Commercial Real Estate: Trends, Risks, and Federal Monitoring Efforts

Fast Facts

Banks have about $3 trillion of their assets invested in commercial real estate loans, which is double what they had in 2012. The post-pandemic rise in remote work and declining commercial real estate prices have led to a steady increase in delinquent payments since 2022.

This Q&A report examines what bank regulators are doing to monitor risks.

Federal regulators said that current risks are manageable but ongoing monitoring is key. For example, in March, a New York bank needed a $1 billion cash infusion to help it survive commercial real estate loan losses. Regulators have identified banks with high concentrations of these loans for monitoring.

Highlights

What GAO Found

GAO analyses suggest that credit and other risks in the commercial real estate (CRE) market have increased since 2018. The CRE market has experienced strains from the pandemic-related rise in remote and hybrid work, rising interest rates, and declining prices, particularly for office properties. CRE prices declined about 11 percent from August 2022 through December 2023, according to Real Capital Analytics data.

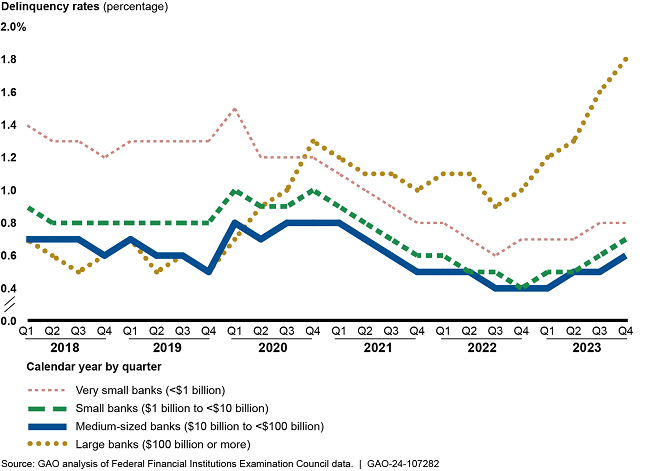

These factors can make it difficult for borrowers to repay their CRE loans, resulting in potential losses to banks. The delinquency rate for CRE loans generally increased from July 2022 through December 2023, especially among large banks.

Percentage of the Total Value of Commercial Real Estate Loans That Are Delinquent, by Bank Asset Size, 2018–2023

The Federal Deposit Insurance Corporation, Board of Governors of the Federal Reserve System, and Office of the Comptroller of the Currency monitor CRE lending through their supervision of banks, using on-site examinations and off-site monitoring. Through their monitoring efforts, they also identify banks with high concentrations of CRE loans for increased monitoring. According to the regulators, between 2018 and 2023, the number of such banks with high CRE concentrations that received increased monitoring ranged from 335 to 437, with the highest number in 2023. However, we have previously reported on long-standing concerns about the timeliness of escalating supervisory concerns found through their monitoring and have ongoing work on this topic.

Banking regulators and credit rating agencies have expressed concerns about the potential impact of the CRE market on the financial system. They have noted weaknesses in risk management practices at some large banks and an increase in rating downgrades for community and regional banks. Although banking regulators have stated that risks to financial stability appear to be manageable for most banks, economic weakness and CRE concentration could amplify financial system risks.

Why GAO Did This Study

The shift to remote and hybrid work during the COVID-19 pandemic and rising interest rates have intensified concerns about banks' exposure to CRE. The CARES Act includes a provision for GAO to monitor and oversee federal efforts to address the COVID-19 pandemic. This report examines trends in the CRE market (including trends affected by the pandemic), banks' exposure to CRE, and federal monitoring efforts related to CRE loans.

GAO analyzed CRE market trends and banks' CRE exposure using data from Bloomberg, bank financial statement filings, the Federal Reserve, and industry reports. GAO reviewed bank regulators' guidance and regulations related to bank CRE lending and interviewed staff from the regulators and credit rating agencies.

For more information, contact Michael Clements at (202) 512-8678 or clementsm@gao.gov.