mail continue to be delayed, with 66 percent considered late at the filing season's end. In March 2024, IRS launched a web page showing the receipt date of correspondence that IRS is currently processing. The web page does not provide information estimating how long taxpayers can expect to wait for a response once processing begins. Fully addressing GAO's 2022 recommendation to estimate and communicate time frames for resolving correspondence delays will better set expectations for, and potentially reduce repeat inquiries from, taxpayers.

IRS Correspondence Inventory, Including Late Responses, as of the End of Each Filing Season, 2019 to 2024

During fiscal year 2024, IRS used Inflation Reduction Act (IRA) funding to staff and begin modernizing some filing season operations. IRS officials said this helped improve customer service during the 2024 filing season. IRS also used IRA funding for modernization efforts (e.g., mail sorting and scanning machines).

Why GAO Did This Study

During the annual tax filing season, IRS processes millions of tax returns and issues hundreds of billions of dollars in taxpayer refunds. IRS also provides telephone, correspondence, online, and in-person services to tens of millions of taxpayers. Partly due to the COVID-19 pandemic, IRS has faced challenges in recent years processing tax returns, meeting taxpayer service demands, and hiring employees. The IRA provided IRS tens of billions of dollars in funding to improve these and other areas.

GAO was asked to review IRS's 2024 filing season performance. This report (1) assesses IRS's performance processing tax returns, (2) assesses IRS's performance providing customer service, and (3) describes IRS's efforts to improve service and processing. GAO analyzed IRS documentation and data and interviewed officials. GAO determined that these data were sufficiently reliable by reviewing IRS documentation and interviewing officials. GAO also visited two IRS processing facilities and held discussion groups with IRS staff.

Recommendations

GAO has previously made six key recommendations related to improving returns processing and customer service performance. IRS generally agreed and fully implemented one and has taken some steps to implement the others. To fully implement the remaining recommendations, IRS needs to (1) determine the cause of and address processing shortfalls, and (2) communicate time frames for processing its correspondence backlog, among other actions. IRS said that it is focused on improving service.