Debt Limit: Statutory Changes Could Avert the Risk of a Government Default and Its Potentially Severe Consequences

Fast Facts

Congress sets a limit on federal borrowing, known as the debt limit. If the government reaches this limit and exhausts available cash, it risks missing payments on its debt, thereby defaulting. A default could have devastating effects on financial markets, the economy, and the United States' stature abroad.

Federal spending and revenue decisions are made separately from decisions on the debt limit. This can create borrowing needs that exceed the limit.

We recommended Congress consider immediately replacing the debt limit process with one that requires decisions on debt to be made at the same time as decisions on spending and revenue.

Highlights

What GAO Found

The current debt limit process separates decisions on revenue and spending from decisions on debt. As a result, the government periodically runs out of borrowing authority needed to pay existing, legally committed obligations. The Department of the Treasury has used extraordinary measures, which can temporarily free up existing borrowing authority, and cash on hand to continue making payments. However, these resources are limited and eventually run out. Predictions about when the government will no longer be able to pay all of its obligations—the “X-date”—are inherently imprecise due to the unpredictable size and timing of federal cash flows. Consequently, last-minute negotiations on the debt limit can increase the risk of a default. Further, these negotiations do not directly tackle structural spending and revenue levels that contribute to the growing debt.

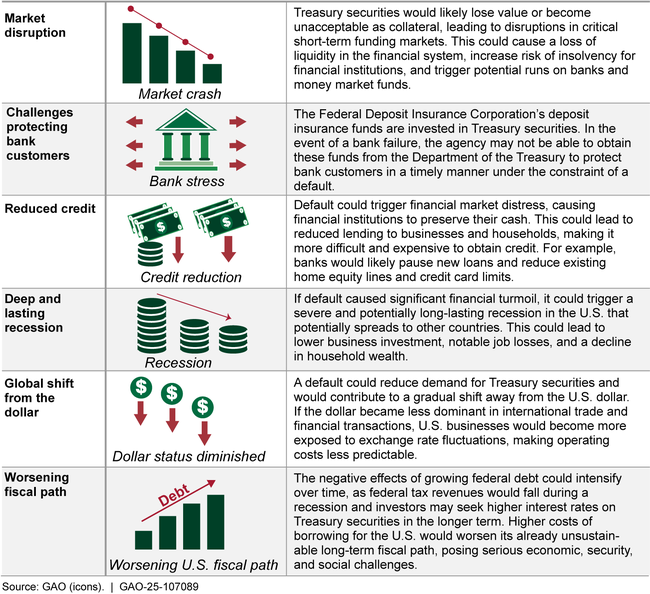

A default would disrupt financial markets, with immediate, potentially severe consequences for businesses and households. A default could also inflict long-lasting damage to the U.S. and global economies (see figure).

Potential Effects of a U.S. Default on Financial Markets and the U.S. and Global Economies

Why GAO Did This Study

To meet the federal government's borrowing needs, Treasury issues debt in the form of bills, notes, and bonds. These securities play a vital role in U.S. and global financial markets. Congress imposes a legal limit on federal borrowing, known as the debt limit. In recent years, when debt outstanding has reached the limit, extended congressional negotiations have frequently brought the federal government close to being unable to continue paying its obligations. If Treasury exhausts its borrowing authority and runs out of cash to continue paying government obligations, a default will occur. GAO prepared this report as part of its continuing efforts to assist Congress in addressing challenges related to the debt limit. This report examines (1) factors related to the debt limit that expose the U.S. to a potential default, (2) immediate consequences of a U.S. default for the U.S. financial system, and (3) longer-term consequences of a U.S. default for the economy. GAO reviewed academic literature and agency documents and interviewed agency officials, economists, and market participants from banks, money market funds, and rating agencies, among others.

Recommendations

GAO previously outlined alternatives to the current debt limit process and recommends that Congress consider immediately replacing it with an approach that links debt decisions to spending and revenue decisions at the time they are made.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider immediately removing the debt limit and adopting an approach that better links decisions about the debt with decisions about spending and revenue at the time those decisions are made. (Matter for Consideration 1) | After a debt limit suspension from June 2023 through January 2025, the debt limit was reinstated. As of February 2025, Treasury had begun taking extraordinary measures to avoid default, but no new legislation had been enacted to raise, suspend, or remove the debt limit, or to better link decisions about the debt limit with decisions about spending and revenue at the time those decisions are made. Without such legislation, the nation risks being unable to pay its bills and defaulting on its debt. GAO will continue monitoring legislative action responsive to this matter. |