Tax Administration: IRS Needs to Take Additional Actions to Prepare for New Information Reporting Requirements

Fast Facts

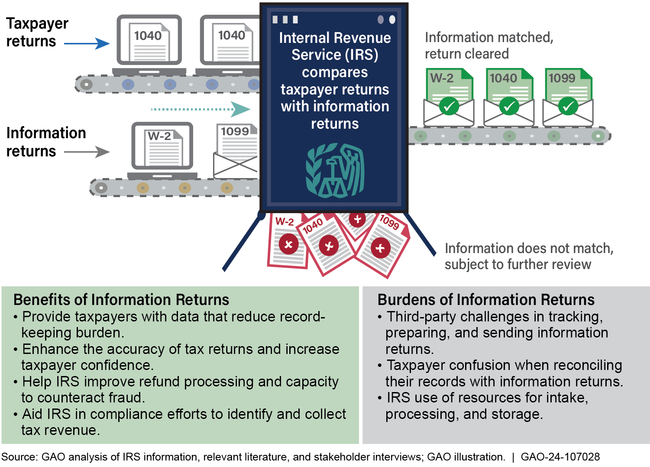

Employers, banks, and other third-parties file "information returns" with the IRS detailing your income and other factors that can affect your tax bill. Mismatches between this data and what you report on your taxes can indicate errors or fraud.

Recent changes to reporting requirements—including new rules for reporting cryptocurrency—could allow IRS to collect billions of dollars more in taxes. But IRS could better prepare to implement these changes. For example, IRS could evaluate its communications efforts to ensure tax professionals get timely and easy-to-understand information about the changes.

Our recommendations address this, and more.

Highlights

What GAO Found

The Internal Revenue Service (IRS) has taken steps to implement information reporting changes, but GAO identified actions for IRS to be more prepared.

Lowered Form 1099-K Reporting Threshold. The American Rescue Plan Act of 2021 changed reporting requirements for Third-Party Settlement Organizations (TPSO), such as some online marketplaces that connect users to goods and services. Previously, TPSOs were not required to report payments on Form 1099-K unless they exceeded $20,000 and an aggregate of 200 transactions. As amended, TPSOs must report payments that exceed $600 annually. IRS decided to delay full implementation for 2 years and did not consistently document risks for its decisions. Documenting risks will help ensure IRS has a sound rationale for decisions and is prepared for the reporting threshold change.

Form 1099-DA. IRS has begun planning its outreach and education efforts for new digital asset (e.g., cryptocurrency) reporting in its communication strategy, but IRS is missing an opportunity to apply lessons learned from its Form 1099-K implementation efforts, such as what did and did not work well. IRS also did not have plans to evaluate its communication efforts. Incorporating lessons learned and evaluating outreach and education efforts could help IRS more effectively prepare for the new reporting and adjust communication efforts, if needed.

Information returns provide benefits, but also create burden. For example, the Joint Committee on Taxation estimated that digital asset reporting will increase revenue by $28 billion over 10 years after implementation. However, third-party filers can face costs and challenges in tracking information for reporting.

Reported Benefits and Burdens of Information Returns

Why GAO Did This Study

IRS uses information returns—forms filed by third parties that provide information about reportable transactions—to help ensure tax compliance. IRS is working to implement two new information reporting requirements: (1) change of existing reporting requirements for payments made through TPSOs and (2) new reporting requirements for digital asset transactions.

GAO was asked to review the information reporting IRS receives and how IRS uses it. This report (1) evaluates the extent that IRS is prepared for additional information reporting and (2) describes the benefits and burdens of information returns. For both objectives, GAO interviewed relevant stakeholders, including outside organizations that interact with IRS and those affected by information reporting; analyzed IRS documentation; and interviewed IRS officials. To describe the benefits and burdens of information returns, GAO reviewed 13 studies from peer reviewed journals and policy organizations.

Recommendations

GAO is making four recommendations to IRS, including updating its policies and procedures to require documentation of risk; incorporating lessons learned into its Form 1099-DA communication strategy; and evaluating its outreach and education efforts. IRS agreed with and intends to implement all four recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should update IRS's policies and procedures to require a documented risk assessment for substantive tax administration decisions and include guidance on when these assessments are needed, such as when a decision could affect a large number of taxpayers or when decisions could generate congressional or oversight scrutiny. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure offices implementing the lowered Form 1099-K reporting threshold develop and implement a process to comprehensively and systematically document stakeholder feedback. (Recommendation 2) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure the Communication and Liaison Office and the Office of Digital Asset Initiative consult with the offices implementing the lowered Form 1099-K reporting threshold and incorporate any lessons learned and effective outreach strategies into their communication strategy for the new digital asset reporting requirements. (Recommendation 3) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure the Communication and Liaison Office and the Office of Digital Asset Initiative update their Communication Strategy to include periodic evaluation of their outreach and education efforts to assess whether they are meeting the agency's goals and providing timely, understandable, readily available, and accessible information to tax professionals, industry, and taxpayers. (Recommendation 4) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|