COVID-19 Relief: State and Local Fiscal Recovery Funds Spending as of September 30, 2023

Fast Facts

The Department of the Treasury has awarded billions of dollars to state and local governments to help them cover COVID-19 recovery costs. In this Snapshot, we update our prior work on the status of this funding, including spent funds and more.

As of September 30, 2023:

States, including the District of Columbia, have reported spending $103.7 billion, or 53% of their awards

Localities have reported spending $59.4 billion, or 47% of their awards

States and localities generally have until December 31, 2026, to spend their awards.

Highlights

The Coronavirus State and Local Fiscal Recovery Funds, established under the American Rescue Plan Act of 2021, allocated $350 billion to Tribes, states, the District of Columbia, localities, and U.S. territories to help cover a broad range of costs stemming from the health and economic effects of the COVID-19 pandemic. This snapshot updates the status of these funds.

The Big Picture

Most ($325.5 billion) of the $350 billion in Coronavirus State and Local Fiscal Recovery Funds (SLFRF) were allocated to states, the District of Columbia, and local governments. SLFRF recipients have until December 31, 2024, to obligate their SLFRF awards and generally have until December 31, 2026, to spend their awards.

The Department of the Treasury, which administers the SLFRF, requires recipients to submit project and expenditure reports quarterly or annually—depending on the recipient type, population, and award size. The reports detail recipients’ uses of SLFRF funds, including obligations and spending amounts. The most recent quarterly reports reflect this information as of September 30, 2023.

This snapshot includes aggregate data on obligation and spending amounts that SLFRF recipients reported to Treasury as of September 30, 2023, the most recent reporting available when this snapshot was issued. The snapshot updates our October 2023 report on states’ and localities’ obligations and spending amounts, as of March 31, 2023 (GAO-24-106753). Our prior report also includes detailed information on Treasury’s reporting requirements for SLFRF recipients.

What GAO’s Work Shows

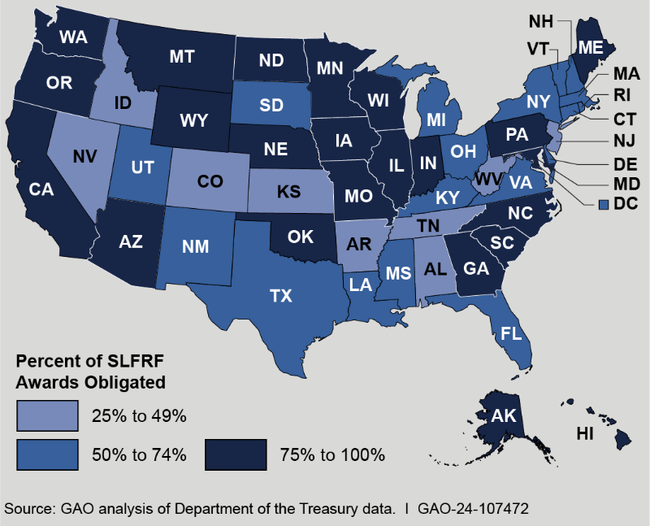

States’ Reported Obligations

As of September 30, 2023, states and the District of Columbia reported obligating 73 percent ($142.4 billion) of their $195.8 billion in SLFRF awards. All states reported obligating at least 25 percent of their SLFRF awards and 23 states reported obligating over 75 percent. Minnesota and North Dakota reported obligating the largest share of their awards (over 99 percent and 100 percent, respectively), while New Jersey and West Virginia reported obligating the smallest shares (36 percent and 33 percent, respectively).

States’ Reported Coronavirus State and Local Fiscal Recovery Funds (SLFRF) Obligations, as of Sept. 30, 2023

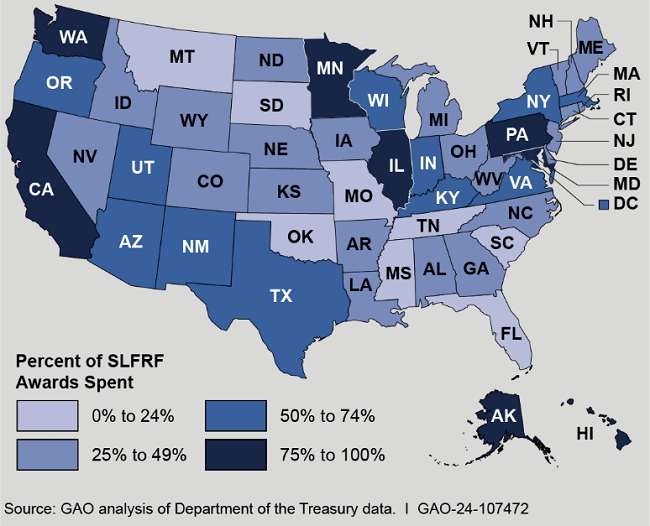

States’ Reported Spending

As of September 30, 2023, states and the District of Columbia reported spending 53 percent ($103.7 billion) of their $195.8 billion in SLFRF awards. All but eight states reported spending at least 25 percent of their awards. Eight states reported spending 75 percent or more of their awards. Minnesota and Alaska each reported spending the largest share of their awards (99 percent and 96 percent, respectively). Oklahoma and South Carolina reported spending the smallest shares (5 percent each).

