Federal Student Loans: How Education Has Communicated with Borrowers About Resuming Payments

Fast Facts

Federal student loan payments were paused for more than 3 years due to COVID-19. Payments resumed in October 2023. This Q&A report looks at how the Department of Education communicated with borrowers about resuming their payments.

Before payments resumed, Education notified borrowers about the upcoming change via email, text message, social media, and its website. It also sent information to borrowers about temporary relief options, such as temporary protections from some penalties for missed payments.

Education has also developed a plan for how to notify borrowers about the end of temporary relief options.

Highlights

What GAO Found

The Department of Education used various methods to communicate with borrowers about resuming their student loan payments in October 2023, following a 3½-year pandemic-related payment pause that began in March 2020. Education provided borrowers with this information through emails, text messages, social media posts, and its website.

All of these communications referred borrowers to Education’s StudentAid.gov website as the primary source of information about resuming student loan payments.

Education targeted additional outreach to certain borrowers who it determined were at higher risk of late or missed payments. These include borrowers who were entering repayment for the first time or who had a prior history of late or missed payments. Education also provided information about temporary loan relief available to certain borrowers via email, postal mail, and its website.

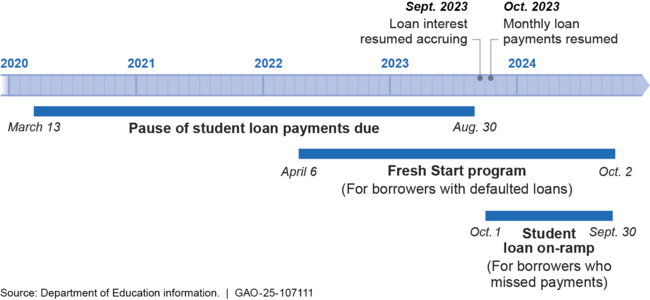

- Temporary relief for borrowers who miss payments. Education instituted a 12-month “on-ramp” period from October 1, 2023, to September 30, 2024, during which borrowers could temporarily avoid negative consequences for late or missed payments. Education and its loan servicers notified borrowers that they would not be reported to credit bureaus and their loans would not be considered delinquent if they missed payments during this “on-ramp” period. However, interest on student loans would continue to accrue as normal. Loan servicers also provided additional information to borrowers enrolled in the on-ramp initiative via email and postal mail about options for managing their monthly payment. These options included the availability of affordable repayment plans.

- Temporary relief for borrowers with defaulted loans. Education established Fresh Start, a temporary program available from April 6, 2022, to October 2, 2024, that allowed borrowers with defaulted loans who signed up to get their loans out of default and restore them to good standing. These borrowers would also gain access to other benefits, including income-driven repayment plans and postponement options to help manage repayment. Education sent emails and postal mail letters to defaulted borrowers outlining the benefits of the program, how to sign up, and the potential negative effects of not signing up, such as collections restarting on their loan.

Timeline of Education's Student Loan Payment Pause and Temporary Relief Options, 2020–2024

In June 2024, Education began to implement a plan for communicating with borrowers about the end of both the temporary on-ramp and Fresh Start program. Education sent communications to borrowers in June 2024 and August 2024 and was planning additional borrower communications about the end of these loan relief options for fall 2024.

Why GAO Did This Study

As of March 2024, Education held $1.5 trillion in outstanding federal student loans for nearly 45 million borrowers.

In March 2020, in response to the COVID-19 pandemic, Education implemented a payment pause for borrowers. This pause suspended all federal student loan payments due, stopped interest from accruing, and halted involuntary collections on loans in default. After several extensions, the payment pause ended on August 30, 2023, as required under the Fiscal Responsibility Act of 2023. Interest began accruing on these loans in September 2023, and borrowers’ monthly payments resumed in October 2023, according to Education.

GAO was asked to address issues related to Education’s communications to borrowers about resuming student loan payments. This report provides information on how Education communicated with borrowers about resuming student loan payments and temporary loan relief options.

GAO reviewed Education’s and student loan servicers’ written communication with borrowers and Education’s communication plans. GAO also interviewed Education officials and collected written responses from Education and all four of its student loan servicers. Education provided written comments with additional information about its efforts to support borrowers in resuming repayment. GAO is not making recommendations.

For more information, contact Melissa Emrey-Arras at (617) 788-0534 or emreyarrasm@gao.gov.