Improper Payments: Key Concepts and Information on Programs with High Rates or Lacking Estimates

Fast Facts

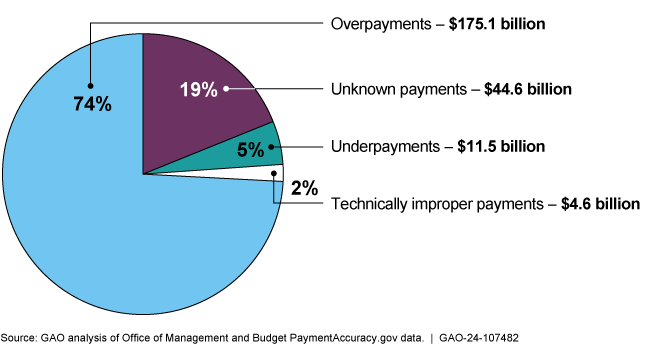

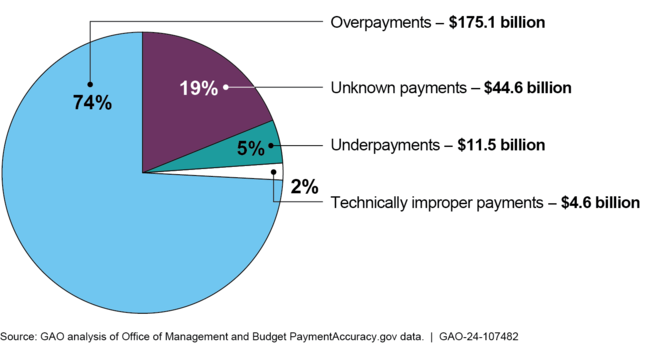

In FY 2023, federal agencies reported an estimated $236 billion in improper payments—ones that shouldn't have been made, were made in an incorrect amount, or lacked sufficient supporting documentation.

Estimating improper payments is a key step in helping agencies identify their causes and ways to reduce them. This Q&A report—the sixth in a series of quarterly reports—examines this process and more.

For example, for FY 2023, agencies reported improper payment rates of 10% or higher for 16 programs. Ten of those programs topped 10% for 2 years in a row.

Agencies also didn't develop and report required estimates for 9 programs in FY 2023.

Agency-Reported FY 2023 Improper Payment Estimates by Type

Highlights

What GAO Found

Improper payments are those that should not have been made or that were made in an incorrect amount. When estimating improper payments, federal executive agencies also consider payments that cannot be verified as proper—due to lacking or insufficient documentation—as improper. The causes of improper payments can range from unintentional administrative errors to the willful misrepresentation inherent in fraud. Agencies reported an estimated $235.8 billion in improper payments across 71 programs for fiscal year 2023.

Agency-Reported Fiscal Year 2023 Improper Payment Estimates by Type (Totaling $235.8 Billion)

Note: Office of Management and Budget guidance defines unknown payments as those that an agency cannot determine to be either proper or improper because of insufficient or lacking documentation

Reliable improper payment estimates are helpful for understanding and addressing financial vulnerabilities, as well as assessing the effectiveness of corrective actions. Agencies generally estimate a program’s improper payments by analyzing a sample of payments to determine whether they were proper. Agencies typically then use the results of this analysis to statistically project, or estimate, the improper payment rate for the program.

Agency inspectors general review improper payment estimates as part of their annual reports on their respective agencies’ compliance with applicable Payment Integrity Information Act of 2019 (PIIA) criteria. Under PIIA, in each year a federal executive agency is found noncompliant with the applicable criteria, it must submit to Congress a plan describing the actions it will take to come into compliance. Additional reporting requirements take effect if an agency is found noncompliant for the same program for consecutive years.

For fiscal year 2023, agencies reported estimated improper payment rates of 10 percent or higher for 16 programs. Of these, 10 programs had rates exceeding 10 percent for at least 2 consecutive years. Agencies identified various corrective actions to address improper payments, including training and automation.

Agencies did not develop and report improper payment estimates as required for the following nine risk-susceptible programs for fiscal year 2023:

- Department of Agriculture: Food and Nutrition Service – Summer Food Service Program

- Department of Health and Human Services: Foster Care

- Department of Health and Human Services: Temporary Assistance for Needy Families

- Department of Homeland Security: Federal Emergency Management Agency Public Assistance – Validate As You Go

- Department of Housing and Urban Development: Project-Based Rental Assistance

- Department of Housing and Urban Development: Tenant-Based Rental Assistance

- Office of Personnel Management: Federal Employees Health Benefits – Experience Related Carriers

- Small Business Administration: Restaurant Revitalization Fund

- Small Business Administration: Shuttered Venue Operators Grant

Agencies cited various reasons for these failures to develop and report estimates, including statutory limitations and lack of supporting documentation.

Why GAO Did This Study

Improper payments are a long-standing and significant problem in the federal government. Since fiscal year 2003, agencies have reported cumulative improper payment estimates of about $2.7 trillion. PIIA requires federal executive agencies to manage improper payments by, among other things, identifying risks, taking corrective actions, and estimating and reporting on improper payments in programs or activities they administer.

House Report 117-389, which accompanied the Legislative Branch Appropriations Act, 2023, includes a provision for GAO to provide quarterly reports on improper payments. This is GAO’s sixth such report. This report provides information related to requirements, standards, and guidance for identifying, estimating, and reporting improper payments. Additionally, this report discusses programs for which agencies reported fiscal year 2023 estimated improper payment rates of 10 percent or higher, as well as those for which agencies failed to report fiscal year 2023 estimates as required.

GAO reviewed relevant federal statutes, standards, and guidance related to managing improper payments, as well as relevant GAO and agency inspector general PIIA criteria compliance reports. In addition, GAO reviewed agencies’ improper payment information as reported on the Office of Management and Budget’s PaymentAccuracy.gov website and in agency financial reports.

Recommendations

GAO has made numerous recommendations to Congress to help reduce improper payments government-wide. In March 2022, GAO recommended 10 matters for congressional consideration to enhance transparency and accountability of federal spending. These matters included designating all new federal programs making more than $100 million in payments in any one fiscal year as susceptible to improper payments and establishing a permanent data analytics center of excellence to aid the oversight community in identifying improper payments and fraud. In April 2022, GAO recommended that Congress consider providing the Department of Health and Human Services the authority to require states to report the data the agency needs to estimate and report on improper payments for Temporary Assistance for Needy Families. As of June 2024, these matters remain open.