States’ Reported Coronavirus State and Local Fiscal Recovery Funds (SLFRF) Spending, as of Sept. 30, 2023

Localities’ Reported Obligations and Spending

As of September 30, 2023, a total of 26,442 localities reported SLFRF obligations and expenditures, either through an annual report (as of March 31, 2023) or a quarterly report (as of September 30, 2023). Smaller localities—referred to as non-entitlement units of local government (NEU)—comprised the majority of reporting localities (22,361) but received the smallest amount of allocations ($18.9 billion) in the aggregate, compared to counties and metropolitan cities (which we refer to as cities throughout this snapshot).As of September 30, 2023, a total of 26,442 localities reported SLFRF obligations and expenditures, either through an annual report (as of March 31, 2023) or a quarterly report (as of September 30, 2023). Smaller localities—referred to as non-entitlement units of local government (NEU)—comprised the majority of reporting localities (22,361) but received the smallest amount of allocations ($18.9 billion) in the aggregate, compared to counties and metropolitan cities (which we refer to as cities throughout this snapshot).

Coronavirus State and Local Fiscal Recovery Funds (SLFRF) Allocations Received, by Locality Type, as of Sept. 30, 2023

| Number of localities reporting | Amount of SLFRF allocation (in billions) | |

|---|---|---|

| Citiesa | 1,105 | $47.7 |

| Counties | 2,976 | $59.4 |

| Non-entitlement units of local governmentb | 22,361 | $18.9 |

| Total | 26,442 | $126.1 |

Source: GAO analysis of Department of the Treasury data. I GAO-24-107472

aCities refer to metropolitan cities as defined in 42 U.S.C. § 803(g)(4).

bNon-entitlement units of local government as defined in 42 U.S.C. § 803(g)(5).

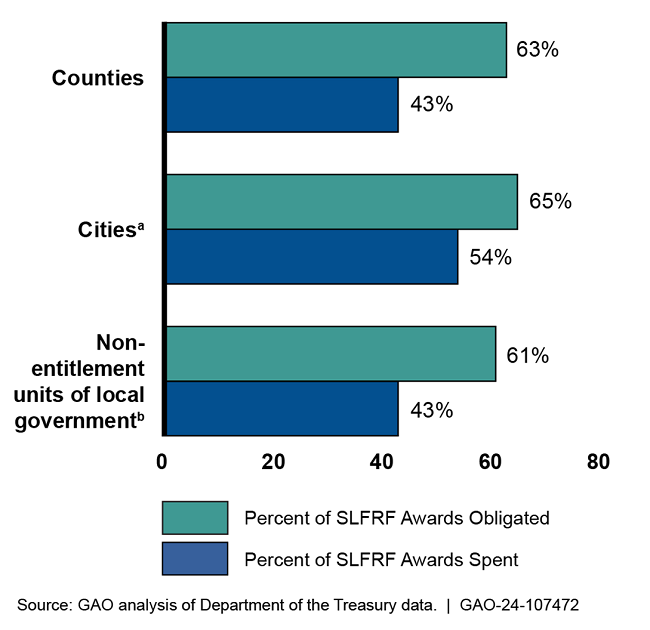

In their annual or quarterly reports, these localities reported obligating 64 percent ($80.1 billion) and spending 47 percent ($59.4 billion) of their $126.1 billion in SLFRF allocations.

Cities, counties, and NEUs in the aggregate each reported obligating between 61 and 65 percent of their awards. Cities received the second largest amount of allocations ($47.7 billion), but they reported spending the largest amount of their awards (54 percent), compared to counties and NEUs (each reporting spending 43 percent of their awards).

Localities’ Reported Coronavirus State and Local Fiscal Recovery Funds (SLFRF) Obligations and Spending, as of Sept. 30, 2023

aCities refer to metropolitan cities as defined in 42 U.S.C. § 803(g)(4).

bNon-entitlement units of local government as defined in 42 U.S.C. § 803(g)(5).

We will continue to review states’ and localities’ reported obligations and spending, as well as their uses of SLFRF awards.

For more information, contact Jeff Arkin at (202) 512-6806 or ArkinJ@gao.gov.